The first quarter of 2024 saw a continuation of the strong market momentum experienced towards the end of 2023, as the soft-landing narrative retains its place as the consensus view. After reaching multi-decade highs in 2022, the aggressive Fed hiking campaign was expected to result in an economic slowdown that would help to taper inflation. Job losses, decreases in earnings, and defaults were expected to be required to stabilize prices, but so far, economic activity has remained resilient as inflation has moderated significantly.

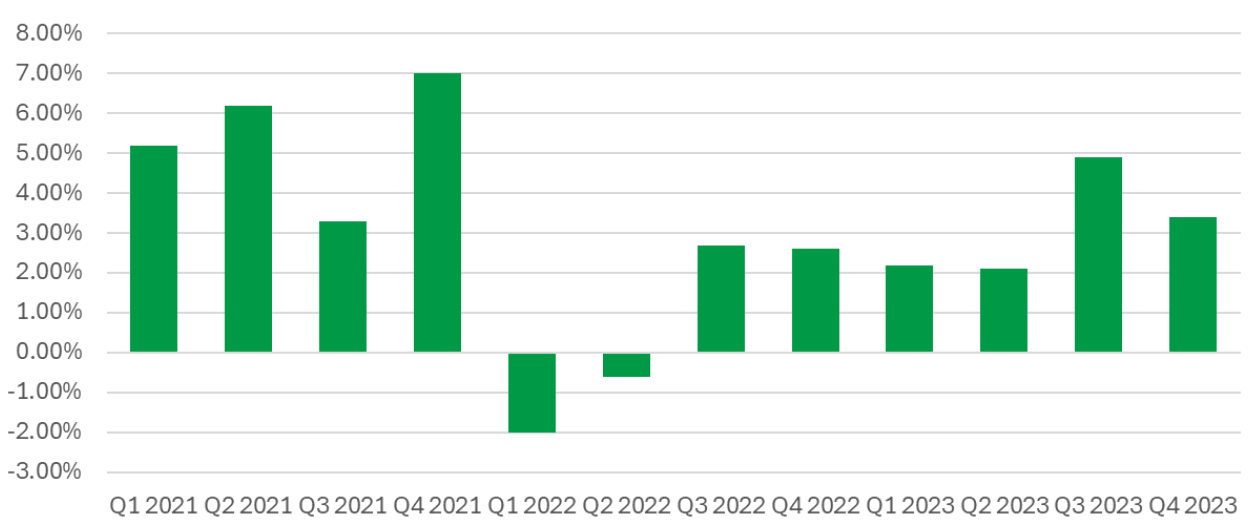

Economic resilience was highlighted by a consistently strong GDP growth rate in the US. In the 4th quarter of 2023, the US economy expanded at a 3.4% annualized rate bringing full year GDP growth to 2.5%. Early readings for Q1 GDP point to a continuation of this growth rate, with the Atlanta Fed’s GDPNow real-time forecast pointing to 2.4% growth for Q1 as of April 10th. The mighty US consumer continues to do the heavy lifting, bolstered by the strength of the labor market and increases in household net worth, but durable good spending has also been resilient and supported by fiscal spending packages put in place over recent years.

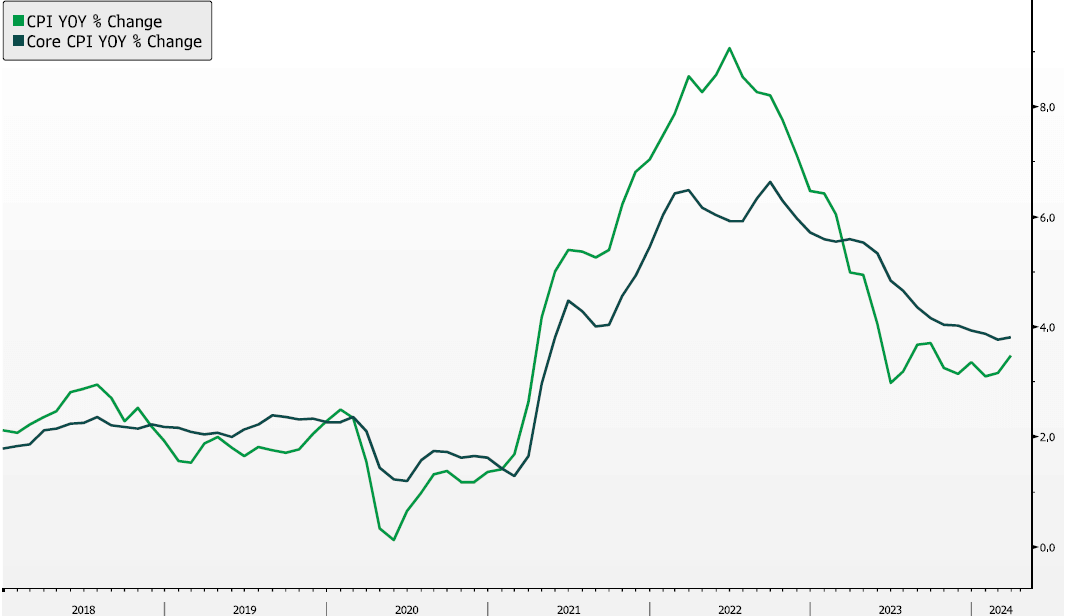

Even with the strong economic growth experienced last year, inflation has moderated considerably. However, in recent months this decline has been much less pronounced. From the June 2022 peak of 9.1%, inflation fell rapidly to just 3% on a year-over-year basis by June of 2023 – a remarkable level of disinflation without a negative impact to broader economic activity. But since then, inflation has proven to be much sticker as the Consumer Price Index has oscillated between 3% and 3.7%.

Despite the difficulty experienced in this last mile of the inflation fight, financial markets continue to respond favorably to the prospect of a soft landing. Chairman Powell & the Federal Reserve have kept these hopes alive by persistently signaling to the market their intent to cut interest rates in 2024 – most recently in the Fed’s March FOMC meeting where the median Governor survey showed expectations for 3 rate cuts for 2024 being maintained. This largely surprised market participants who expected a more hawkish tone in response to the above expectation growth & inflation data.

The S&P 500 has retained its place as the market leader in this environment, advancing over 10% on the quarter and strongly outperforming most global indices. In addition to accommodative forward guidance by the Fed, the S&P has continued to see strength from the high-quality mega cap technology companies that benefit from the Artificial Intelligence trend and comprise a large portion of the index (NVIDIA up another 80% in Q1!). Small caps, international, and value-oriented equities saw strong performance in Q1 as well but lagged the strength of this cohort.

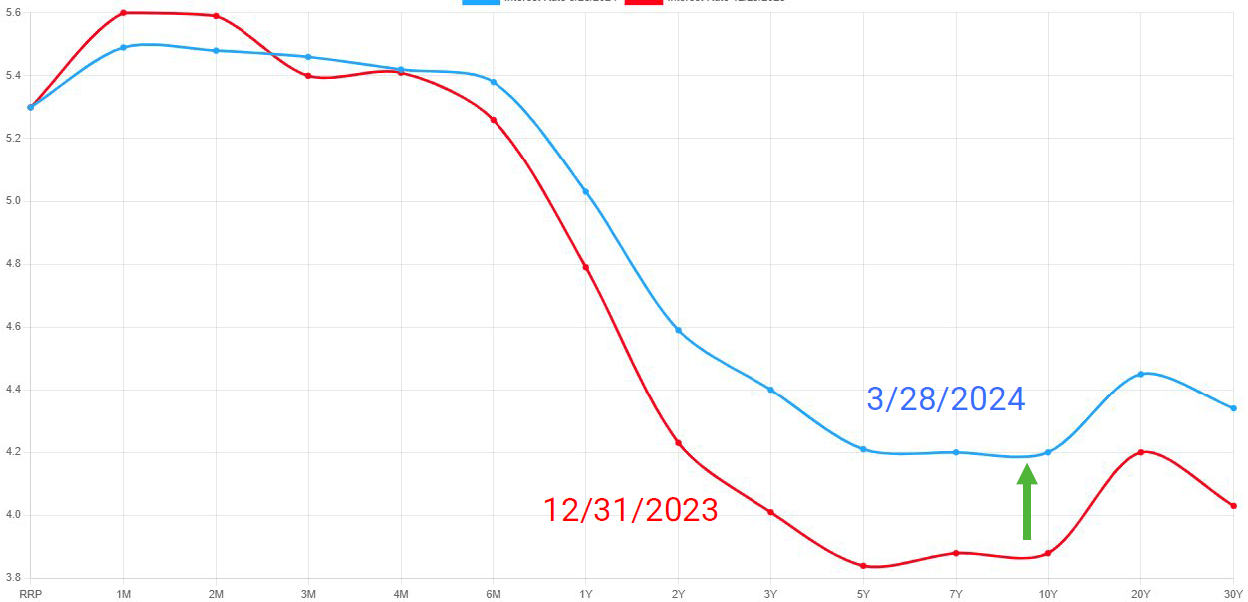

Fixed income markets have seen more dispersion in performance. The resilience of inflation & growth has pressured interest rate sensitive fixed income investments, but the dovish tone from the Fed has helped to contain losses in the asset class. The Bloomberg US Agg Bond Index detracted 0.78% during the quarter as the 10-year US treasury yield moved 40 basis points higher over the quarter from 3.8% to 4.2%. The less interest rate sensitive parts of the market saw much stronger performance, with the High Yield market up 1.5% as income generation & tightening spreads drove performance.

There is strong positive sentiment radiating through the markets as we move into the second quarter. While this sentiment has helped contribute to the strong performance since the October lows, risks from overstretched positioning and momentum unwinds remain possible. Additionally, signs of reaccelerating inflation, weakening economic activity, soft earnings, and other idiosyncratic factors may disrupt this positive momentum and thus are being monitored closely.

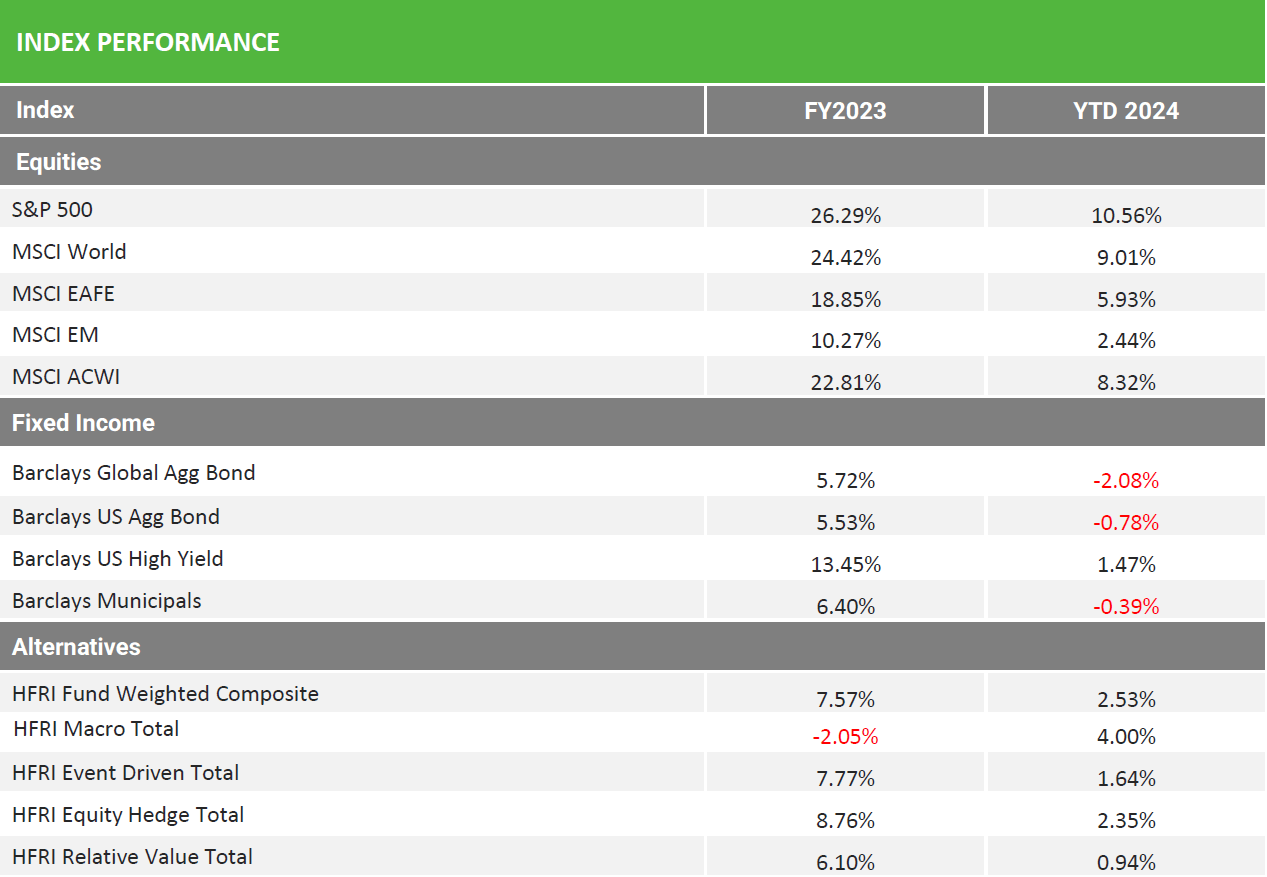

Market Overview

Equity markets have had a strong start in 2024 as US economic resiliency has helped to drive continued outperformance for the US vs. international peers.

Interest rate sensitive investments lagged as resilient economic data and sticky inflation helped to push rates higher.

Source: Bloomberg Barclays, MSCI; FY2023 as of 12/31/2023. For Equities & Fixed Income, YTD 2024 as of 3/31/2024. For Alternatives, FY 2024 as of 2/29/2024.

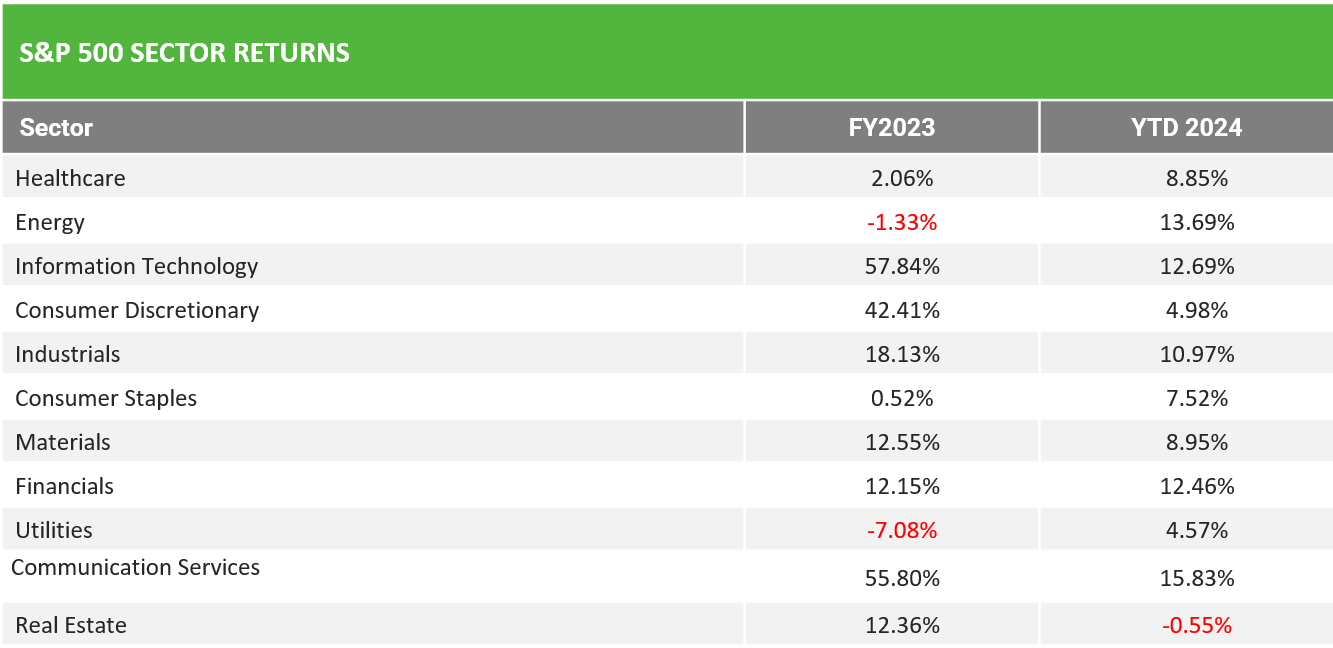

Equity market performance has generally broadened since the end of 2023.

NVIDIA & Meta continue to be dominant contributors to the Info Tech & Communication Services sectors, while Financials, Industrials, and Energy are seeing strong recoveries after lagging in 2024.

Source: Bloomberg; FY2023 as of 12/31/2023;. 2024 YTD as of 3/31/2024.

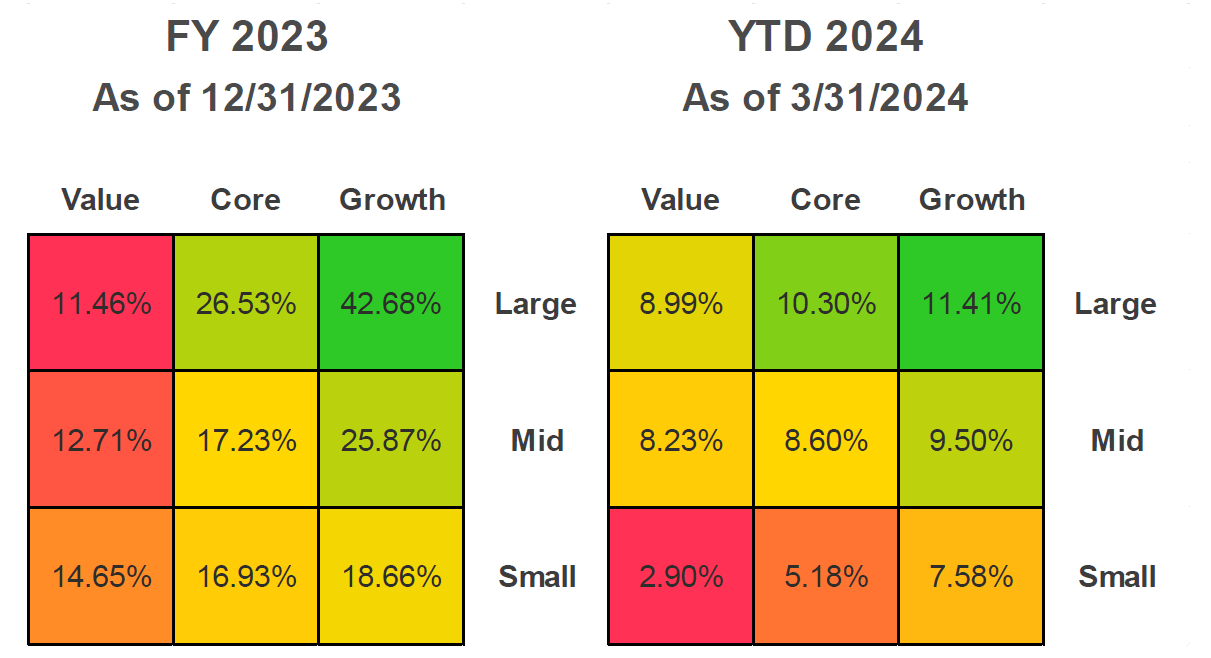

U.S. Equity Style & Market Capitalization Returns

Large Cap Growth outperformance persists but to a lesser degree as Magnificent 7 performance has narrowed.

Small Caps remain a laggard as the market continues to have a bias towards quality in today’s uncertain rate environment.

Source: Bloomberg; FY 2023 as of 12/31/2023. YTD 2024 as of 3/31/2024.

US Economy Remains Resilient

Despite the dramatic tightening of financial conditions by the Fed, US GDP growth has remained surprisingly resilient in recent years.

Consumer strength and fiscal spending packages have bolstered economic activity as the Fed continues to fight elevated inflation.

US Quarterly GDP Growth Annualized

Source: Bloomberg. As of 3/31/2024

Inflation Trend Stalls

The pace of decline in inflation stalled in recent months as economic strength & consumption remains strong.

Elevated shelter costs and strong service spending continue to be the primary contributors to inflation.

Consumer Price Inflation Year-Over-Year

Source: Bloomberg. As of 3/31/2024

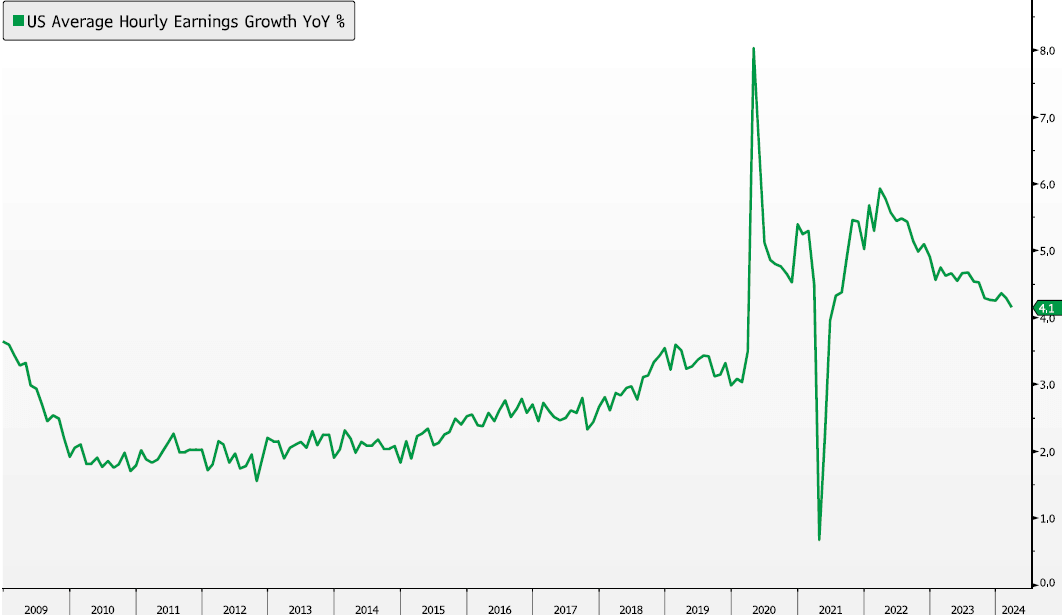

Wage Growth Continues its Descent

Wage growth has been on a steady path of decline since 2022. Labor markets continue to normalize as quit rates & job openings move back towards pre-COVID levels – something the Fed has been watching closely in this cycle and had a pronounced impact on wage gains.

US Wage Growth Rate

Source: Bloomberg. As of 3/31/2024

Energy Prices Climb Steadily Higher

Amidst heightening geopolitical tensions, oil & commodity prices have been moving steadily higher.

Close attention will be paid to the potential for higher energy prices to reignite an increase in inflation & response from the Fed.

Crude Oil Price

Source: Bloomberg. As of 3/31/2024

Pushing Yields Higher Across the Curve

The stronger than expected economic data along with rising commodity costs have pushed yields higher as rate cut expectations are priced out of the market.

US Treasury Yield Curve

Source: ustreasuryyieldcurve.com. As of 3/312024

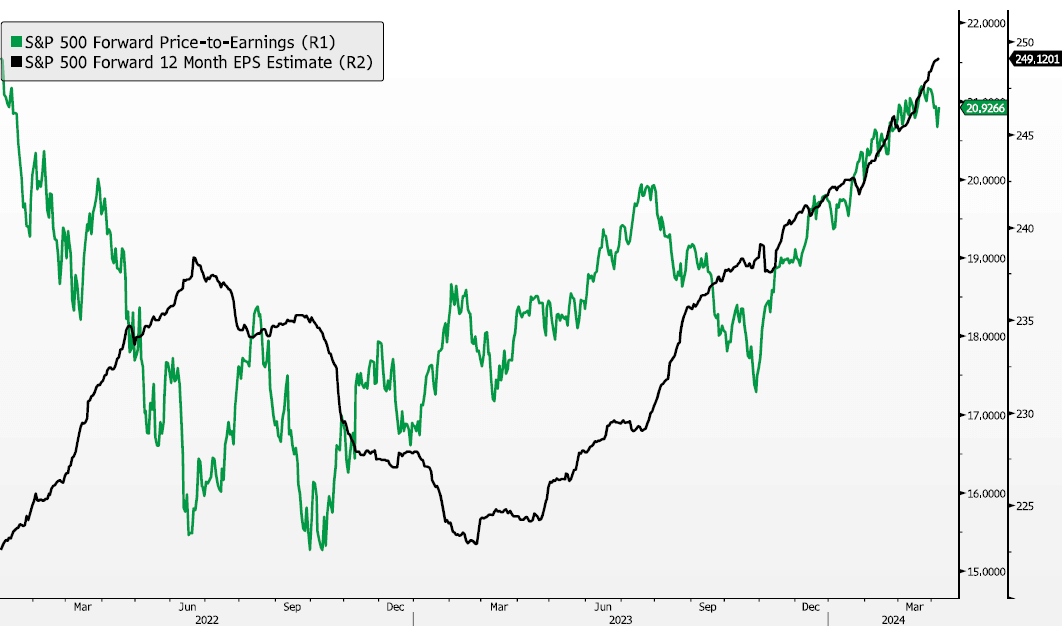

Earnings Estimates & Valuations Grow

After troughing in early 2023, earnings growth has been steadily positive over the last year.

Since the Fed pivot in Q4 2023, valuation multiples have followed earnings estimates higher as soft-landing expectations became consensus.

S&P Forward Earnings & Forward 12 Month EPS Estimate

Source: Bloomberg. As of 3/31/2024

Equity Market Breadth Widens

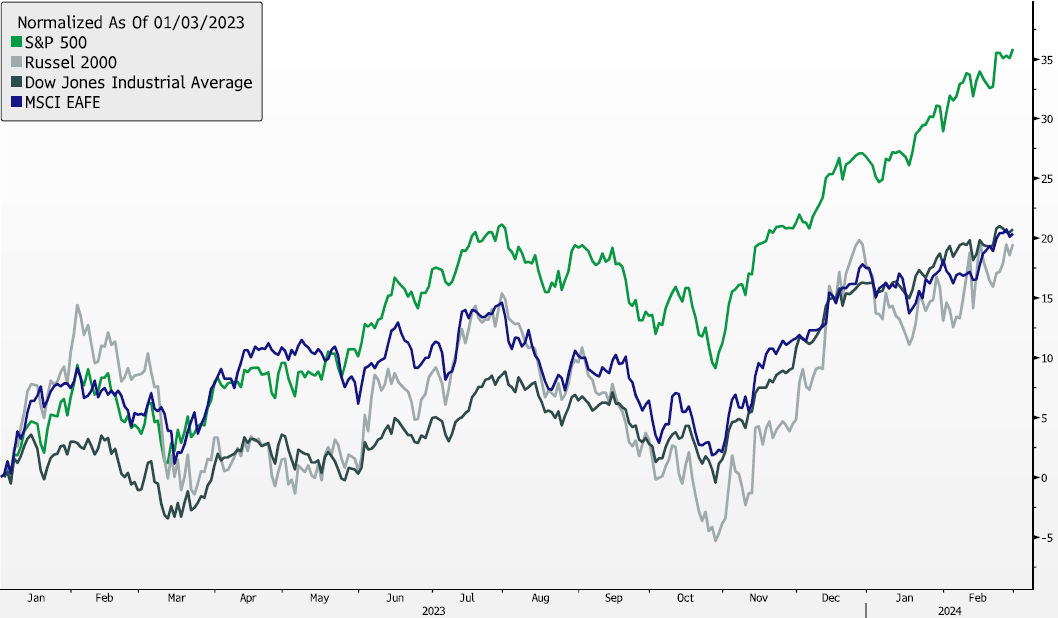

Equity markets broadly have advanced in this environment, but the S&P 500 has remained the market leader. A preference for quality and balance sheet resiliency has persisted while AI themes have contributed significantly.

However, equity market breadth has expanded significantly since Q4 2024 with International & Small Cap stocks seeing a strong recovery.

Equity Market Performance Since 2023

Source: Bloomberg. As of 3/31/2024

Asset Class Analysis

Equities: Target-weight

The domestic economy remains resilient, as we see above-trend GDP growth and corporate earnings strength. Consumers overall remain strong, albeit at a moderating level than what we experienced over the past couple years. A path to rate cuts should support valuations and contain volatility. Cash continues to move off the sidelines, which should support equity momentum. While the Magnificent 7 can still perform well in the new year, the current economic and Fed backdrop may favor the other 493 stocks in the index, in addition to smaller cap companies that are more levered to economic growth and lower interest rates. We remain domestically oriented as Europe appears to be lagging the disinflation trend and emerging markets continue to be volatile, led by China weakness.

Fixed Income: Target-weight

Fixed Income assets generated attractive yields and saw capital appreciation as target interest rate expectations fell. We remain constructive on the diversifying, income-producing nature of the asset class, and would barbell the asset with short-duration income producing credit and longer-duration investment grade bonds.

Liquid Alternatives: Target-weight

Hedge Funds: Hedge funds have shown their ability to be sources of portfolio diversification over the past couple of years. While stocks and bonds still exhibit positive correlation in the current environment, we appreciate the contribution of alternative strategies with low directionality, but actively traded, dynamic portfolios that can take advantage of moments of disconnect between trading relationships of securities and asset classes in periods of transition. These opportunities can help funds generate steady returns with less sensitivity to market direction or the actual path of interest rate cuts in 2024. We continue to expand our multi-strategy allocation and complemented it with differentiated lending and volatility strategies to balance out the more directional small cap exposures.

Real Estate: We have been adding core-plus real estate opportunities, notably in residential assets for its inflation aligned properties and as a complement to stock and bond portfolios. We continue to remain cautious on the fundamental outlook of office buildings. Lower interest rates should ease some pressure on financing situations.

Illiquid Alternatives: Target-weight

2023 performance for illiquid assets was muted. While underlying portfolio company earnings have improved, transaction activity has remained light. Lower rates and a narrowing of bid-ask spreads should reaccelerate over the next couple years and committed capital for opportunistic deployment should make newer vintages highly accretive. Venture valuations have remained muted, thus making secondary opportunities in this segment of the market notably attractive for discerning investors.

DISCLAIMER

The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained herein is intended to constitute legal, tax, accounting, securities, or investment advice nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick Advisors LLC), or any non-investment related content, made reference to directly or indirectly in this presentation will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Investing in alternatives may not be suitable for all investors, and involves a high degree of risk. Many alternative investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of alternative investments can vary based on the underlying strategies used.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

Simon Quick Advisors LLC is neither a law firm nor a certified public accounting firm and no portion of the presentation content should be construed as legal or accounting advice. If you are a Simon Quick Advisors LLC client, please remember to contact Simon Quick Advisors LLC, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please Note: (1) performance results do not reflect the impact of taxes; (2) It should not be assumed that account holdings will correspond directly to any comparative benchmark index; and, (3) comparative indices may be more or less volatile than your account holdings.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document

Economic, index, and performance information is obtained from various third party sources. While we believe these sources to be reliable Simon Quick Advisors LLC has not independently verified the accuracy of this information and makes no representation regarding the accuracy or completeness of information provided herein.

As of April 1st, 2022, Simon Quick Advisors LLC has changed private capital index providers from Cambridge Associates to Pitchbook Benchmarks.