We entered the new year with a constructive view on the economy. The US and China had finally signed a Phase 1 trade deal that was anticipated to reaccelerate manufacturing and investment; GDP was moderating but very gradually, supported by an accommodative Fed; and fourth quarter earnings and guidance were better than expected. The 30%+ rally in stocks in 2019 (based on the S&P500) was driven by anticipation for good news, and corporate executives, central bankers and trade delegates delivered.

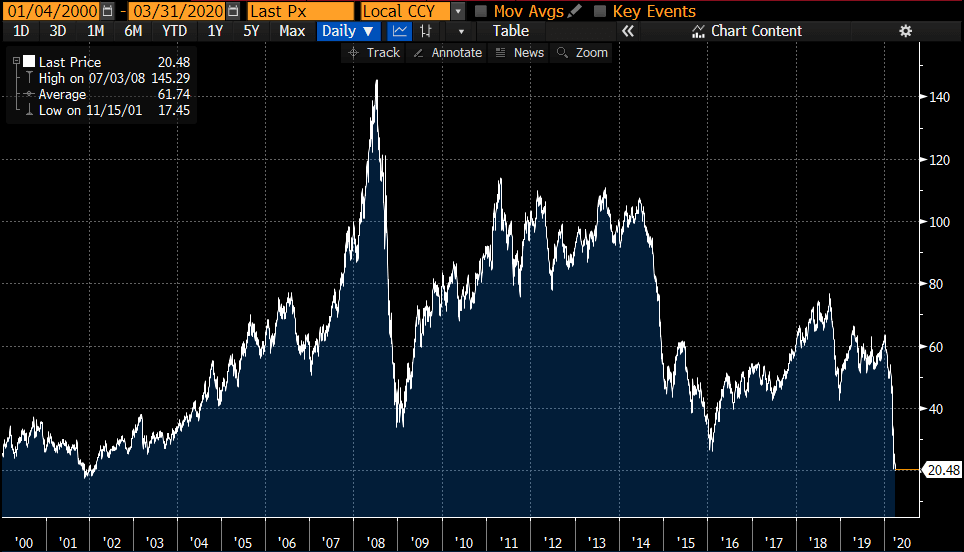

We were not planning for a recession in the near-term, rather a gradual slowing of the economy, with the greatest threat being multiple contraction until investors could find the next catalyst for marginally better up-side. Because of this view, we were modestly underweight equities, and had skewed towards defensive large-cap domestics to further reduce risk. In fixed income, we had increased our longer-duration, investment grade allocations as high yield credit did not seem compelling for the amount of risk they bore. We sought to be cautious in a bull market. Welp…it didn’t matter because we didn’t have the right call on Covid-19 and the ensuing national shut-down of the economy in an effort to contain the virus. Whether you owned high-quality, defensive assets or speculative ones, everything traded down materially in the quarter. This was further exacerbated by an escalation in the oil war in early March between Saudi Arabia and Russia, with US producers caught in the crossfire. Oil prices collapsed amidst slumping demand, which reverberated through the banking system and cyclical sectors. WTI traded at $20 a barrel by month-end, and April saw contracts enter into unprecedented negative territory before slightly recovering.

WTI Futures Pricing

Source: Bloomberg, Simon Quick Research

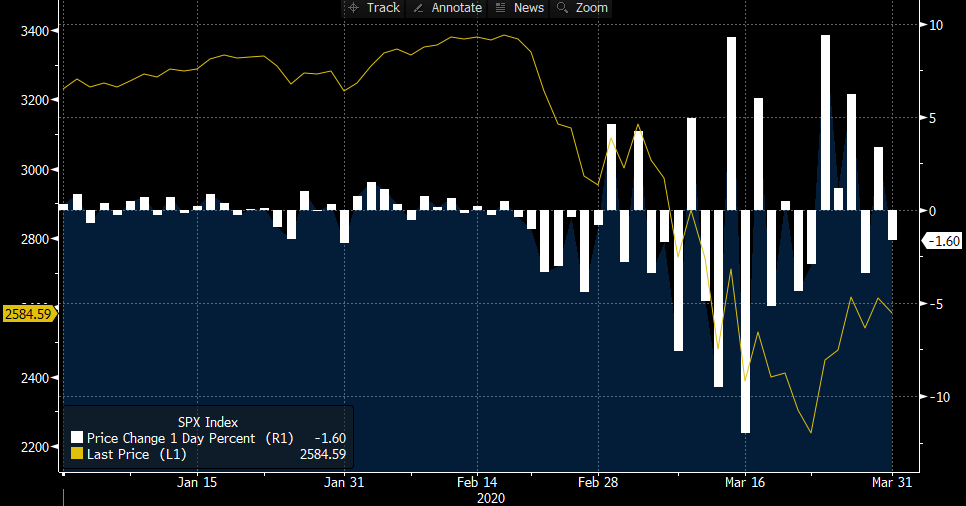

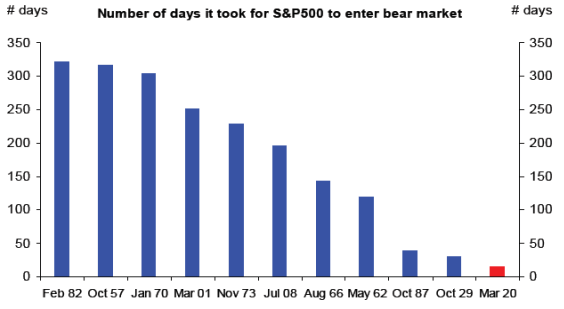

This was the beginning of the equity market collapse as the S&P500 lost 7.6% the following day, to be outdone by a 9.5% loss on the Thursday of that same week, and then almost 12% on the Monday after that. When it was all said and done, the S&P500 lost a third of its value in slightly over a month and now holds the record for the shortest amount of time to enter a bear market ever at 15 days (defined as a 20% fall from an all-time high in the last 52 weeks).

S&P Index and Daily Percentage Moves YTD

Source: Bloomberg, Simon Quick Research

Source: Deutsche Bank Research

Sell what you can, then sell everything else even lower

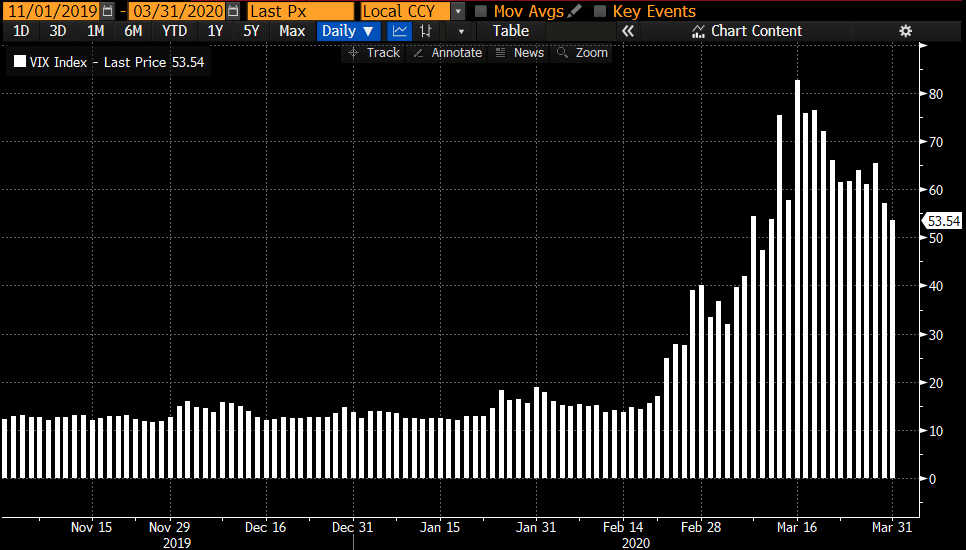

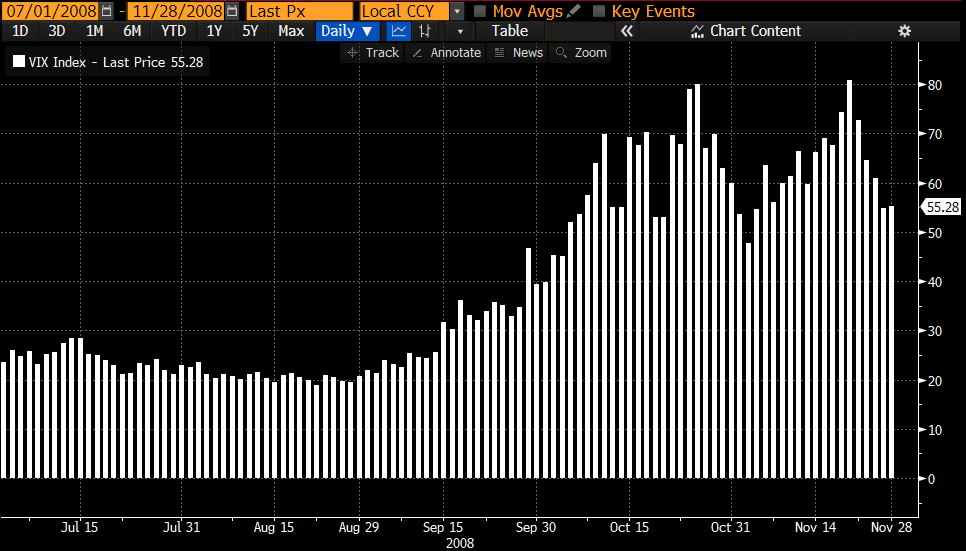

Investor panic was extreme, with the VIX going from 14.4 at the close of February 19th, to 82.7 less than a month later (March 16). This peak exceeds levels we saw in the 2008 Global Financial Crisis, but even more notable was how suddenly it came about. What we show below is a comparison of these two events over a five-month period. We can see how sudden the volatility shock was this past quarter than the relatively more gradual two-month expansion of the VIX in 2008, that really began in 2007.

Daily Volatility (VIX): November 2019 – March 2020

Daily Volatility (VIX): July 2008 – November 2008

Source: Bloomberg, Simon Quick Research

The banking system has de-risked since the ’08 recession, serving more as a utility to the financial system rather than being a participant. This may have exacerbated the sell-off in assets in March as banks no longer maintain large enough balance sheets to provide liquidity to sellers in a period of extreme volatility. The market experienced pressure across asset classes, but most notably in what is traditionally considered highly liquid, short maturity, strongest credit quality debt securities. This would include money market funds, municipal bonds, and Triple-A rated securitizations.

Market fear of an economic shut-down and its negative impact was so large that investors were willing to sell these assets at several point discounts just to raise cash. Unfortunately, banks and other investors didn’t have enough liquidity to buy up and counteract this selling, which essentially heightened fears and further increased selling pressure. At the extremes, investors could buy municipal money market funds at an 8-9% yield, in a period when Fed Funds are anchored at zero. Similar pressure was seen in municipal bonds, investment grade asset-backed and corporate loans, and are still evident in the market today.

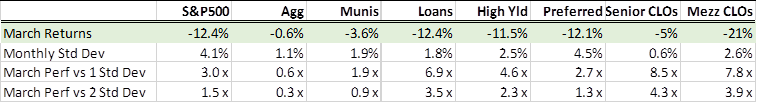

Moving further down the risk spectrum, investors experienced 20-30% or greater mark-to-market losses as forced-sellers began taking large discounts on less liquid positions to raise cash. We illustrate below how all asset classes were pushed to the extremes of their expected levels of risk, approaching or exceeding two standard deviation price moves, or the equivalent of the 2.5% percentile or lower of historical experience.

March Returns and Standard Deviation

Source: Bloomberg, Simon Quick Research

The Fed Put and Moral Hazard

To their credit, the Federal Reserve was able to dust off its Global Financial Crisis playbook and came to support the market en force quickly and significantly through liquidity facilities and bond buying programs to back-stop the market, reinvigorating and expanding programs to ETFs and high yield this time around. Congress, albeit slower to move, has also stepped in with a massive $2tn+ fiscal stimulus program with additional funding to come.

The Fed’s efforts have brought back near-term confidence in the stability of the financial system. Fiscal stimulus has reflated markets somewhat to recoup a meaningful portion of equity market losses. However, we recognize that there is more that is necessary in order to rebuild confidence in markets. We do not yet have a cure for the virus, but as the nation steadily makes its way down the infection curve, we can see a path to returning to work. We recognize that the shut-down will result in a possible 20% unemployment rate as businesses have shuttered, and if they re-open will operate at socially-distant, lower productivity, levels. Certain industries will be pressured for significantly longer, notably travel, dining, social venues, colleges, and real estate.

Economists are predicting a 3-4% negative GDP for the full year of 2020, with a severe decline in the first half, and a sharp recovery into the second half of the year. Longer-term, there will be careful observance of how the Federal Reserve will get the country out of its huge debt balance while also staving off inflation. The unknown of how the virus comes back in the fall, and whether herd immunity will apply, increases uncertainty.

With the risks noted above, we do not think it to be prudent to wait on the side-lines for the “all clear” signal as by the time that is apparent, the market will have already moved beyond those levels. At current prices and valuations, the investment opportunity is significant across assets. However, we don’t simply close our eyes and hold on for the market inflection. Rather, we seek to buy high quality companies that can weather the current period, and balance that with a mix of countercyclical (distressed credit) and opportunistic (technically pressured prices on high quality assets) investments and growth companies and industries that can ride the wave of change in how we conduct business going forward.

As we stated last quarter, one must invest with a long-term plan that cuts through short-lived volatility and maintain discipline to remain invested when others are fearful. At current valuations, it is now possible to build high quality, balanced portfolios without sacrificing long-term returns for the patient investor.

Research Spotlight: Getting Paid to be the Liquidity Provider

It is difficult to write about only one compelling opportunity when the vast majority of investible assets have repriced meaningfully lower…so I will make the executive decision to discuss two, with teasers to a few more.

In order to support the financial sector and broad functioning of the capital markets, the Fed has reopened liquidity facilities and lines of credit to astute investors. One of these opportunities is the Term Asset-Backed Securities Loan Facility (“TALF”) program. This program was first made available in the ’08 financial crisis and was a means of providing cheap funding, backed by the government, to buy high quality asset-backed securitizations (“ABS”) to restart the lending market. ABS securities are typically comprised of a pool of auto loans, credit card receivables, student loans, small business loans, etc. that are structured with a risk and return profile that can satisfy a broad spectrum of investors. The highest quality assets, typically held by insurance and pension funds, have the highest level of credit support, but receive the lowest coupon payments. Risk-takers, such as the securitization managers and asset managers, would seek the junior tranches where there is greater interest income, but bear a higher probability of principal loss.

TALF focuses on the highest quality tiers where there is minimal risk to principal loss. The Fed is enticing investors to participate in this typically boring tranche by providing financing that can result in mid- to high-teens or greater returns for the investor. This opportunity will be short-lived as it is a means of rebuilding investor confidence in capital markets, but is highly attractive to early participants. We have approved a fund that will participate in TALF and related asset opportunities with a manager that successfully participated in the first TALF opportunity in 2009, and where Simon Quick has had a long-standing relationship with and confidence in the manager’s ability to successfully invest in this strategy.

Our second highlighted strategy is in closed-end fund arbitrage. Publicly traded closed-end funds (“CEF”) and business development corps (“BDCs”) can be viewed as a collection of underlying assets and securities that can be priced individually to determine the value of the entirety of the portfolio. In normal markets, the price of the CEF or BDC trades closely to the value of the underlying holdings. However, in severe market dislocations, like the one we have just experienced, because of selling pressure, or leverage constraints, the value of the security can trade at meaningful discounts to the value of the actual holdings. These discounts can be meaningful at 10-15%, with certain ones almost double that at current levels. The manager on our platform seeks to find attractive securities with hedgeable underlying assets with these wide discounts to purchase and monetize the implied temporary discount. The manager hedges the market-risk to significantly limit market directionality, and doesn’t need a strong recovery in indices to generate a profit, rather a normalization of volatility over time to do so.

Both of these strategies seek to capitalize on temporary market dislocations to generate returns and are very timely for the current environment. Their targeted returns should be achieved over a relatively shorter timeframe and requires less conviction on the direction markets are heading, rather that capital markets will return to more normalized volatility levels.

Asset Allocation

Equities: Move to Target-Weight

We have moved our underweight recommendation to target-weight. Equities across the world entered a bear market in the first quarter of 2020 as the novel coronavirus (Covid-19) ripped through every major city in a matter of months. The global economy ground to a sudden halt as mass populations were forced indoors and away from other people to stem the spread of infection, while doctors and scientists scrambled for a cure, and world political and financial leaders sought to maintain stability in these uncertain and undefined times.

Despite being underweight equities for most of 2019, we didn’t anticipate the severity and pace at which the coronavirus shook our markets, and is testing the financial plumbing that was rebuilt after the 2008 financial crisis. We do not yet know when a cure will be available, but we know that humans are resilient and adaptable. We will learn to manage working from home, while homeschooling our children, and helping our parents from a safe social distance. We will adapt to virtual communication and collaboration as take-out and delivery replaces bars and restaurants for the time being. Peloton at home sounds a lot more appealing now when compared to an enclosed room of three dozen strangers sweating in a spin class together. While this period in our lives will forever be etched in our minds and history e-books, we are confident that humankind, society, industry, and capital markets will continue on and thrive.

We cannot call the timing of the turn, so we must be patient and stick to our convictions and remember what we learned from prior volatile periods. With the severe market sell-off, stocks have gotten cheap. We recognize that earnings will suffer in the near-term but believe they will find stability and recovery, supported by coordinated fiscal and monetary actions, and trust in medical science. There are significant, long-term growth companies that are trading below hyper-conservative earnings expectations and valuations. These are companies that provide products and services that are necessary regardless of the business cycle. Additionally, there are companies that are providing solutions to businesses and consumers that will accelerate in scale as mass populations live/work/play from within their four walls. Consider the exponential growth of video conferencing, workflow and productivity software, internet bandwidth utilization, and educational and entertainment content coming to consumers in the matter of days and weeks since this virus hit. These are the areas of the equity market we seek to invest in.

This is not a transformational change to our prior posture, rather circling the wagons around our conviction areas of the stock market where there will be long-term winners. This is where we’re raising our equity allocation recommendation to target-weight: businesses that have shown resilience through economic downturns, with strong balance sheets and a demonstrated need by consumers as shown by their scale and profitability. Furthermore, we continue to seek growth businesses and industries, such as healthcare and technology, that we expect to enrich the lives of people and further business productivity. We also are culling cyclical exposure from our portfolios to protect against further economic weakness. That means further reducing our International and Emerging Markets positions. When the economy finds new footing and markets stabilize, equities will rip higher. We will be ready for that opportunity and our positioning will see us through to then.

Fixed Income: Move to Under-weight

Along the same lines of recommending an increase in equity allocations, we also reduced our fixed income allocation recommendation to under-weight. We have been tilting fixed income allocations towards investment grade credit quality strategies and extended duration of the portfolios. While yields were low, we appreciated the counterbalance of fixed income instruments versus stocks. The sudden collapse in equities, and the immediate Fed action in cutting rates 150 basis points to zero caused treasuries to rally. However, liquidity pressures, tied to investors looking to raise cash, the sudden spike in volatility, and market participants acclimating themselves to remote offices dampened the full effect. With recent follow-on monetary actions to stimulate liquidity, we anticipate higher quality assets to continue to tighten. We would use this opportunity to lighten holdings here, starting with lower credit quality assets, in order to build on equity allocations.

Liquid Alternatives: Overweight

We are constructive on hedge funds in the current investment environment as they are helping to dampen portfolios from equity market volatility and losses. We remain selective on long/short equity managers broadly as the ability to generate consistent excess returns is very difficult. However, we retain a select group of funds in this strategy that we expect to achieve that high hurdle and can be a substitute to long-only equity risk. We recently approved a bio-tech manager that has shown an ability to be long-term uncorrelated to broader equity markets, and should benefit from a tailwind of capital and resources being diverted to companies that can fight Covid-19 amongst other infections and diseases. This aligns with our earlier comments about investing in industries that show economic resilience and where new products and innovations are necessities to society. Merger arbitrage strategies have seen an expansion in deal spreads and closed end funds are trading at significant discounts. These strategies are compelling as they don’t necessarily need the markets to trend higher, rather volatility to normalize and rational trading relationships to return, even if prices are lower. These strategies can generate strong returns ahead of fixed income and without the same level of rate sensitivity. We have been utilizing closed end fund arbitrage strategies in both hedge funds and through long-only fixed income managers. Finally, while we are negative on high yield credit, we are getting more sanguine around the distressed opportunity as defaults will inevitably rise and companies will need to undergo restructurings. Yields on stressed and distressed credit are wide and may widen further, but this will be a fertile hunting ground through this downturn.

Illiquid Alternatives: Overweight

We are overweight illiquid alternatives given their longer investment periods and ability to extract value through active engagement with their portfolio companies. An economic recession will impact private businesses along with their public peers, however the control held by our managers in effecting change in portfolio companies can drive true fundamental value creation during the holding period. Additionally, valuations are driven less by technical factors exhibited in public markets as the majority of investors are holding and engaging with the companies over multiple years. We recognize that cyclically sensitive businesses will be the most impacted during this time, but this can also create opportunity for funds currently raising capital to deploy into. Over an investment cycle, private equity investments should generate materially stronger returns over public markets in exchange for longer holding periods. We remain constructive on venture capital opportunities as the growth engine of equity markets.

Do you have any questions regarding this content? We would love to chat!