About Structured Credit

The Global Financial Crisis gave structured credit a bad name. As a result of 2008, many investors believe the broader asset class contains unnecessary complexity and risk to warrant much attention. It’s true, subprime mortgages in mortgage-backed securities (MBS) and certain collateralized debt obligations (CDOs) led to extreme losses at the time, and while these structures grabbed the headlines, other structured products were resilient and performed well. For example, collateralized loan obligations (CLOs), which are backed by pools of secured bank loans to businesses, performed largely in-line with expectations through the trough and the ensuing recovery, in spite of the short-term mark-to-market volatility. There were certain investors that added excessive leverage on these securities and suffered from the resulting liquidity mismatch, but the actual products remained intact. Furthermore, since then, the CLO market has seen further structural improvements to protect investors and satisfy regulators, including higher levels of subordination, more rigorous collateral eligibility requirements, shorter non-call periods, and shorter reinvestment periods. We believe these actions improved the quality of the investible universe for structured credit today and find the return potential more compelling than buying individual loans or loan funds for long-term investors.

Leveraged loans are senior loans made to businesses with below investment grade ratings, often used to finance a private equity buy-out, acquisitions and funding for general growth opportunities. These loans are typically secured by the assets and cash flows of the business and have priority in recovery in a bankruptcy scenario. Investors who purchase loans outright are subject to idiosyncratic credit risk and compete against both institutional and retail buyers. CLOs, however, are purchased primarily by institutional investors and can offer higher returns for the equivalent or better credit quality as long as the investor has a long-term investment horizon. How is this possible? A CLO consists of a pool of hundreds of leveraged loans diversified across a broad range of industries and borrowers. CLOs are “securitized”, meaning borrowers can invest at different risk and return thresholds on this pool of assets. Insurance and pension funds may look towards the top of the securitization stack to maximize principal protection, but give up on returns. While junior tranches, typically purchased by investment managers (such as hedge funds and private equity firms), require greater credit underwriting but can deliver double-digit returns. This tranching of risk and return in CLOs allows for an opportunity to acquire better credit quality and enhanced return asymmetry versus owning the loans outright, but the trade-off being that lighter trading activity can create periods of pricing volatility. CLOs have historically generated higher returns with wider spreads compared to traditional debt instruments due to the institutional orientation, regulatory requirements and illiquidity. This complexity creates an appealing risk/return profile, especially in periods of dislocation.

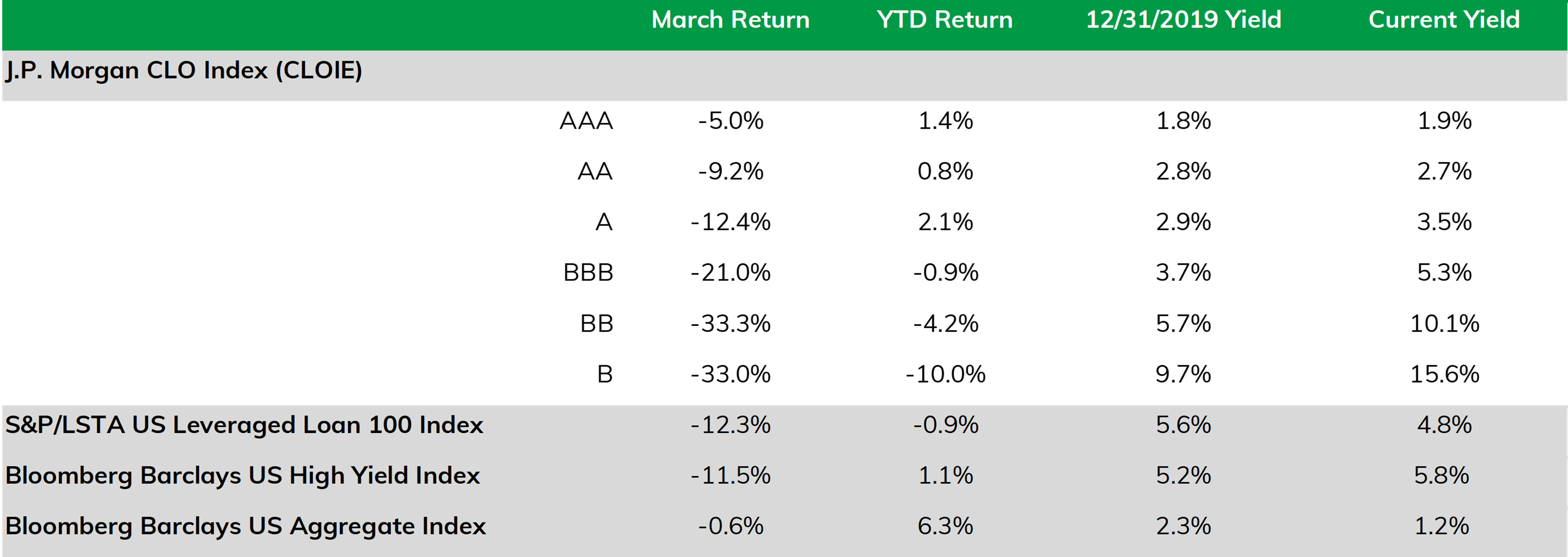

That brings us to March 2020. The unexpected closing of the economy as a result of COVID-19 caused a sharp and sudden decline across all asset classes. There was a tremendous liquidity squeeze as investors went into risk-off mode, selling out of assets to raise cash, with no regard for their fundamental value. The S&P 500 was down over 12% in March with a standard deviation 3x the typical monthly volatility. High quality securities were not immune to this effect. Municipal bonds, as an example, ended the month down nearly 4%, notwithstanding the dramatic intra-month swing. Leveraged loans had a similar path as equities also declined approximately 12%. In comparison, CLO investment grade rated notes dropped about 5% while high yield tranches dropped over 20%. This was partially driven by heightened concerns for credit losses, but a more powerful driver was general fear and a need for liquidity, causing sellers to transact at large discounts in order to raise cash quickly.

The precipitous drop in prices, due to indiscriminate selling, has resulted in an exciting investment opportunity in structured credit, specifically for those with patient capital. If you hesitated in March, you may have missed the rebound in liquid markets which experienced one of the quickest recoveries on record supported by the government’s unprecedented stimulus package and various programs implemented by the Fed. As an example, leveraged loans have recovered most of the losses from the decline and are nearly flat on the year through October. On the contrary, the recovery in structured credit has been gradual, particularly in junior tranches. CLO equities have steadily climbed higher, only regaining about half of their pre-COVID values, and thus still affords an attractive opportunity for the next several quarters. We believe that the universe will continue to reprice higher as the market gains more certainty around an economic recovery. While we anticipate higher default risk compared to recent years, we believe returns generated from structured credit more than compensate investors for this risk as current yields today are much more attractive to pre-COVID levels. We believe there is additional upside based on current marks in comparison to fair value and relative to other asset classes.

Sources: J.P. Morgan, DoubleLine, S&P Global, Bloomberg; As of 10/31/2020

At Simon Quick, we are active allocators to the structured credit opportunity. We have aligned ourselves with managers displaying rigorous credit underwriting standards, conservative use of leverage, and a history of avoiding permanent losses. While these managers and funds suffered from selling pressure in March, these funds were unlevered and, in many cases, carrying a cash balance. Margin calls or redemptions did not force their hand. We’ve focused on smaller managers that can be nimble and react quickly to pockets of opportunity. They were able to play offense and be proactive buyers during a period characterized by significant mispricings.

In April, we began increasing our exposure to this asset class with the understanding that this opportunity will take a healthy dose of patience. We believe an allocation to structured credit, in particular those collateralized by corporate borrowers, represents a very attractive multi-year opportunity. With all that being said, it is crucial to enlist a best-in-class investor with the expertise to navigate the inefficiencies in the market including the geographical, collateral and manager dispersion.

If you would like to discuss this opportunity further, please reach out to your Client Advisor at Simon Quick.

Important Disclaimer

Investing in Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable, equal any corresponding indicated historical performance level(s), be suitable for a portfolio or individual situation, or prove successful. This document is strictly confidential and may not be reproduced or distributed in whole or in part without the prior written consent of Simon Quick Advisors. This presentation represents proprietary information that may not be shared without express permission from Simon Quick Advisors.

This information is being provided to you on a confidential basis. By accessing and reviewing this document, you acknowledge and agree that (i) you will not disclose or distribute this information, in whole or in part, to any third party without the prior written consent of the investment manager, Simon Quick Advisors and (ii) that such information is being provided to you for informational purposes only as a current or potential investor qualified to invest in hedge funds and other alternative investments. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer of solicitation will be made only by means of a formal Offering Memorandum that will be furnished to prospective investors.

This material is for intended to be for general and educational purposes only and is being furnished on a confidential basis to the recipient for discussion purposes only. You should not make any decision, financial, investment, trading or otherwise, based on any of the information contained herein without undertaking independent due diligence and consultation with a professional advisor of his/her choosing. You understand that you are using any and all information herein at your own risk. No information provided herein shall constitute, or be construed as an offer or recommendation to sell, acquire, or hold any security, investment product or service, nor shall any such security, product or service be offered or sold in any jurisdiction where such an offer or solicitation is prohibited by law or registration.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick Advisors is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice.

This report includes forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Information herein has been obtained from third party sources. While we believe the source to be accurate and reliable, Simon Quick Advisors Simon has not independently verified the accuracy of information. In addition, Simon Quick Advisors makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.