Taking off the Training Wheels

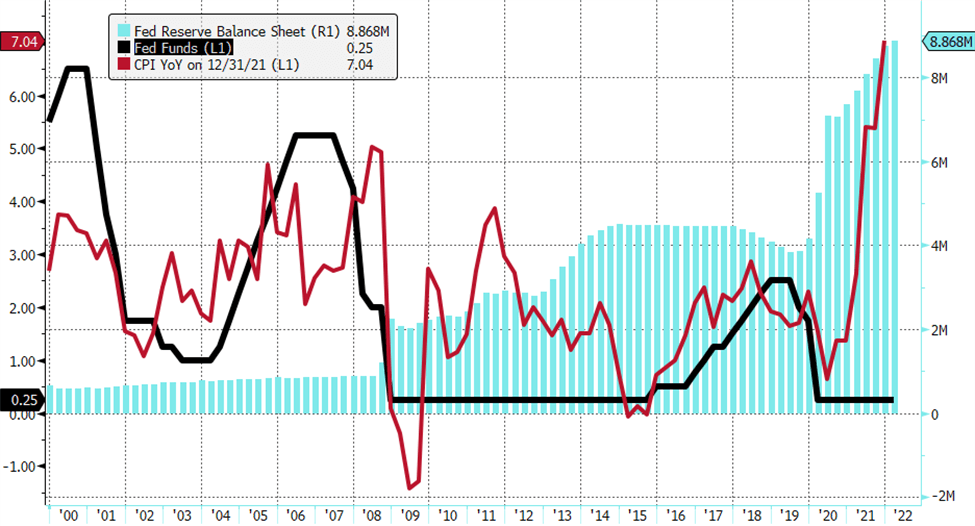

Equities logged another tremendous year for returns in 2021, generating over 28% on the S&P 500, with a strong fourth quarter rally of 11%. We have seen significant resiliency in the index since the ’08 Global Financial Crisis. Even if you were to have started investing at the beginning of that year, which experienced a 37% decline, you would have annualized at an impressive >12% return to date. In fact, there was only one calendar year where returns were negative after the GFC (-4.4% in 2018), and only two other years (2011 and 2015) where returns were not in the double digits. It was easy to be an investor in this cycle. But…the Fed had been highly accommodative to risk assets during this time. Since Chairman Bernanke, Fed Funds have largely been pegged to zero. Succeeding Chairpersons Yellen and Powell did attempt to raise rates, reaching a peak of 2.5% in early 2019, but ended up easing again even before the pandemic had reached our shores. The economy and stock market were quite happy in this regime. GDP and inflation chugged along at a balanced, sub-2% rate as stocks were the only return generating game in town. The Fed’s response to the economic shutdown from COVID gave another shot of adrenaline to the economy and markets as the rates were once again slashed to zero, and the Fed initiated an aggressive bond buying program. Markets blasted off from their March 2020 lows on the anticipation of the economic recovery.

Federal Reserve Balance Sheet Growth and Fed Funds

Source: Bloomberg

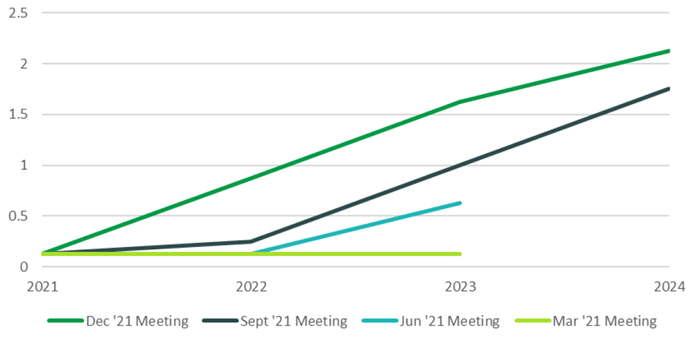

As we enter 2022, COVID is still with us, but we’ve learned to live with it. The economy grew over 5% last year and is poised to expand approximately another 4% in 2022. While labor participation rates overall haven’t fully recovered, there is plenty of demand for workers at higher pay to drive unemployment down to pre-pandemic levels. However, inflationary pressures have remained persistent, and the Fed is now in a tough position where they need to control it as much as possible by quickly ending its bond buying and begin a rate hiking cycle. Back at the March 2021 Fed meeting, there was very little expectation for a rate hike before 2023. Less than a year later, the market is anticipating at least 3 if not 4 hikes this year to quell the current 7% inflation rate. A half-point hike is now certainly on the table.

Changes in Fed Rate Hike Expectations

Source: Bloomberg, Simon Quick Research

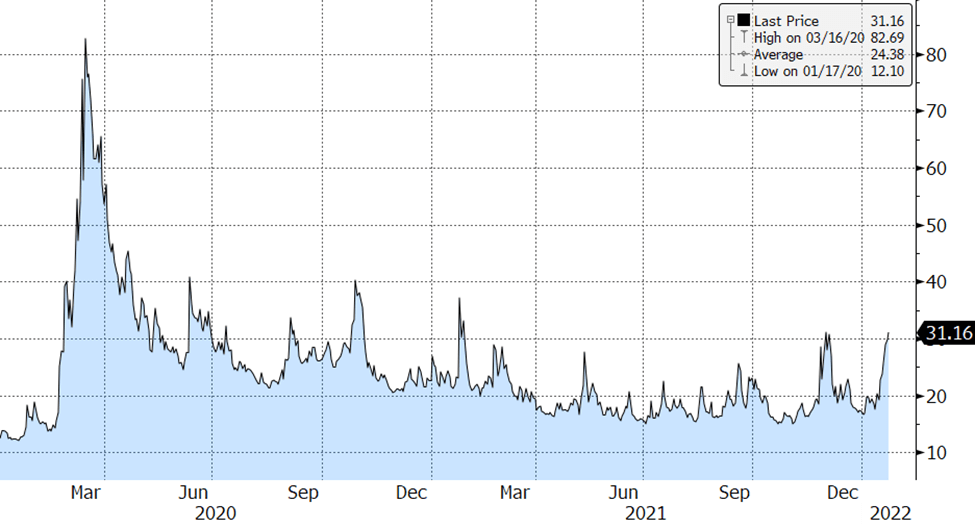

The market has reacted very negatively to this news, with the S&P 500 entering correction territory to kick off the new year and volatility breaking 30, a level previously reached when inflation concerns were initially raised a year ago.

VIX changes since 2020

Source: Bloomberg

In periods of market weakness like this, one should be looking to BUY rather than SELL equities. We could look towards recent periods like December 2018 and March 2020 as similar examples of finding opportunity when others are selling. But rather than simply concluding this article here, let’s delve a little deeper as to what’s driving this selling pressure.

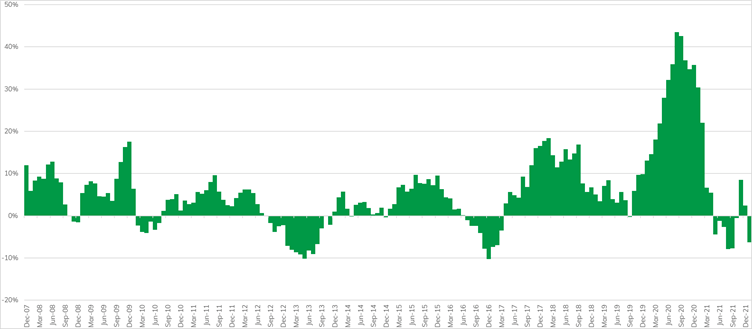

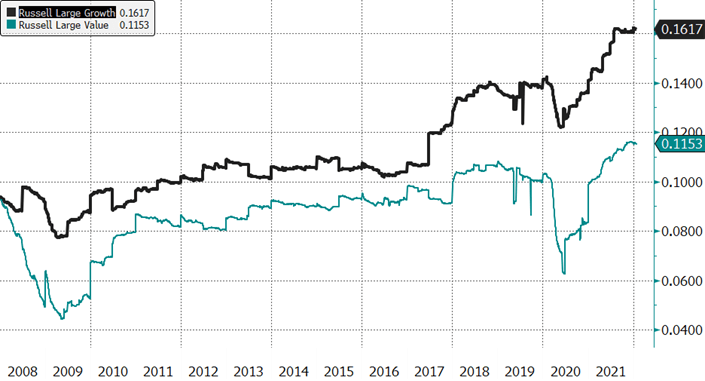

Growth stocks have been the dominating leader (as compared to Value stocks) on a rolling 12-month return basis at an approximate 3-to-1 ratio since 2008 (using the Russell Large Growth and Value indices as proxies). Russell Growth has annualized at over 14%, with Value returning about half that at 7%. However, we noted earlier that rates were hugging 0% during that timeframe. Between 2000-2007, when Fed Funds ranged from 1% to 6%, Value outperformed almost 4-to-1. Considering the entirety of the past 22 years, the outperformance of Growth versus Value has been much more balanced.

Rolling 12-month Excess Returns of Growth Over Value

Source: Bloomberg, Simon Quick Research

Today, there is notable market concern that we’re entering another period of rotation away from high valuation growth stocks and into inflation-supported value stocks. This has been a consideration throughout most of last year on the back of initial upside surprises on inflation and momentum behind the reopening trade, which favored value-cyclicals. This sentiment grew stronger over the holiday season, and while growth stocks were the winner in the final quarter and for the full year, the trend began to fade in November.

Source: Bloomberg

Source: Bloomberg

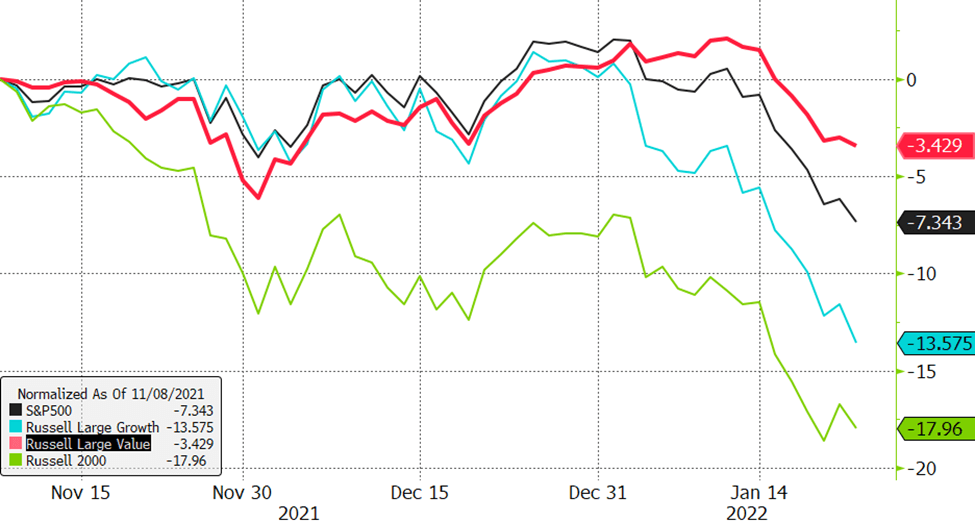

Equity Performance since Russell 2000’s November 8, 2021 Peak

Starting in November, small cap stocks began to meaningfully underperform the market, initially due to interest rate hike concerns, and then more meaningfully as Omicron news raised fears of economic slowdown. Growth stocks were able to hold on to their gains until late December, however they began to falter entering the new year, as the likelihood of an accelerated rate hiking cycle increased. From the November 8th Russell 2000 highs, small caps are down almost 20% at the time of this writing, with Growth indices down over 10%. This is in contrast to Value stocks also being lower, but only by 3%. We fully recognize that we are in a period of rising rates, which mathematically negatively impacts high-multiple companies more than low-multiple ones. However, we do not think this will be a drawn-out regime change of leaders and laggards, rather a shorter-term resetting of valuations. Growth multiples will likely contract further, but these are the businesses we want to own for the long-term as fundamentals broadly remain attractive with strong market share gains and expanding margins that continue to drive earnings to shareholders.

Profit Margins between Growth and Value Indices

Source: Bloomberg

As the Fed begins to hike, likely in March, we should also see inflation moderate. Inflation to date was not driven by a singular catalyst, but by a culmination of factors including economic stop-then start activity due to COVID, the stockpiling of semiconductors and technology (which pre-dated the pandemic but was exacerbated by it), a swift recovery for demand of goods which was fueled by stimulus checks and strained an already tight supply chain, labor shortages, and the need to pay higher wages to get workers back into jobs. It has been somewhat of a vicious cycle that may be with us through 2022, but should come down from current levels over the course of this year as the Fed takes a more hawkish stance, and supply chain imbalances are corrected. Full year inflation levels may remain elevated, but we look towards an improving trend.

GDP will likely still expand above-trend this year, but come down off the mid-5% growth of 2021, towards a more consistent 2-3% historical annual rate. In this more stable economy and steady monetary policy, we believe growth stocks will regain favor as they continue to be the driving force behind innovation and economic growth. We believe in the power of technological adoption and that chips and software are the commodities that will advance our economy and society. However, growth opportunities are diversified across industries, and we look to invest broadly across them to seek out the most compelling businesses. While we anticipate some continued level of heightened volatility in equities in the near-term, we believe this is an opportune time to be adding for the long-term, particularly in oversold growth names.

Increasing Access to Alternatives

There has been an expanding opportunity set of alternative investment strategies being offered in registered fund format versus traditional private fund vehicles. As market volatility increases, alternative strategies like direct lending, private equity and real estate have become more compelling as relatively more stable return generators and diversifiers to traditional asset classes. These vehicles allow for immediate exposure to illiquid assets and permit the investor to remain fully and continuously invested until they elect to redeem their capital. Investors no longer need to wait for their commitments to be drawn down over several years, and then figure out how to reinvest irregular distributions in the future. Furthermore, with lower minimums and investor qualifications, these funds are easier to incorporate as a solution across a broader base of investors. We recognize that open-ended structures may result in some performance dilution versus their closed-end counterparts, however the ability to get immediate exposure and have better liquidity provisions are attractive offsets. If investors can tolerate quarterly redemption windows versus the daily liquidity offered by mutual funds, we believe investors can benefit from enhanced returns and income through these vehicles.

We have recently approved a private equity strategy managed by one of our existing managers on our platform to complement a direct lending strategy from a significant institution that was approved in 2021. We are currently evaluating real estate opportunities that will likely round out our solution set in the coming months. Please reach out to your client advisor to learn more.

Equities: Maintain Target-weight

Equities concluded 2021 with another solid quarter of performance. The market has enjoyed a dovish Fed for most of the year, with consumers spurring on the economy by spending their cash stockpiles and returning to a life of travel and gathering. However, we recognize that valuations are high and businesses are forced to adapt to rising input costs and labor shortages. The omnipresent concerns of omicron are also a headwind to sustained above-trend earnings growth. We believe companies will still be able to generate solid earnings, but equity multiple compression, as the Fed begins to hike, will offset this fundamental strength. This will likely result in increased periods of market volatility this year, as we have already witnessed in January.

We remain constructive on equities as the key driver of wealth creation for investors, however had reduced our recommendation to a more neutral weight as markets had rallied while the Fed looked to pivot. Inflation continues to remain uncomfortably high, and a faster tapering and rate hiking cycle will be a headwind to equities, notably Growth stocks that are focused on the innovation subsectors of technology, consumer and healthcare. We remain sanguine on their long-term fundamentals towards growth and profitability, despite near-term pressures. We will continue to invest for the long-term opportunity through our growth managers, and complementing them with more defensive, stable businesses that should weather inflation and rate fluctuations better in the current environment. We are also reducing smaller-cap and international exposures to raise the capitalization (and business resilience) in portfolios.

While the reopening trade had been tremendous last year, we remain cautious around cyclical industries, which are subject to earnings disappointment as growth moderates and businesses with high operating leverage see margin and cash flow pressures. We remain ready buyers of equities in any notable market pull-back, or relative lag by growth stocks versus cyclicals.

Fixed Income: Maintain Underweight

The Fed has begun to taper its bond buying program and is indicating an earlier start to the rate hiking cycle. This has been a headwind to interest-rate sensitive bonds. In contrast, credit spreads have performed well as investors sought risk assets in the current benign, low-default environment. Inflation and rate hikes will continue to pressure bond performance in the near-term. We are generally unenthused about the asset class, but are finding attractive yields in floating rate corporate and real estate lending as a substitute to traditional bonds. Structured credit has rallied meaningfully, however still affords attractive absolute yields for investors. For tax-sensitive investors, municipal bonds, particularly high yield munis, provide an attractive relative value opportunity versus comparably rated taxable instruments.

Liquid Alternatives: Maintain Target-weight

Rising rates and volatility in equity markets have made liquid alternatives a more attractive option to traditional asset classes. Equity hedge funds can add diversification to ideas through smaller, lesser-known companies and allocations to investment themes that are not easily expressed in traditional funds. Portfolio hedging and stock shorts also create opportunities to capitalize on the currently wide levels of stock dispersion. We continue to emphasize, and have been increasing allocations to multi-strategy, and low-correlation arbitrage strategies as they exhibit the potential to provide better than fixed income returns while avoiding the extremes of market volatility.

Illiquid Alternatives: Maintain Overweight

We remain overweight illiquid alternatives, particularly middle market buy-out and venture capital strategies, given their longer investment horizons where sponsors and management can execute on strategic value creation plans rather than focusing on short-term earnings management. Through the COVID shutdown and into the current recovery, sponsors have actively engaged and supported their portfolio companies, optimizing operations and sourcing acquisition opportunities, in order to expand the breadth of these businesses and resilience of their customer base, and make them more attractive to large private buyers or public markets for potential exit.

We recognize that competition for private assets has increased, elevating multiples and creating a scarcity of supply for good investments. While these businesses are not immune to public market dynamics, investment returns are driven more by the success of fundamental execution than general market temperament and thus can be a high-returning long-term allocation opportunity for investment portfolios. We currently have venture, buy-out, SBIC lending and real estate strategies in market.

Important Disclaimer

Investing in Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable, equal any corresponding indicated historical performance level(s), be suitable for a portfolio or individual situation, or prove successful. This document is strictly confidential and may not be reproduced or distributed in whole or in part without the prior written consent of Simon Quick Advisors. This presentation represents proprietary information that may not be shared without express permission from Simon Quick Advisors.

This information is being provided to you on a confidential basis. By accessing and reviewing this document, you acknowledge and agree that (i) you will not disclose or distribute this information, in whole or in part, to any third party without the prior written consent of the investment manager, Simon Quick Advisors and (ii) that such information is being provided to you for informational purposes only as a current or potential investor qualified to invest in hedge funds and other alternative investments. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer of solicitation will be made only by means of a formal Offering Memorandum that will be furnished to prospective investors.

This material is for intended to be for general and educational purposes only and is being furnished on a confidential basis to the recipient for discussion purposes only. You should not make any decision, financial, investment, trading or otherwise, based on any of the information contained herein without undertaking independent due diligence and consultation with a professional advisor of his/her choosing. You understand that you are using any and all information herein at your own risk. No information provided herein shall constitute, or be construed as an offer or recommendation to sell, acquire, or hold any security, investment product or service, nor shall any such security, product or service be offered or sold in any jurisdiction where such an offer or solicitation is prohibited by law or registration.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick Advisors is neither a law firm nor a certified public accounting firm and no portion of this document’s content should be construed as legal or accounting advice.

This report includes forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Information herein has been obtained from third party sources. While we believe the source to be accurate and reliable, Simon Quick Advisors Simon has not independently verified the accuracy of information. In addition, Simon Quick Advisors makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.