The Tax Cuts and Jobs Act (“TCJA”) of 2017, has been viewed as a “win” for domestic businesses and economic growth, as lower taxes expanded corporate earnings and boosted investor returns. Individual taxpayers also benefited from tax breaks and touted simplified filing requirements.

But, how is one supposed to realize last year’s 20%+ market return, not to mention the over 4x return since the S&P500 bottomed in early 2009, without having to give up a meaningful chunk of those gains to the IRS. Business-builders and entrepreneurs with low cost basis stocks face the same tax planning conundrum. In fact, it is estimated that there is as much as $6 trillion in unrealized capital gains held (or trapped?) in investment portfolios.

Opportunity Zones

Interestingly, the TCJA not only incentivized businesses to invest in domestic capital improvements, but also included a provision for individuals to do so as well through a new section in the tax code called the Investing in Opportunity Act (“IOA”). This was a relatively small clause that had initially been overlooked by the market, but has more recently gained a lot of attention, as it can potentially be a meaningful avenue to realize large pools of capital gains while both deferring and reducing the resultant tax bill. Additionally, investors can roll their profits into long-term investment opportunities where potential gains would be tax-free. So how is this possible?

The IOA was a bi-partisan effort led by Senators Corey Booker (D, NJ) and Tim Scott (R, SC) to create federal tax incentives that would promote private investment in under-developed communities which might have otherwise been overlooked. State governors have designated 8,760 census tracts across the country and US territories as “Opportunity Zones” (“O-zones”) that could potentially benefit from economic rejuvenation, and meet the criteria of the median family income being less than 80% of the surrounding area median and a greater than 20% poverty rate. As an aside, essentially all of Puerto Rico is considered an opportunity zone and could offer significant investment potential for those with a larger risk appetite.

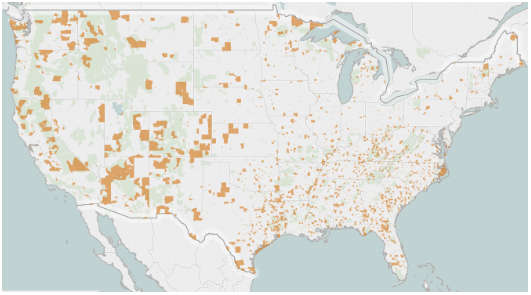

The map below highlights in orange the designated Opportunity Zones within the contiguous 48 states:

Source: https://www.enterprisecommunity.org/opportunity360/opportunity-zone-eligibility-tool

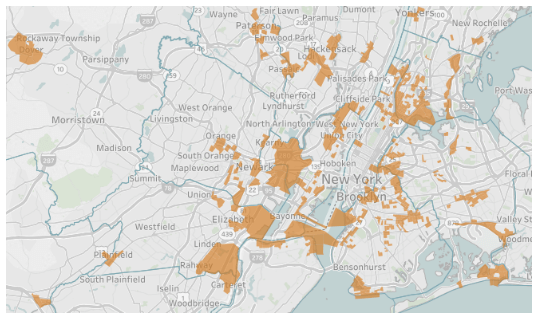

While the national map above shows the largest blocs of designated space in the western and southeastern regions of the country, there are significant parcels of land in and around major urban markets as well, with large embedded populations, which will likely attract the most amount of initial investor interest. Interestingly, the Opportunity Zones were determined from 2015 census data. As we are nearing the end of 2018, many of these areas have already attracted investment and show signs of growth prior to this new tax incentive. Below is a close-up of the New York City area to show the proximity and size of zones that are targetted for the program. Neighborhoods such as Gowanus in Brooklyn, Long Island City in Queens, and East Harlem in Manhattan (adjacent to Central Park!) fall within these designations. Cities along the Northeast Corridor, as well as other major markets across the country, show similar characteristics that can benefit from tax-advantaged investments.

Source: https://www.enterprisecommunity.org/opportunity360/opportunity-zone-eligibility-too

Tax incentive enticement

There are two tax advantages to investing in an opportunity zone. The first allows for tax payments on realized capital gains to be deferred for up to seven years on the amount that is reinvested in opportunity zones. There is also a reduction in the amount of taxes payable at that time, depending on how long the investment has been held. The second advantage, and what may be even more compelling, is that capital gains are tax-exempt after holding an investment for at least ten years. To be clear, the original gain can be deferred and reduced but will still need to be paid. The returns generated from the investment out of realized proceeds, however, are tax-free. The benefit from these two incentives can be materially accretive to performance if appropriately invested, and thus the attraction for private capital.

How do you invest in an Opportunity Zone Fund?

One can invest in opportunity zones through Opportunity Zone Funds (“OZFs”), which are private vehicles that invest in properties, assets, and businesses in the zones and satisfy a set of criteria to receive the favorable tax treatment, which is passed along to its shareholders. Investors would roll ANY realized capital gains(generated from securities, real estate and other assets) into OZFs of their choosing, which would then invest the proceeds into these designated neighborhoods through select real estate development and business start-up projects.

Investors have 180 days from the date of the original realization of a capital gain to invest in an Opportunity Zone Fund. These funds can be commingled vehicles where investors can pool their resources and increase the scale of capital deployed into investment and development. These funds must invest at least 90% of their capital into a qualified opportunity zone property, and properties only qualify if they are acquired after December 31, 2017. Once the fund has received the capital, it must invest in a qualified property within another 180 days and satisfy the significant improvement test 30 months thereafter.

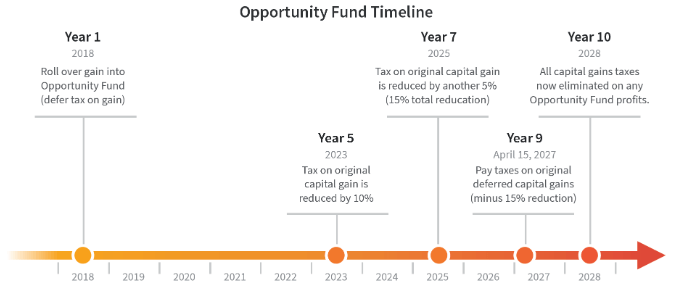

The deferability and size of the ultimate tax payment are based on the investor’s holding period. The realized gain of the original investment decreases by 10% if the OZ fund is held for at least 5 years, and an additional 5% (for a total of 15%) after 7 years.

- As an example, assume a $1,000 initial investment that appreciated 10% ($100) after a one-year holding period. Long-term capital gains taxes must be paid on that $100 gain. However, the IRS will recognize only a $90 gain after a five year hold of an OZF, and an $85 gain after a seven year hold if it is invested in an opportunity fund.

The deferred gain must be recognized by 12/31/2026, or earlier if the investment is sold. In order to receive the full 15% reduction in gains, the proceeds must be invested by the end of 2019 in order to attain the seven-year deferral.

After 10 a ten year hold, the basis of the fund (the original $100 that was invested in our example) will equal the value at which the investment is sold or exchanged, thus realizing no capital gains on realization. This is where investors would maximize their tax benefit as there is no limit to the amount of taxes that can be saved through an opportunity fund, with no income-based phase outs for high earners.

Source: Opportunity Zone Investing Guide, Fundrise

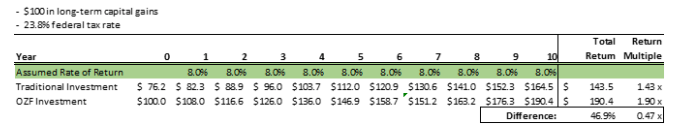

We run through some basic math to show the power of tax-deferred compounding and the tax-exemption benefit to investors below. We compare the total return of $100 in realized gains that is invested in a traditional investment generating assumed 8% annualized returns (after paying 23.8% in capital gains taxes at initial realization in year 0 and again at the end of year 10) to an investment in an OZF also generating 8% in annual returns but capital gains taxes are paid on only $85 (rather than $100) in year 7 and no capital gains taxes at the end of year 10. In this scenario, the OZF investor generates a near 47% better return over the life of the investment, or a 1.90x multiple on the original $100 versus 1.43x from a traditional investment.

Furthermore, the tax incentives provide enough cushion to allow for a meaningful margin of error to still be an attractive investment. Below, we assume an OZF investment only generates a 5.3% annualized pre-tax return (only 2/3 of assumed traditional investment returns of 8%). After 10 years, the OZF investment has still slightly outperformed the after-tax return of a traditional investment.

This structure can appeal to traditional 1031-exchange investors as gains do not have to be rolled in perpetuity to avoid the tax bill. Additionally reinvested capital does not have to go back into real estate assets nor does a sale used to fund an OZF investment need to come only from a real estate transaction to qualify. Another notable difference is that 1031’s require the full initial principal and gain to be rolled into the new asset, while an OZF investment can be comprised of any amount of the capital gain to benefit from the tax treatment. While an OZF investment only defers a tax payable up to seven years, it also reduces that bill and allows for future gains on the rolled investment to be tax free upon realization.

Aligning Private Capital with Public Interest

The motivations for the government behind the IOA are to drive private investment where there otherwise might not have been much interest. In order to accomplish this, the government will forgo receipts from taxes on gains from Opportunity Zone Funds, however this is mitigated by crystalizing tax receivables on at least 85% of realized capital gains by 2027 that might have otherwise not been available, in addition to potential tax receipts from new businesses budding in the opportunity zones.

Furthermore, in order to prevent investors from simply hoarding assets and flipping for profit, the law promotes actual financial contribution and active development in order to qualify for the favorable tax treatment. This is achieved by a requirement that the original use of an acquired property must begin with the OZF, or that the property is substantially improved within 30 months of acquisition. The definition of “substantially improved” is understood as a dollar-for-dollar investment to the original purchase price. For real estate investments, this would be based on the value of the acquired building alone, excluding the value of the land the property sits on. This clause limits the purchase of fully stabilized assets, rather emphasizes heavy value-add capital improvement and ground-up development deals for the funds. By mandating active capital deployment in addition to the initial purchase price, managers are compelled to engage and support the neighborhood in and around their asset to further drive economic growth to enhance value.

Good investments might become great… but bad investments aren’t made good

While we noted above that the tax incentives provide some margin of safety, investing in Opportunity Zones and Funds should be led by the return potential on a pre-tax basis. Investors should be aware that there is risk in the program, as opportunity zones are typically depressed local economies that did not garner much interest in the past and OZ fund managers must find projects that can benefit from significant capital investment AND be able to generate an acceptable return over a relatively long holding period. These aspects may result in a return profile that can differ from a traditional private equity investment. Furthermore, making sure the asset retains its designation as a qualified property within set timeframes adds to the complexity of investing. While there are nearly 9000 tracts designated as O-zones across the country, what is likely to be investable with attractive return potential is a significantly smaller pool and this will naturally drive up the cost of entry into these markets even before any improvements are made. Finally, as this is a new program, there will be a learning curve as managers figure out how to best execute in this investment framework.

These incentives can make a good investment opportunity be great on an after-tax basis, but can’t make bad investments turn good. Thus, we think it is critical to invest in an experienced manager that is familiar with the asset and logistics around large-scale developments, the nuances of the neighborhoods where they are investing in, and a deep understanding of the rules to qualify and retain the tax incentives. Investment decisions should also be led by the merits in underwriting the asset within the guidelines of the IOA, and then look towards the favorable tax treatment as incremental return enhancement for long-term investors.

Regulatory clarifications accelerate momentum

The IRS and Department of Treasury recently released a set of regulations to provide further guidance on investing in OZFs, largely reinforcing their accommodative stance to encourage investment. These regulations are now open for public comment before being finalized, but have a safe harbor provision allowing for investors to begin investing in properties based on these preliminary terms. The IRS and Treasury will also provide additional clarifications to the program by the end of the year. The key elements of the release specify that:

- Beneficiaries of this new regulation are not limited solely to individuals, rather corporations, regulated investment companies, REITs, partnerships, and other pass-through entities can also elect to defer capital gains through this program. Thus, a larger pool of capital can invest in these zones to receive the favorable tax treatment, beyond just individuals.

- Entities organized as limited liability companies (LLCs) can also be qualified OZFs as long as they are recognized as taxable entities such as a partnership or corporation.

- A major clarification around the substantial improvement test was made, whereby a purchase of a building located on land entirely within an opportunity zone would only require substantial improvement of the basis in the building, not including the value of the land it resided on. This is a significant positive for developers as it reduces the amount of investment dollars necessary to have a project qualify.

- Furthermore, working capital can be held for projects as long as there is a written plan detailing the amount of working capital and how it is scheduled to be deployed within a 31-month completion schedule.

- Debt financing, collateralized by assets in the OZF, is permissible. However, debt investments are not recognized as qualified property. We note that there is a provision to qualify preferred stock, which technically would sit above the equity investment.

- The Ten-Year Benefit in basis step-up is available until December 31, 2047, which is 20 ½ years after the last day an investor can invest eligible gains in a fund. The last day to defer gains is June 29, 2027, which is 180 days after December 31, 2026, the last day gains are eligible for deferral. This provision is meaningful in that it provides a long window during which OZFs can monetize their investments methodically over a long period of time, rather than all these funds trying to exit together in 2029.

- The ability to reinvest proceeds from a sale of assets within an OZF has still not been addressed, but may be done in the second set of guidance. However, there is interesting language in the recent release allowing for a deferral of gains from a sale of an OZF if the proceeds were re-invested in another OZF. If this is true, it may create interesting opportunities for secondary trading and new strategies later into the program. We do not yet have clarity to the tax ramifications on secondary sales and recognition of holding periods, so this is purely speculation but worth keeping an eye out for.

Conclusion

There are more efficient ways to minimize taxes, such as the step-up in basis on inherited assets, however the concept of Opportunity Zone Funds offer an attractive vehicle where the original investors can enjoy the embedded gains, and not just their heirs. We also appreciate the alignment of private capital in supporting the broader public good where both parties can benefit if executed properly. The program is thoughtful, and the recent IRS/Treasury clarification validates the foundation for which initial investments can begin. We expect there to be a significant amount of interest for real estate and business start-ups that can last for the next several years and are excited about the program’s potential for tax-conscious investors. We continue to actively diligence the program and potential managers that can effectively employ the strategy. Please reach out to me at [email protected] to discuss how Opportunity Zone Funds can be applicable to your investment and financial planning needs.

Sources

- Opportunity Zone Investing Guide, Fundrise

- Saxum Insights: Opportunity Zones: A Historic Tax-Efficient Mechanism to Leverage Real Estate, Saxum Real Estate

- Opportunity Zones & Funds: The Definition of Capital on a Mission, Bellweather Enterprise

- Long-Awaited Proposed Regulations on Qualified Opportunity Zones Issued, Hirschler Fleischer, October 22, 2018

- https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions

Disclaimer

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick Advisors, LLC), or any non-investment related content, made reference to directly or indirectly in this presentation will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors, LLC (“SIMON QUICK”).

This presentation is general in nature and for educational purposes only. While all the information prepared in this presentation is believed to be accurate, SIMON QUICK makes no express or implied warranty as to its completeness, accuracy, or fitness for any particular purpose, nor can it accept responsibility for errors appearing in the presentation. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from SIMON QUICK. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

The information herein contains certain assumptions and forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future legislative conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

You should not make any decision, financial, investment, trading or otherwise, based on any of the information contained in this presentation without undertaking independent due diligence and consultation with a professional advisor of his/her choosing. You understand that you are using any and all Information available in this presentation at your own risk.

SIMON QUICK is neither a law firm nor a certified public accounting firm and no portion of the presentation content should be construed as legal or accounting advice. If you are a SIMON QUICK client, please remember to contact SIMON QUICK, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to SIMON QUICK as being “registered” does not imply a certain level of education or expertise.

No information provided herein shall constitute, or be construed as, an offer to sell or a solicitation of an offer to acquire any security, investment product or service, nor shall any such security, product or service be offered or sold in any jurisdiction where such an offer or solicitation is prohibited by law or registration. This document is strictly confidential and may not be reproduced or distributed in whole or in part without the prior written consent of SIMON QUICK. This presentation represents proprietary information. All investment advice furnished by SIMON QUICK to a Client shall not be distributed or shared and will be treated as confidential. In addition, it shall not be utilized in trading for a client’s other accounts or disclosed to third parties except as required by law.