Looking More Like Tricks than Treats for Markets

As we prepare for Halloween and the swarms of costumed trick-or-treaters banging down our doors, I thought I’d share a spooky excerpt from the IMF’s latest World Economic Outlook publication: “The global economy is in a synchronized slowdown, with growth for 2019 downgraded again…its slowest pace since the global financial crisis.”

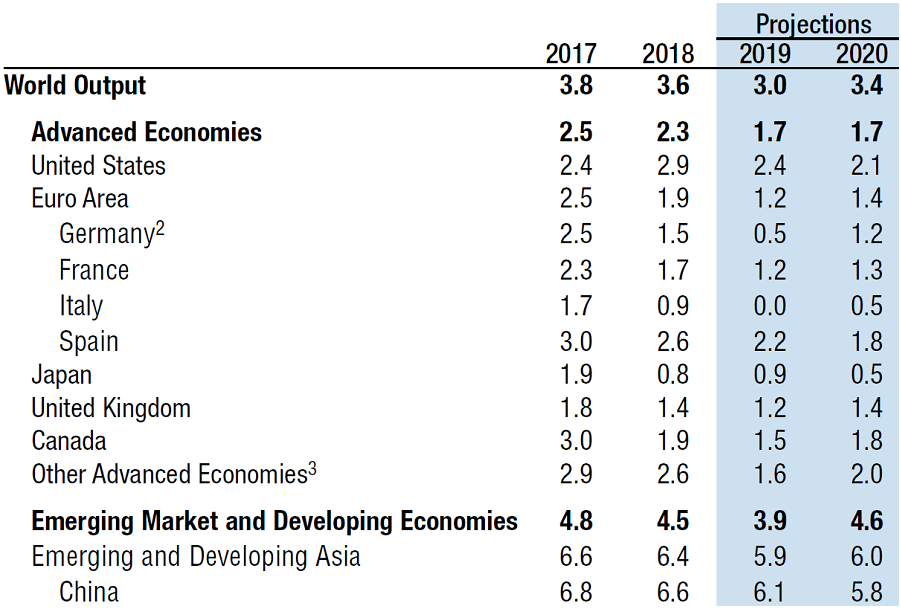

Global Economic Outlook Projections

SOURCE: INTERNATIONAL MONETARY FUND

Global growth expectations have been reduced to 3% for the year, from 3.2% projected in July. A lot of this softness is attributed to the slowdown in manufacturing and international trade, led by the ongoing tensions in US-China trade. The continuation of accommodative monetary policies from central banks across the world have mitigated the slowdown, but these actions have not completely offset it. More relevant to us, despite the depth and breadth of our economy, the US has not been immune to the slowdown. Prospects for domestic growth, while higher than other advanced economies, have been cut and are expected to slow further into 2020, a presidential election year, while many other countries, notably emerging markets, are anticipated to recover.

Third quarter earnings season has begun, with analyst expectations for revenues to grow in the mid- to upper-2% range, but earnings are down 4-5% year-over-year. With forward P/E multiples trading at 17x, according to FactSet, equities aren’t cheap and risks to the downside have increased.

Having read thus far, one might begin howling like a werewolf that equities are expensive, the economy is slowing, and thus we need to get out of stocks. We agree that equity valuations are, at best, fairly priced and there is greater uncertainty in the economy and capital markets. As we don’t see a clear path towards a re-acceleration in growth in the near-term, we have recommended our clients take a more defensive approach to equities along with a modest underweight allocation. However, there is no silver bullet to timing the markets and we would caution against drastic reductions in equities as this bull market can still run. Instead, we rely on asset diversification and regular rebalancing to generate long-term appreciation with lower dependency on antacids.

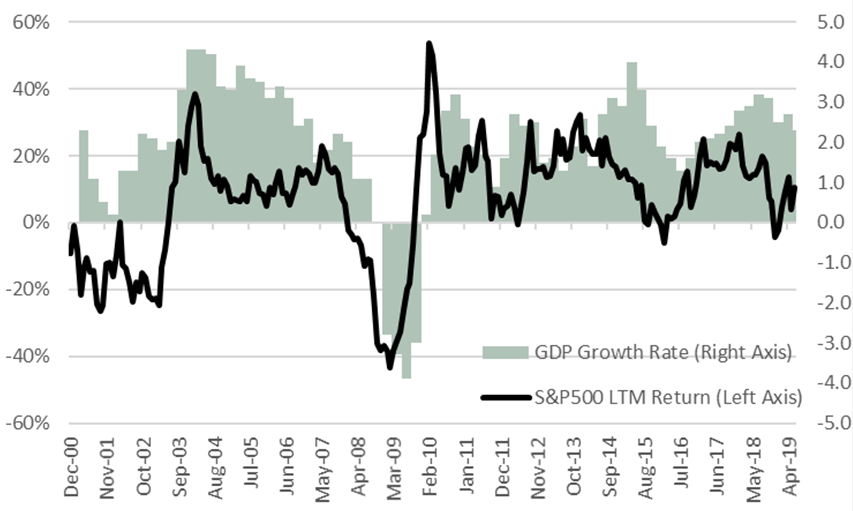

The trick-y thing about markets is that neither man nor algorithmic machine can predict both the magnitude and timing of market inflections. Logic would say that stock markets should do best when valuations are low or economic growth is strongest. But the simple graphs below show that the equity market doesn’t move to the same rhythm of economic fundamentals. GDP and stocks are correlated over the long-run, but over relatively shorter periods, the relationship is sporadic with many incidences of antithetical behavior that would rattle the bones of your typical market technician. Markets have rallied in the midst of slowing growth and underperformed in periods of expansion.

Limited Ability to Time GDP’s Impact on Markets

Source: Bloomberg, Simon Quick Research

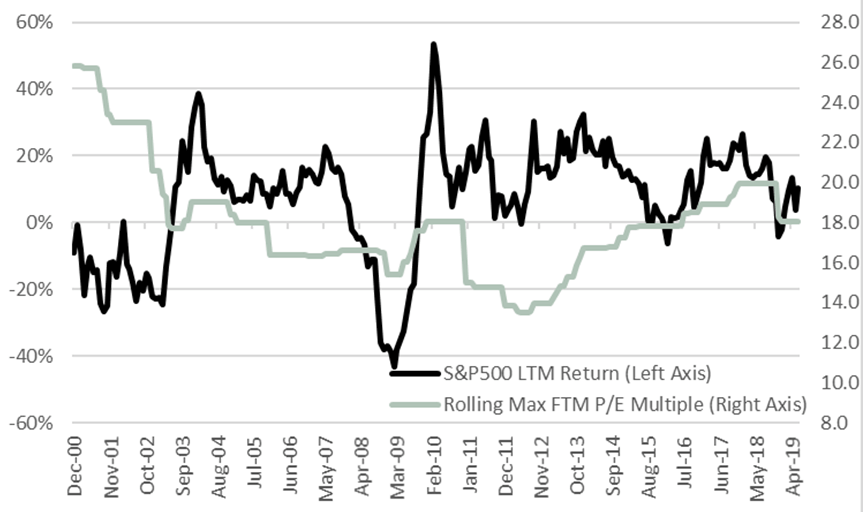

Furthermore, expensive stocks can get more expensive for a painfully long time before valuations correct. Thus, being out of the market because “it’s too expensive” over the past few years would have resulted in greater stomach pains than eating all the leftover Halloween candy in a single sitting.

Valuations Alone Can’t Predict Market Behavior

Source: Bloomberg, Simon Quick Research

We constantly incorporate new economic information, with market prices, and geopolitical events, as a witch would stir her cauldron, to establish our asset allocation recommendations. Interest rates, and the anticipated posture of our Fed, continues to be a key ingredient for that. The IMF report commented that interest rates will likely remain “low for long” in the absence of meaningful growth and inflation, particularly in international markets. The Fed Funds rate has been reduced twice in the past quarter to 2%, with a likely additional two before the end of the year and reversing the hikes from 2018. This dovish stance, in addition to the recent asset purchase program to stabilize the repurchase obligation market, are evidence of a still vulnerable economy, but also has the side effect of pushing equity and bond valuations higher. In comparison, Europe and Japan have been in a negative rate stance and will likely continue to do so for the foreseeable future. There are approximately $15tn of debt trading at negative yields. What’s interesting about this is that there are now over a dozen high yield bond issuers, such as Altice and Nokia in Europe, that also have negative-yielding debt, as investors are resigned to buy whatever assets they can that are considered relatively “safe” yet offer some spread to the sovereign debt. Can the US also enter a negative rate regime? We maintain a core fixed income allocation and have modestly extended duration with rates cuts seeming more likely than hikes in the near term.

The following are some candy corn-sized events we are tracking that we continue to evaluate in shaping our market outlooks:

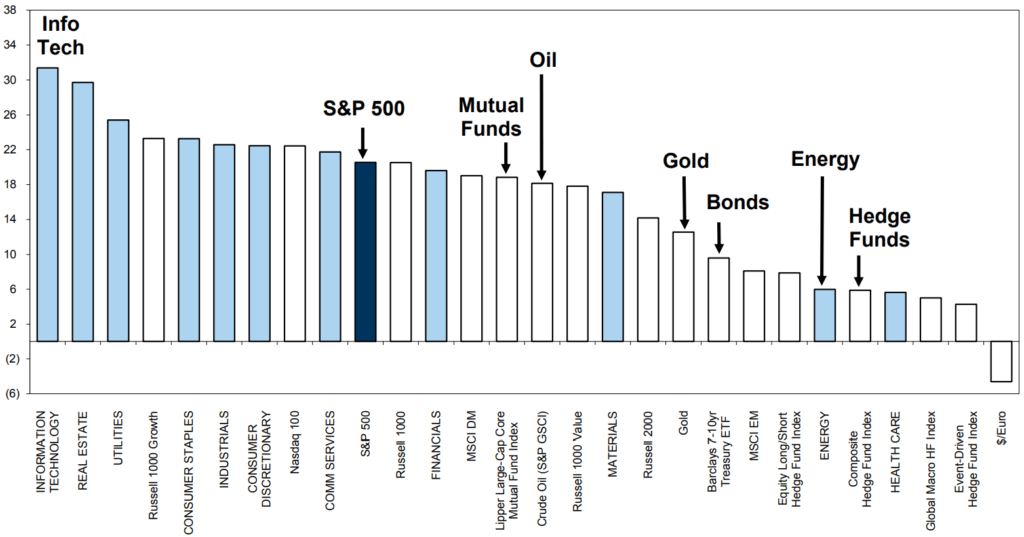

Equity market winners are coming from two opposite ends of the spectrum.

Tech is leading the pack amongst sector returns this year. However, defensive sectors Real Estate and Utilities are the next two in line. This is notable as Tech investors are typically not also buying the other two industries. We do note that this is due to investor appetite in defensive equities, and the additional benefit of interest rate sensitivity in a rate cutting cycle. We do note that Real Estate and Utilities are very small components of the S&P500 at 3% and 4%, respectively.

2019 Returns Through September

Source: Goldman Sachs Investment Research

The failed WeWork IPO:

While several other large venture-backed unicorns were able to come to the public markets, performance has been disappointing, and the failure of WeWork, and recent announcement of a delayed Saudi Aramco listing makes it feel like that part of the market was on the receiving end of mischief night.

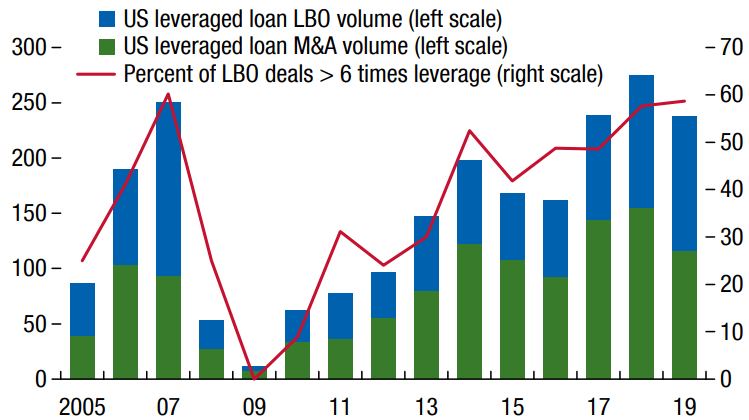

Leverage is Increasing; Share-count reduction is replacing capital investment:

While debt financing is cheap, companies and private equity sponsors have taken advantage of this to increase leverage and pursue shareholder-friendly activities to improve short-term sentiment, like buybacks and dividends, rather than invest in their business.

US Leveraged Loan M&A and LBO Volume

($Billions; %)

Source: IMF

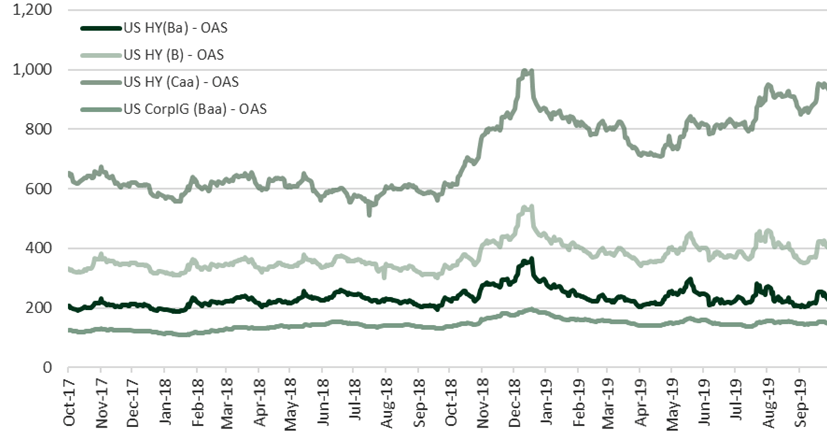

High yield index has recovered almost 30% of its spread from year-end, but Triple-C’s have not.

By rating, double- and single-B’s recovered 40% and 30% respectively this year. However, Triple-C’s have only regained about 10% of their spread. From a returns basis, high yield has returned over 11% on the year, with double- and single-B’s returning 12-13%, however triple-C’s have returned a little over 5%. Small cap equities, which serve as a decent proxy to similar risk appetite to high yield bonds, is also up over 14% on the year. This seems discongruous and warrants our further evaluation.

High Yield Spreads: Triple-C’s Haven’t Recovered

Source: Barclays, Simon Quick Research

A final quote from the IMF report:

“there is no room for policy mistakes and an urgent need for policymakers to cooperatively deescalate trade and geopolitical tensions.” This is particularly hair-raising given the spate of recent news flow:

- On the international front, the US-China trade war continues. There have been glimmers of hope for progress towards a deal, however until there is an inked agreement, markets will continue to be whipsawed by speculation and tweets.

- The withdrawal of US troops and the resultant Syria-Turkey conflict has renewed tension in the region.

- It appears as though Brexit will be delayed again.

- Domestically, the President now faces an impeachment inquiry and the current front-runner for the Democratic Presidential candidate, Elizabeth Warren, is rattling the Tech and Healthcare sectors with plans for greater regulation and calls for a break-up of the tech titans.

Outlook and Asset Allocation

EQUITIES: MODEST UNDERWEIGHT

Equities were up modestly in the quarter at 1.7%, but have tipped the markets above 20%, as measured by the S&P500. Stable but slowing macro fundamentals, with limited catalysts for further material upside in the near-term warrant a more defensive posture. As we are closer to the end of the business cycle than we are to the beginning, we expect more frequent bouts of volatility in equities and thus find returns to come with greater risk. We remain modestly underweight stocks and believe a Value and “Quality” tilt will be more resilient to potential market weakness. We continue to rotate into higher quality (strong margins, low financial leverage), large cap, domestically oriented businesses. We have also added to dividend-oriented stocks, to provide additional defensive, value-focused exposure. We currently remain underweight developed international and emerging markets given greater economic weakness and political uncertainty in these regions, however recognize the valuation discounts available in these regions and continue to evaluate the opportunity set.

FIXED INCOME: TARGETWEIGHT

Rates are expected to continue to move lower over the course of this year. While the return opportunity is limited from bonds, they do serve as a counterbalance to equities and should protect on a stock market sell-off. We have modestly extended duration, but still remain shorter relative to benchmarks given the lack of additional yield. We are constructive on municipals for tax-sensitive investors. We remain selective with credit risk and thus have limited exposure to traditional high yield bonds and loans, and instead have opted for structural and liquidity arbitrage options to enhance returns.

LIQUID ALTERNATIVES: OVERWEIGHT

We are constructive on hedge funds in the current investment environment. We remain selective on long/short equity managers broadly as the ability to generate consistent excess returns is very difficult. However, we retain a select group of funds in this strategy that we expect to achieve that high hurdle and can be a substitute to the long-only equity risk. Arbitrage, idiosyncratic credit, and un-correlated asset strategies can generate strong, consistent returns ahead of fixed income and without rate sensitivity in a directionless market. Furthermore, increased market volatility can potentially expand the investment opportunity for these strategies as they have modestly longer liquidity terms versus their long-only peers.

ILLIQUID ALTERNATIVES: OVERWEIGHT

We are overweight illiquid alternatives given their longer investment periods and ability to extract value through active engagement with their portfolio companies. We recognize that valuations in private equity have also risen, but to a lesser extent in the lower middle market space. Furthermore, institutionalizing operations and strategic acquisitions can improve margins and offset some of the purchase premiums. Over an investment cycle, private equity investments should generate materially stronger returns over public markets in exchange for longer holding periods.

Do you have any other additional questions about the market? We would love to chat!

IMPORTANT DISCLOSURES

This information is for general and educational purposes only. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors, LLC (“Simon Quick”) nor should this be construed as an offer to sell or the solicitation of an offer to purchase an interest in a security or separate accounts of any type. Asset Allocation and diversifying asset classes may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Investing in Liquid and Illiquid Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of Alternative Investments can vary based on the underlying strategies used.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Simon Quick client, please remember to contact Simon Quick, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick as being “registered” does not imply a certain level of education or expertise.

This newsletter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Economic, index, and performance information herein has been obtained from various third party sources. While we believe the source to be accurate and reliable, Simon Quick has not independently verified the accuracy of information. In addition, Simon Quick makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or benchmark index, as comparative indices or benchmark index may be more or less volatile than your account holdings. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document. Index data and other information contained herein is supplied from various sources and is believed to be accurate but Simon Quick has not independently verified the accuracy of this information.