Volatility is normal, but that doesn’t make it any less painful.

Unsettling headlines, unpredictable policy decisions, and fluctuating account balances are never easy to stomach.

If you’re feeling uncertain, you’re not alone. And you’re not overreacting. Discomfort in periods of market turbulence is entirely rational. In fact, it’s expected.

If you’re feeling ambitious and looking to turn volatility into quick gains, you’re also not alone. But you might be overreacting. While “buy the dip” has become a popular mantra, it’s not foolproof or a viable substitute for a disciplined, long-term strategy.

Discomfort and FOMO shouldn’t drive your decisions.

In times of volatility, what’s most important is staying level-headed, patient, and committed to your financial plan. That’s why we’ve outlined common behavioral traps to avoid, tips on how to stay grounded, and why it’s important to maintain a long-term perspective regardless of what the market throws at you.

What Volatility Really Means

Investors and market pundits toss the “V” word around liberally, usually with a negative connotation.

Except volatility, in and of itself, is not a threat. It’s simply a measure of how much the market moves up or down over a period of time. And those movements, while uncomfortable, are not unusual. They’re an inherent feature of investing.

Markets are made up of people, and people are prone to hasty decisions. Elections, geopolitical events, policy shifts, inflation data, and trade disputes — none of these are new forces, even if the headlines seem more intense today. Volatility is what gives markets their dynamism. It also helps make positive returns possible.

To participate in the market’s long-term upside, you must be willing to endure its short-term fluctuations. That doesn’t mean you should ignore risk. It means understanding that temporary declines are part of the process.

Investing without volatility would be like sailing without wind: calm, sure, but also stagnant and directionless.

Behavioral Traps to Watch For During Volatility

Market turbulence pushes rational, plan-oriented investors into emotional decisions. It’s human nature. That said, understanding the psychological traps that tend to surface can help you pause and respond deliberately instead of impulsively.

Let’s explore a few of the most common ones.

Loss Aversion

We tend to feel the pain of losses more acutely than the pleasure of gains. That emotional imbalance can lead to reactionary trades, like pulling out of the market after a downturn to avoid “further damage” — even if doing so locks in a loss and hinders long-term progress.

It’s uncomfortable to watch your portfolio decline. Remember, your balance represents an estimate of what you’d receive if you liquidated everything right now. Unrealized losses only become permanent if you sell.

Herding Bias

We’re wired to trust the crowd and question our own convictions if they contradict what everyone else is doing. When the masses move in unison (e.g., buying a trendy IPO, selling in a panic), it can be hard to resist following along.

Herding bias is most prominent in times of volatility, as popular opinion can seem safer than independent thought. Yet crowd behavior rarely translates to sound strategy.

If your decision is driven more by consensus than conviction, it’s worth taking a step back and reevaluating.

Recency Bias

Simply put, we tend to grant extra weight to recent stimuli and experiences when making decisions.

When markets rise, we assume they’ll keep rising. When they fall, we assume the worst is still ahead. The former can fuel greed, while the latter often provokes fear. In either case, investors risk chasing performance or selling prematurely, both of which can work against them.

Don’t let short-term swings distort your long-term strategy.

How to Stay Grounded During Volatility

You don’t have to be emotionless — that would be like saying don’t be human. But you do have to resist the urge to let fear or anxiety steer your decision-making.

Here are a few ways to stay grounded during volatility:

Clarify your concerns. In other words, what specifically is worrying you? Is it a drop in your account balance? Delaying your retirement? A change in your income or job security? It’s easier to corral emotions when we know definitively what’s behind them.

Revisit your plan. Media outlets and online self-described gurus don’t have your future in mind. Your financial plan, on the other hand, is built around you — your goals, your timeline, your needs. During times of uncertainty, lean on it to keep things in perspective.

Know what your portfolio is designed to do. Short-term expenses should be covered by stable, accessible cash reserves. Long-term investments are meant to weather drawdowns. If you confuse the two, volatility will feel more disruptive than it needs to.

Accept that volatility is normal. Steep declines, sudden rallies, political noise — none of it is unusual. History doesn’t foretell the future, but the market tends to generate positive returns about 7 out of every 10 years.¹ Conversely, down years are expected. It’s just part of the process.

Remember that investing is a long game. Success doesn’t hinge on one decision or one moment. It’s the product of consistent, rational choices made over time, especially during periods of uncertainty.

The Power of a Long-Term Outlook

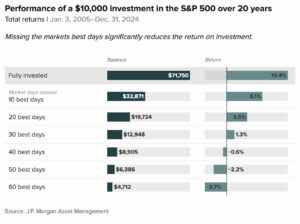

The sidelines may look safe during market choppiness, but pulling out (even temporarily) can drastically reduce your long-term returns. That’s because the best trading days generally coincide with rebounds from downturns.

Over the past 20 years, a $1 million investment in the S&P 500 would have grown to approximately $7.18 million if left untouched.² But if you missed just the 10 best trading days, that return would have been cut by more than half, down to $3.29 million. Miss the 30 best days, and your portfolio would have grown to just $1.3 million.

If we dive deeper into history, the pattern holds. Despite wars, recessions, political upheaval, inflation shocks, and a medley of other crises, markets have evened out and produced gains over time.

From 1950 to 2024, the S&P 500’s one-year rolling returns ranged from a high of +60% to a low of -41%.³ That’s a wide and likely jarring spread. However, over 30-year rolling periods, that variance narrows significantly: returns have ranged from 8% to 15% annually.

We’re Here for You

Market volatility stirs up a lot: concern, discomfort, and possibly the temptation to act. All of that is normal. But as we’ve seen, short-term reactions can lead to long-term detours.

Keep in mind:

- Volatility is a feature of markets. An admission to ride, so to speak.

- Your plan is your anchor. A complete financial plan should outline what to do in the event of headwinds and turmoil.

- Behavior shapes outcomes. Resisting impulse can make a sizable difference over time.

If you’re feeling unsettled or simply want to talk things through, we’re here — schedule a complimentary meeting. Let’s talk about how your plan is built to handle this.

Sources:

- S&P 500 data

- S&P 500 data

- S&P 500 data