The pace of sell-off in equity markets accelerated today (Monday, January 24th), down almost 4% around lunchtime, on top of the 7.7% sell-off experienced in the first three weeks of this year. This move put equities formally in a stock market correction for the S&P, which follows the earlier sell-off in small caps and growth indices. We would note that the major indices rallied back to end the day in positive territory, however, we expect volatility to persist this week. A lot of this selling pressure is driven by investors taking gains from the tremendous equity run over the past few years where the Fed had taken a largely dovish stance despite inflation concerns. The Fed has changed their focus away from employment and job participation towards tamping down the currently high inflation rate. This means a quick end to bond-buying and a steady path of rate hikes.

This shifts Fed policy from what was a tailwind to stocks to a headwind. The immediate effect is multiple compression, where the S&P 500, for example, was trading an approximate 20x forward P/E multiple, above its 10-year average of about 17. Growth and small caps were trading at greater multiples and are more sensitive to this new rate policy.

While valuations are coming down, earnings growth and quality of corporate balance sheets still remain resilient, despite the challenges we’ve seen from supply chain disruptions and wage pressures. Fourth-quarter earnings are expected to grow 20% year-over-year with upside surprises to revenues. 2022 is expected to continue to see solid earnings growth at around 10% with high single-digit top-line growth as well. Corporate forward-looking guidance can always change, but we are comforted by strong earnings growth in the back half of last year when some of the macro factors were most acute.

We aren’t calling the bottom to this sell-off, but the velocity of the move in a very short order seems overdone, likely exacerbated by passives selling and algorithmic trading strategies signaling the shift in momentum and de-leveraging as well.

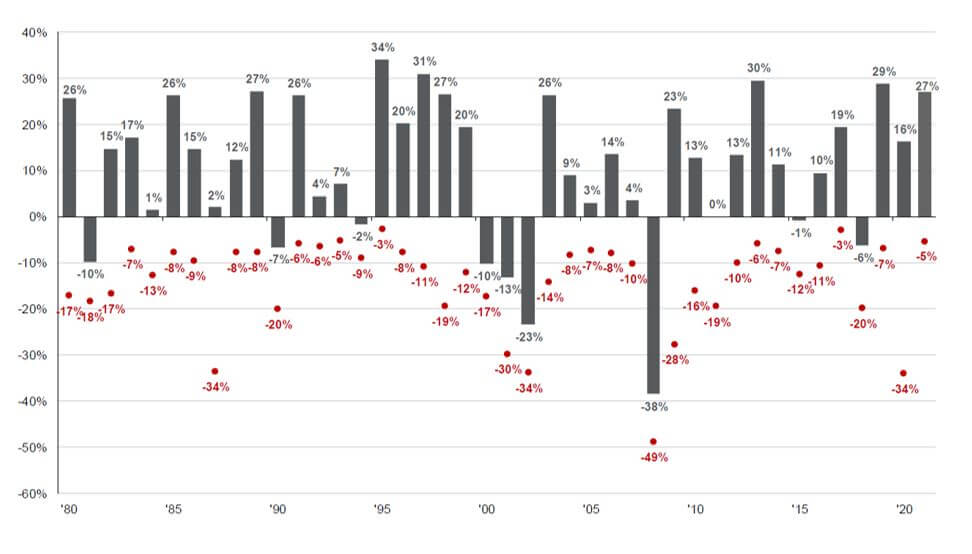

We would note that market corrections of 10-20% occur every 1-2 years. We would also highlight that some of the best equity market returns follow right after these periods. Corrections tend to only last a few months and a Schwab study found that the S&P500 rallied an average of 8% a month after the correction bottom and more than 24% a year later. While unenjoyable, it is healthy for the market to undergo a resetting. We could go so far as to say that a notable decline in equities can also dampen inflationary pressure, resulting in a slower than anticipated hiking cycle.

Annual Returns & Intra-Year Declines

Source: JP Morgan

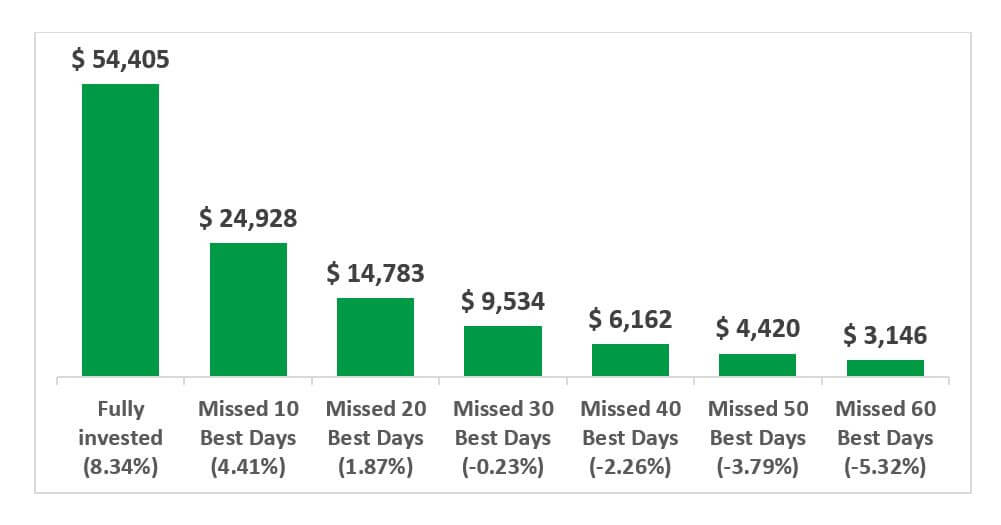

If you had $10,000 to invest beginning in 2001 through 2021…

Source: Simon Quick Research, Bloomberg – Assumes an investor invested $10,000 on 01/02/01 into the S&P 500 Total Return Index

Market corrections are uncomfortable, particularly when they occur in short periods. However, these periods are not new and should be considered opportunities to add to positioning as being invested in the market maximizes wealth creation potential over the long term.

If you have questions or would like to discuss this in more detail, please give us a call. A Simon Quick advisor can help answer your questions and come up with an investment strategy that meets your long-term needs. To learn more, call us at (973) 525-1000 or send an email to [email protected].

IMPORTANT DISCLOSURES

This information is for general and educational purposes only. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors & Co., LLC (“Simon Quick”) nor should this be construed as an offer to sell or the solicitation of an offer to purchase an interest in a security or separate accounts of any type. Asset Allocation and diversifying asset classes may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Investing in Liquid and Illiquid Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of Alternative Investments can vary based on the underlying strategies used.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Simon Quick client, please remember to contact Simon Quick, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick as being “registered” does not imply a certain level of education or expertise.

This newsletter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Economic, index, and performance information herein has been obtained from various third party sources. While we believe the source to be accurate and reliable, Simon Quick has not independently verified the accuracy of information. In addition, Simon Quick makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or benchmark index, as comparative indices or benchmark index may be more or less volatile than your account holdings. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document. Index data and other information contained herein is supplied from various sources and is believed to be accurate but Simon Quick has not independently verified the accuracy of this information.