Not all periods of inflation are the same. Last year’s inflation can be likened to that awkward cousin that you were obliged to invite to your wedding. You were annoyed they accepted the invitation, messed up the seating chart, and increased the cost of the reception, but their presence was supposed to be temporary and not a meaningful distraction from the celebration.

This year’s inflation feels more like that same cousin decided to invite themselves over to crash on your couch, eat your food, borrow your car, and generally disrupt your daily life for an indeterminate amount of time.

Pardon the forced illustration and apologies to my cousin Fred, but the point is that while the perception and drivers of inflation may have shifted from last year to this, the impact of rising costs has become uncomfortably more persistent and pervasive in the economy and markets. Last year, supply chains couldn’t keep up with demand of deferred purchases from the pandemic. This was somewhat temporary, and inventories for goods have since been replenished, but now the Russia-Ukraine war has induced shocks to energy and food supplies, and rapidly raised the cost of living globally. All the while housing prices continue to appreciate faster than wages.

In order to address rising prices, the Federal Reserve is aggressively raising interest rates to slow down consumption and labor demand, and Congress recently passed the Inflation Reduction Act to contain healthcare and energy costs and reduce the government deficit. While these measures are supportive in reigning in certain upward cost pressures, they are less effective at solving the root problem of not enough food, energy, and housing that is weighing on consumers right now. Unfortunately, these are less in our control and may be longer-lived.

These factors have definitively weighed on market sentiment as investors are worried that rising prices would reduce demand, slowing revenue growth of businesses already struggling with high materials and labor costs. The Fed’s willingness to maintain a more restrictive monetary policy of higher interest rates for longer at the sacrifice of strong labor markets further fuels fears that the economy could fall into a recession. We have already logged two-quarters of negative GDP growth and could potentially fall into a broader recession by the end of the year. We have correspondingly seen a double-digit sell-off in equity and bond markets this year, and mortgage rates have doubled from last year’s lows. While we have bounced out of the trough, we are still in a market correction.

Equity and Fixed Income YTD Performance through 08/16/22

Source: Koyfin

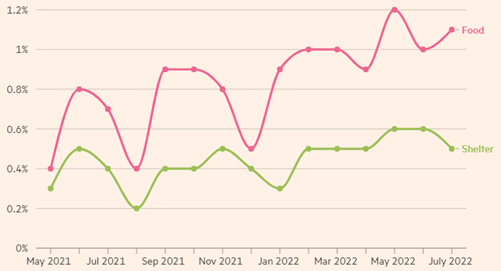

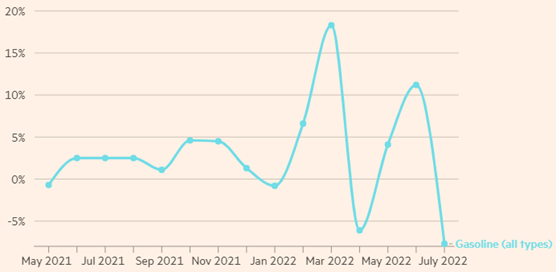

Let’s further unpack the recent drivers of inflation and GDP. July’s torrid inflation rate of 8.5%, measured by year-over-year CPI, came as a relief to the market as it signaled that we were potentially past peak inflation, of 9.1% seen in June, as energy prices declined. Food prices are still rising, but with less cyclicality and volatility than gasoline. Shelter, the largest component of CPI, continues to rise and will likely persist as meaningful home price appreciation will translate into higher rents throughout this year. That is why we still see core inflation still rising at 0.3% sequentially in July, while headline inflation was unchanged. We expect to see inflation decline, but it will likely take several quarters and settle above the historical 2% level. On the bright side, commodity prices in metals and lumber have been coming off their 2021 peaks and are cheaper year-over-year, albeit still meaningfully above pre-pandemic levels.

Month-over-Month CPI Changes by Component

Source: Financial Times

The rule of thumb for determining an economic recession is two consecutive quarters of negative GDP growth. Well, the economy contracted 1.6% in the first quarter this year, and the latest quarter declined another 0.9%, so statistically we may already be in a “recession.” However, the official determination is made by a committee at the National Bureau of Economic Research and decisions can be delayed by several months after the start of the recession. The committee is deliberate in its delayed response as they evaluate a broad-based set of data over a period of months before making a statement. Given the significant lag, it isn’t meaningful enough to make calls whether or not we are in an “official” recession, rather than focusing on the drivers of GDP and changing trends that may impact businesses and markets.

It seems like the second quarter negative GDP print is, dare I say it, “transitory” in that really strong inventory buildup following the supply-chain challenges in 2021 dissipated as merchants sold down goods. This factor is highly variable month by month. Consumer consumption however, which contributes more than 2/3 of GDP, continues to expand, albeit at a slowing pace. We should be careful in relying on the strength of the consumer too much, as their cash surpluses have diminished with rising costs and job growth potentially weakening with the Fed’s hawkish monetary policy. It’s interesting to note that strong jobs data push September rate hike probabilities closer to 75 basis points than 50 basis points as a robust labor market would give the Fed greater confidence that the economy can bear larger rate hikes.

GDP has turned negative; Consumers slowing but positive

Source: Bureau of Economic Analysis

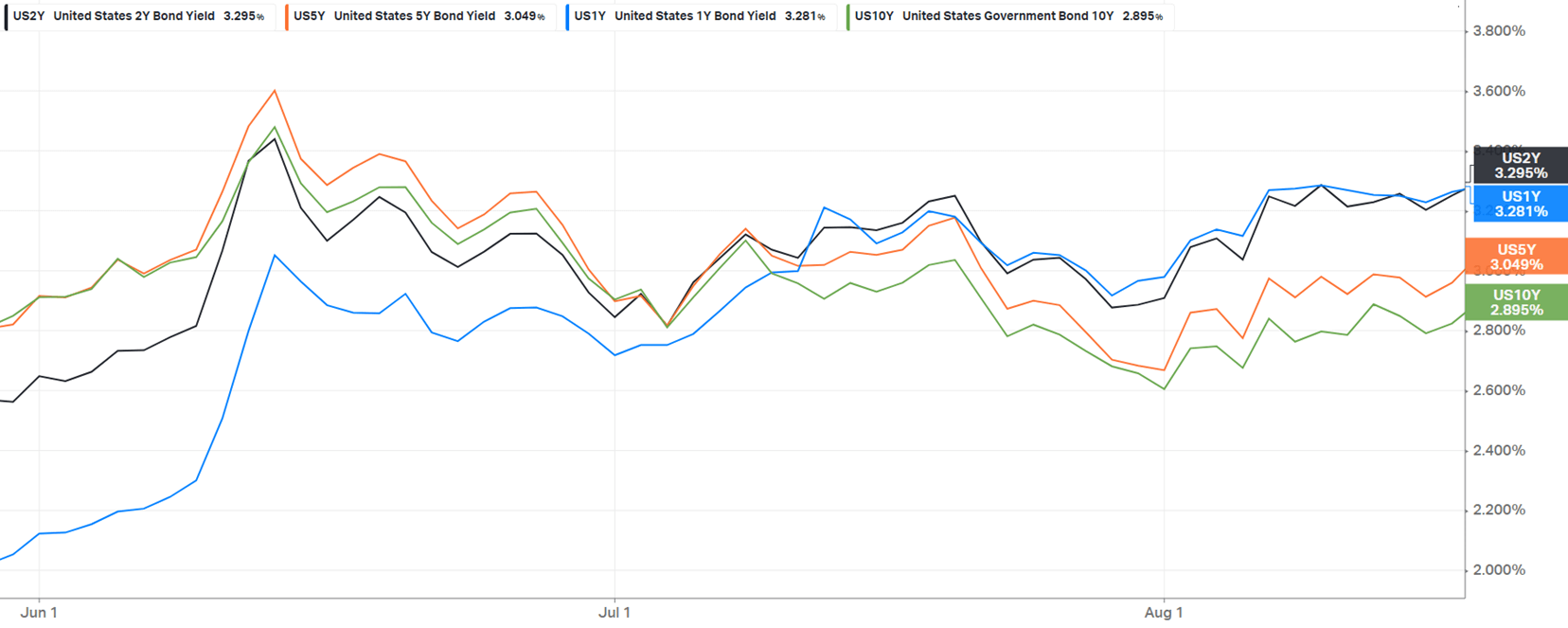

While rate hikes are still expected in the near-term, the market anticipates the Fed to be on an easing path in 2023. Short-term bonds have floated higher and are now yielding over 3%, pricing expectations for further Fed hikes for the rest of this year. However, intermediate maturity bonds (5- and 10-year) are yielding less than 3%, after peaking around 3.5% at recent highs.

Treasury Bond Yield Change Since June 2022

Source: Koyfin

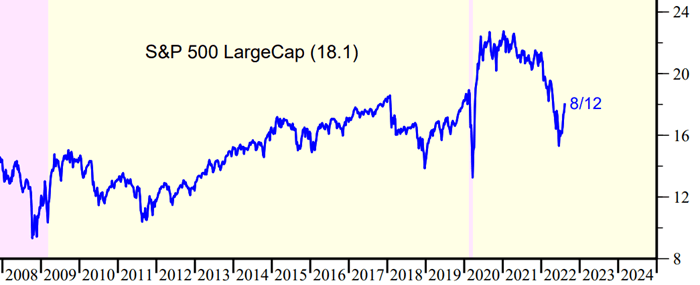

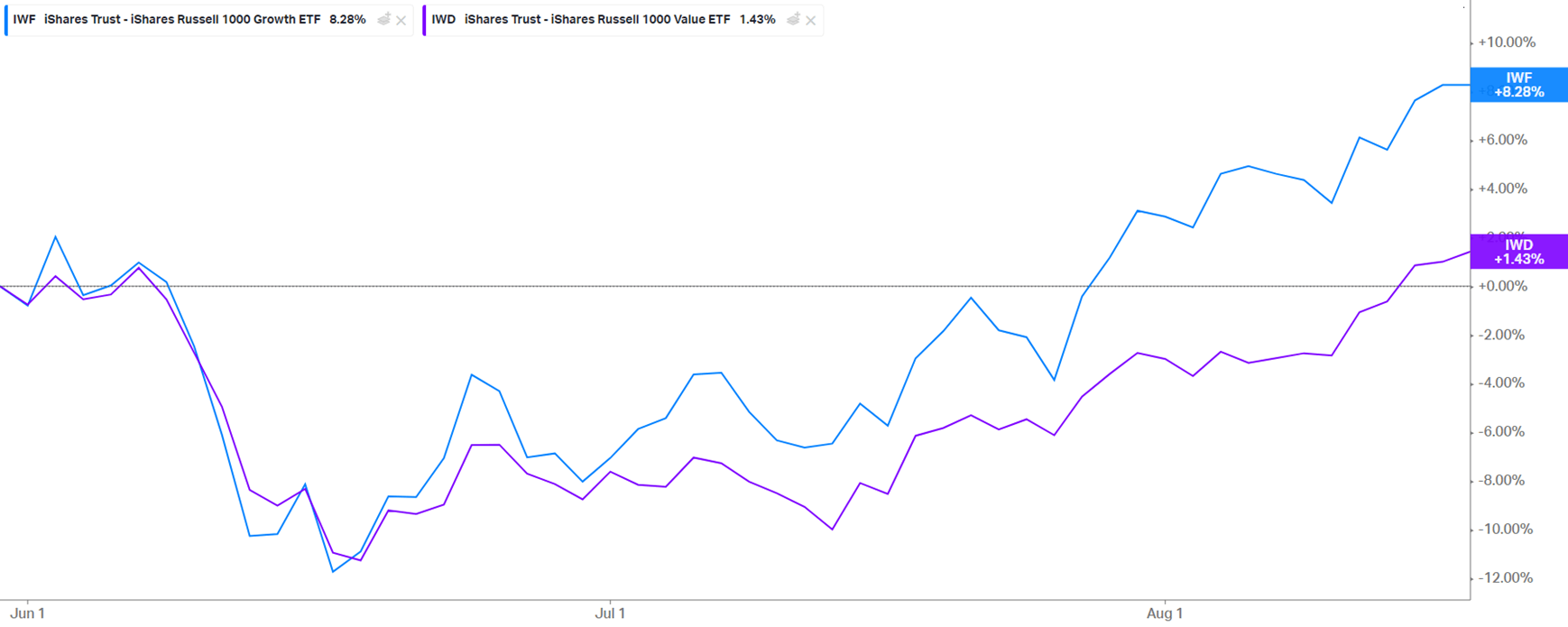

It feels like investors now also believe that businesses may be able to bear this tightening policy. After the sharp market sell-off mid-June following the 9.1% June CPI report, both equity and bond markets have steadily rallied off the lows. This rally is being driven by cooling inflation, thus a moderating Fed, and the overall resilience of the consumer should support continued corporate earnings growth and stave off a real recession… the soft-landing proposition. On the back of this, stocks have rebounded to an 18x forward P/E multiple, from its recent mid-15x trough. Commensurately, higher multiple, Growth stocks have also bounced back faster than Value stocks as rate pressure eases.

Valuations have recovered over the past two months (FTM P/E)

Source: Yardeni

Growth Rebounding Faster than Value from June Lows

Source: Koyfin

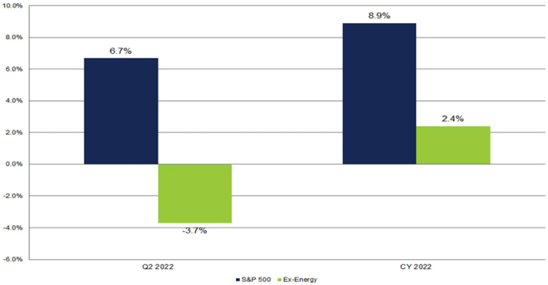

Investor confidence has been supported by second quarter earnings results. While earnings have slowed, they are coming ahead of bearish analyst expectations and high-beta stocks that collapsed in 2Q are rebounding as “it could have been worse”. Excluding the Energy sector however, earnings are down in the quarter and muted for the year. The risk is that the recent declines in oil prices may take away the sector’s earnings contribution faster than the other sectors can rebuild margins, which can make current P/E multiples seem high. We thus would remain measured in chasing this rally higher and continue to monitor the pace of slowing inflation and earnings strength away from Energy.

S&P 500 Earnings Growth

Source:FactSet

Asset Allocation Recommendations

Equities: Target-weight

Equities have recently found some relief as inflation remains elevated but may have peaked, and future rate hikes are likely to moderate. Tight labor markets and high energy prices continue to weigh on margins, but consumer demand has remained resilient thus far. Growth stocks are on a rebound as longer-duration rates have come down but risk to earnings growth remains for the broader market. We continue to recommend a balanced allocation by style as Fed action remains fluid and are overweight domestic larger cap exposure as these businesses are better diversified and more resilient to business cycle change. International markets have sold off and look compelling based on valuations, but increased macroeconomic risks keep us undersized in these regions for now.

Fixed Income: Target-weight

Recent rate hikes have expanded Treasury yields to around peak levels seen in 2018. Investors can now collect a modest income from their bond portfolios while also providing protection against a slowing economy. We have been moving up in credit quality and extending duration to hedge against equity risk and serve as liquidity to be redeployed into over-sold opportunities that may arise in the future.

Municipal bonds experienced one of the worst sell-offs earlier this year, but has since rebounded and has been outperforming both treasuries and the Barclays Agg as of late. We continue to maintain our position here as fundamentals remain resilient.

Liquid Alternatives: Target-weight

Rising rates and volatility in equity markets have made liquid alternatives a more attractive option to traditional asset classes. Equity hedge funds can add diversification through smaller, lesser-known companies and allocations to investment themes that are not easily expressed in traditional funds. Portfolio hedging and shorting also creates opportunities to capitalize on the currently wide levels of stock dispersion. We continue to increase allocations to multi-strategy, and low correlation arbitrage strategies as they exhibit the potential to provide better than fixed income returns while avoiding the extremes of market volatility. Furthermore, we have been adding real estate exposure and researching commodity opportunities to mitigate above-trend inflation pressure which will likely persist through next year.

Illiquid Alternatives: Target-weight

We are long-term proponents for illiquid assets, as they avail a broader opportunity set from which investors can source differentiated, high-returning businesses that are typically inaccessible via public markets. Furthermore, sponsors’ abilities to engage with their portfolio companies to drive operational enhancements and pursue growth initiatives enhances value. While executing on these strategic programs are multi-year processes, illiquid investments have the potential to deliver returns meaningfully more than their public market peers. Investing in buy-out, venture, credit and real estate should be a core component of wealth creation for portfolios that can bear the longer investment horizons.

Relative performance between public and private markets can fluctuate over shorter periods of time, and while private investments have had a tremendous run over the past couple of years, valuations have risen meaningfully as well and haven’t yet re-priced materially enough this year to account for the recent interest rate and inflation headwinds that public securities have experienced. We anticipate sponsors to bring down multiples in the second half of this year. We are monitoring how macro pressures are impacting valuations and in the interim are looking to harvest current realizations and distributions to build up dry powder for more liquid investment opportunities.

Important Disclosures

This information is for general and educational purposes only. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors & Co., LLC (“Simon Quick”) nor should this be construed as an offer to sell or the solicitation of an offer to purchase an interest in a security or separate accounts of any type. Asset Allocation and diversifying asset classes may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Investing in Liquid and Illiquid Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of Alternative Investments can vary based on the underlying strategies used.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Simon Quick client, please remember to contact Simon Quick, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.

This newsletter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Economic, index, and performance information herein has been obtained from various third party sources. While we believe the source to be accurate and reliable, Simon Quick has not independently verified the accuracy of information. In addition, Simon Quick makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or benchmark index, as comparative indices or benchmark index may be more or less volatile than your account holdings. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document. Index data and other information contained herein is supplied from various sources and is believed to be accurate but Simon Quick has not independently verified the accuracy of this information.