Market Insights: Soft Was –Landing Lift-Off

If the US economy falls into a recession this year, it would be one of the most widely telegraphed, with over 60% of 70 economists surveyed by the Wall Street Journal in January predicting a contraction in GDP within the next twelve months. This is up from under 20% in January 2021.

The Majority of Economists Surveyed by the WSJ Are Predicting a Recession in 2023

Probability the U.S. is in a recession in the next 12 months

Source: Wall Street Journal

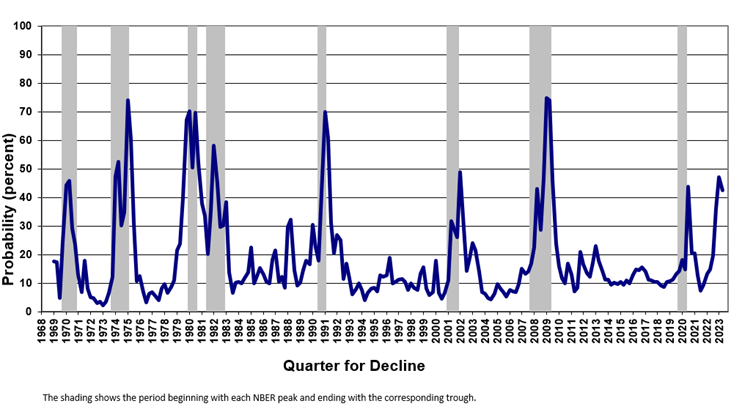

The Philadelphia Fed conducts another long-standing survey of economic forecasters, and produces the “Anxious Index”, which measures the probability of a recession in the following quarter. The current probability of a decline in GDP during the next quarter is 42.4%, which is trending higher from the single-digit lows of late 2021. Historically, probabilities in this range correctly signaled a recession, albeit typically after one has already begun.

The Anxious Index One-Quarter-Ahead Probability of Decline in Real GDP Quarterly, 1969: Q1 to 2023:Q2

Source: Federal Reserve Bank of Philadelphia

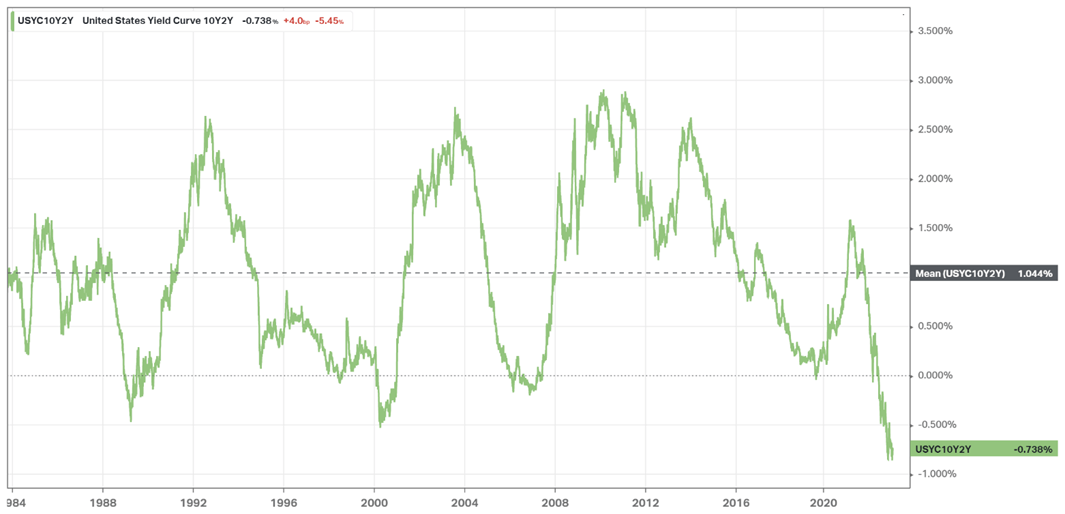

Finally, a more technical indicator, measured by the difference between the 10-year and 2-year Treasury yields, has been highly accurate at predicting recessions within a year. In normal markets, the yield on a 10-year Treasury should be greater than the shorter-dated 2-year bond (as noted in the blue curve below) to compensate holders for the longer time to maturity. However, when that relationship inverts, where an investor can collect a larger yield on shorter-dated risk (noted in the red curve below), it signals the likelihood of a recession. Today, we are looking at one of the largest inversions in the history of the curve. While we do not invest based on technical data alone, it is worth noting the signal.

Historical Treasury 2-Year and 10-Year Yield Relationship

Source: Koyfin; Simon Quick Research

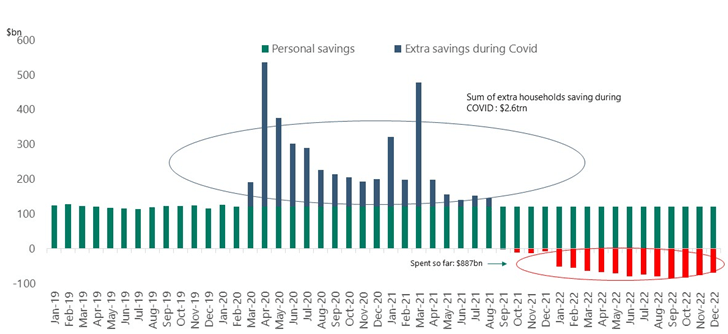

We are also of the view that the economy and markets overall have had a tremendous run since the start of the pandemic, but inflationary pressures and aggressive Fed response will likely push the economy into a period of contraction during 2023. However, despite the wave of predictions calling for the same, we still must recognize that the success rate for economists predicting recessions is awfully low and timing can be off, and thus look to avoid being too aggressively positioned in the certainty of a recession. According to the Wall Street Journal, the Anxious Index has never predicted a recession a year in advance, and even if you excluded the sudden shock of the COVID pandemic causing the 2020 recession, economists missed predicting the prior two recessions of 2001 and 2008 as well. So maybe there’s the possibility that if economists are calling for a recession in 2023, based on their track record, we might just be lucky enough to avoid one, as we did in 2022. If you recall, economic sentiment had turned negative in late 2021 and grew even more sour with the dramatic market rout in early 2022. Forecasters were predicting an inflation-driven recession later that year. However, despite this inflationary pressure and weak GDP results in the first half of 2022, we ended up with over 2% GDP growth, amidst 9%+ inflation, reminding us of how resilient our economy is. Even today, despite headlines of layoffs across technology and financial sectors, unemployment fell to 3.4%, the lowest in over 50 years. Furthermore, with strong labor demand, households have maintained healthy cash surpluses even as fiscal stimulus has receded, supporting overall consumption of goods and services.

Households are running down their savings, but still about $1.7trn left

Source: Apollo Global Management

With a little more luck, we may not experience a gradually slowing, soft-landing at all, rather we may see a reacceleration of growth and economic lift-off. Despite higher interest rates, commodity and goods inflation is slowing and companies are adapting to higher borrowing costs. Consumer demand has remained resilient enough for companies to still generate higher earnings despite weaker margins. For investors, fear has waned as capital moved back into equities and credit as intermediate and long-term rates have come down and momentum stocks skyrocketed to start the new year. Even housing activity is rebounding as mortgage rates cool from their recent 7%+ highs.

While it is great to hope for continued economic strength, it could raise the risk for more persistent inflation, which in turn could motivate more hawkishness from the Fed. Chairman Powell’s core focus is to cut inflation by more than half, primarily by cooling the labor market, and it appears that he is willing to sacrifice the economy in order to achieve it. Thus, we think that near-term economic resilience could be met with a more convicted response of higher interest rates for a longer period of time. This may result in an eventual recession and resurgence of market volatility. In that regard, we continue to favor a diversified, more defensive investment posture built around value-oriented cash flow generative businesses in equities, fixed income and real estate. While recommending “Target-weight” at the high level across asset classes may sound uninspired, we find compelling opportunities within each asset class as higher rates have improved valuations and income generation to investors. We highlight these further below. In the interim, we continue to watch equity valuations and earnings outlooks closely. At about an 18x forward Price-to-Earnings ratio, stocks overall are arguably fairly valued in this rate environment. While stocks overall lost almost 20% last year, we do not anticipate a quick recovery of that value in the current rate environment. Rather we believe longer-term earnings generation will be the core driver to stock returns but may be harder to achieve in a decelerating economy.

Asset Allocation Recommendations

Equities: Target-weight

Value versus Growth: We maintain a relatively balanced approach to Value versus Growth styles, but with a slight bias to Defensive portfolios that may only be modestly cheaper than their core benchmark but exhibit greater business resiliency. These managers would be more protective in a market sell-off, but lag in a market rally.

Large versus Small: We complement our Large Cap Defensive exposure with selective, active small- and mid-cap funds. Small caps tend to be more economically sensitive, so we look to be more valuation-conscious in this segment.

Domestic versus International: We maintain an overweight to Domestic stocks, based on the quality of businesses and capital markets in the US. We have modestly reduced that overweighting with the addition of an active Defensive International manager to complement our incumbent lineup.

Fixed Income: Target-weight

Interest Rate Sensitivity: We had extended our duration as the Fed raised rates throughout 2022. As intermediate and long-rates have since tightened, we recommend leaning shorter duration, notably as short-dated Treasuries yield over 4% while intermediate maturities yield less. We do recommend maintaining a modest exposure to intermediate duration bonds as duration is a hedge to economic weakness and benefit from Fed rate cuts.

Credit Quality: We seek to maintain an overall investment grade credit quality in our liquid fixed income exposures. Structured Credit currently provides an enhancement in yield. We are currently limiting high yield exposure to predominately alternative credit strategies and private investment opportunities that are less sensitive to daily flows and mark-to-market volatility.

Liquid Alternatives: Target-weight

Hedge Funds: Heightened volatility across asset classes is creating a ripe opportunity for diversified and long/short hedge funds. As traditional assets continue to remain under pressure, strategies that can take advantage of short-term pricing dislocations in a choppy market can generate more consistent returns through this challenging period.

Real Estate: We have been adding core-plus real estate, notably in residential assets, for its inflation-aligned properties and as a complement to stock and bond portfolios.

Illiquid Alternatives: Target-weight

Valuations are adjusting lower, following public markets in 2022. Committed capital for opportunistic deployment over the next few years should make the current vintage of funds highly attractive.

Secondaries and Distressed investing strategies may benefit well from a slowing economy as they tend to be opportunistic buyers of good assets at discounted valuations, during a period of market uncertainty.

Important Disclosures

This information is for general and educational purposes only. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors & Co., LLC (“Simon Quick”) nor should this be construed as an offer to sell or the solicitation of an offer to purchase an interest in a security or separate accounts of any type. Asset Allocation and diversifying asset classes may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Investing in Liquid and Illiquid Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of Alternative Investments can vary based on the underlying strategies used.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Simon Quick client, please remember to contact Simon Quick, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.

This newsletter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Economic, index, and performance information herein has been obtained from various third party sources. While we believe the source to be accurate and reliable, Simon Quick has not independently verified the accuracy of information. In addition, Simon Quick makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or benchmark index, as comparative indices or benchmark index may be more or less volatile than your account holdings. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document. Index data and other information contained herein is supplied from various sources and is believed to be accurate but Simon Quick has not independently verified the accuracy of this information.

Important Disclosures

This information is for general and educational purposes only. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors & Co., LLC (“Simon Quick”) nor should this be construed as an offer to sell or the solicitation of an offer to purchase an interest in a security or separate accounts of any type. Asset Allocation and diversifying asset classes may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Investing in Liquid and Illiquid Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of Alternative Investments can vary based on the underlying strategies used.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Simon Quick client, please remember to contact Simon Quick, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.

This newsletter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Economic, index, and performance information herein has been obtained from various third party sources. While we believe the source to be accurate and reliable, Simon Quick has not independently verified the accuracy of information. In addition, Simon Quick makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or benchmark index, as comparative indices or benchmark index may be more or less volatile than your account holdings. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document. Index data and other information contained herein is supplied from various sources and is believed to be accurate but Simon Quick has not independently verified the accuracy of this information.