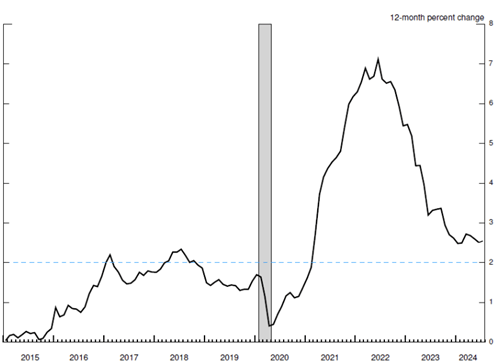

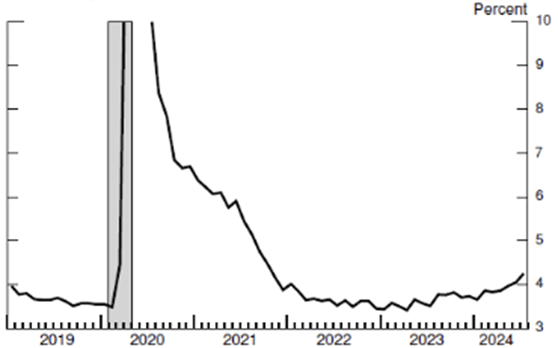

After months of innuendo and data dependency, the Federal Reserve is ready to start lowering interest rates this month. In his speech at the Jackson Hole Economic Symposium, a high-profile annual gathering for central bankers and economists, Chairman Powell was clear that inflation has eased and the labor market has cooled enough, such that “The upside risks to inflation have diminished. And the downside risks to employment have increased…The time has come for policy to adjust. The direction of travel is clear.” While inflation is still higher than the Fed’s long-term target of 2%, it has dropped below 3% and is trending lower. The Fed believes that labor conditions have returned to pre-pandemic levels and have been resilient throughout this period of high rates. Unemployment has remained low at 4.3% but is starting to creep higher and is not going unnoticed. Although layoffs have been muted, the pace of hiring has slowed while the supply of workers has increased.

Personal Consumption Expenditures Price Index

Unemployment Rate

Source: Federal Reserve, BEA, BLS

The Fed is no longer concerned about elevated inflation and has turned its attention to the risks associated with maintaining a monetary policy that is too restrictive and curtails the investment and spending necessary to maintain the current economic momentum. By bringing rates down, the Fed is looking to take its foot off the brakes and let the economy coast towards a healthy mid-2% growth rate, with strong double-digit corporate earnings and low bankruptcies. Coupled with a gainfully employed consumer base that continues to enjoy spending, we expect to stave off any recession considerations through 2025.

Savers Will Get Paid Less…

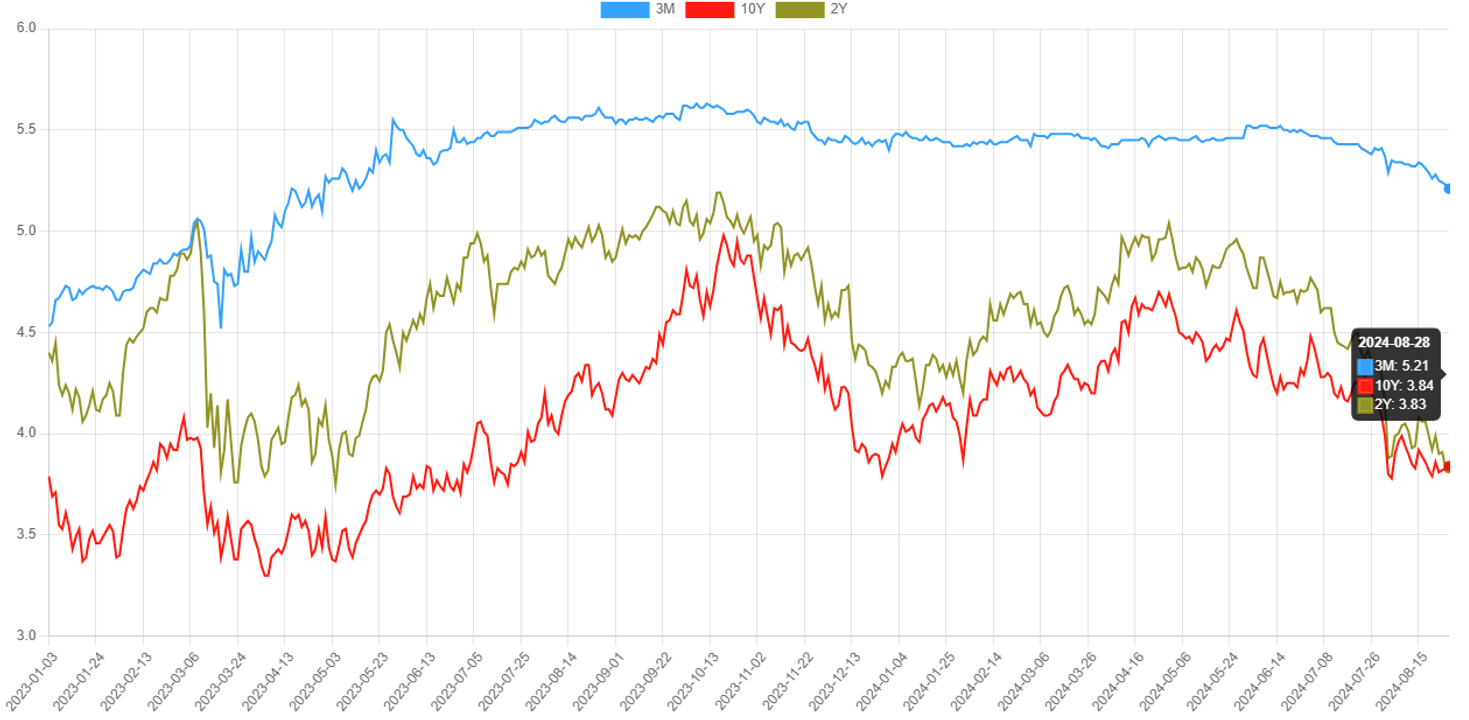

After over a year of 5.3% interest rates, we will likely see the Fed reduce target rates almost monthly until they reach a mid-3% level by the end of next year. This would be faster than their most recent projections, which would have taken until 2026. The increased expectation for cuts has boosted bond prices recently, which are now positively returning on the year, with July and August notably returning around 2% each. Stocks have also continued to have a strong year, with the early signs of broadening gains beyond the Magnificent 7 and into more cyclical and smaller capitalization stocks. International equities are also picking up some momentum as the USD has weakened with lower rate expectations. There is still volatility, as we saw in early August; however, strong fundamental data has overwhelmed these moments of fear and shown them to be buying opportunities.

The hot trade of clipping a safe 5% annual coupon by owning money markets and treasury bills is sizzling out as yields on these instruments will fall quickly heading into 2025. If you didn’t lock in some longer maturity bonds over the past year (10-years had hit 5% in 4Q23) or mid-4%s yields that were available this past spring, it will be very difficult to attain that kind of return from treasuries again in this cycle. Looking forward, we would rather own intermediate-term investment grade corporate bonds and short-term structured credit to achieve mid-single digit yields for the next several years, than hold short-duration Treasuries or cash.

Yields for both 2-year and 10-year treasuries have fallen to 3.8% from highs of 5% in 2023

Source: ustreasuryyieldcurve.com

…So Will They Start Spending More?

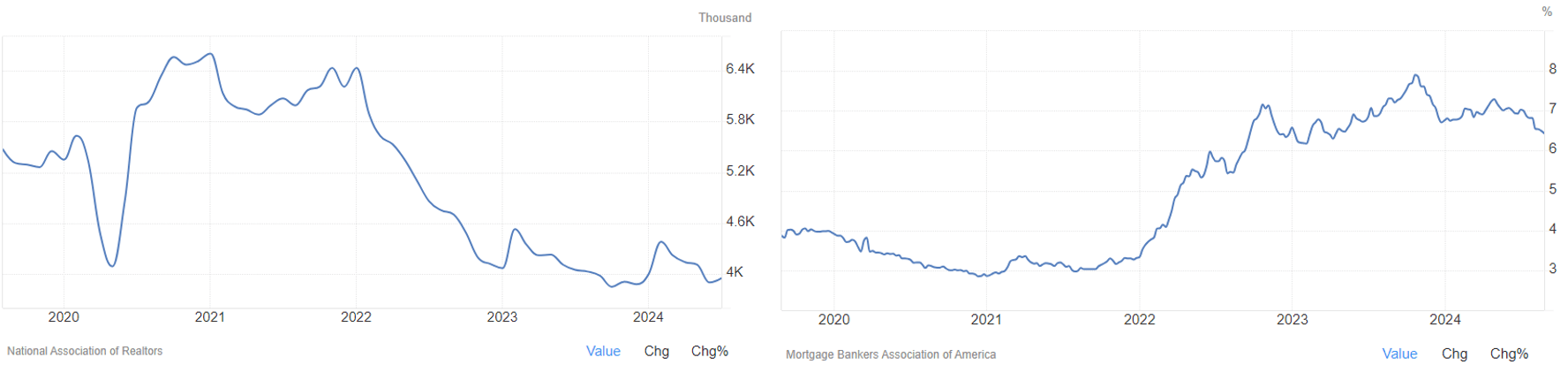

Income generated from bonds will fall with rate cuts, diminishing the appeal of holding short-term fixed income. The Fed hopes this will spur a rotation of capital towards more spending and investment from savers to support the economy. For individuals, buying homes and furnishing them continues to be the primary driver of consumption. However, over the past couple years we saw consumers continue to spend, but more of that went to travel and services than on goods purchases. Higher rates and higher home prices have really challenged home affordability and has made it difficult for first time, and upgrading homebuyers, to buy homes. Additionally, the vast majority of currently outstanding mortgages were locked in at approximately 4% rates or lower, disincentivizing borrowers to move and give up such cheap financing.

Mortgage rates have come off their recent peaks, but they have not dropped enough to spur a meaningful pickup in buying activity. Below, we see that transaction volume has fallen tremendously with rising mortgage rates. This is starting to turn, but not yet to a meaningful degree. Nonetheless, the American desire to own property should drive more activity as rates decline further.

Home Purchase Activity Has Collapsed as 30-year Mortage Rates Approached 8%

Source: Trading Economics

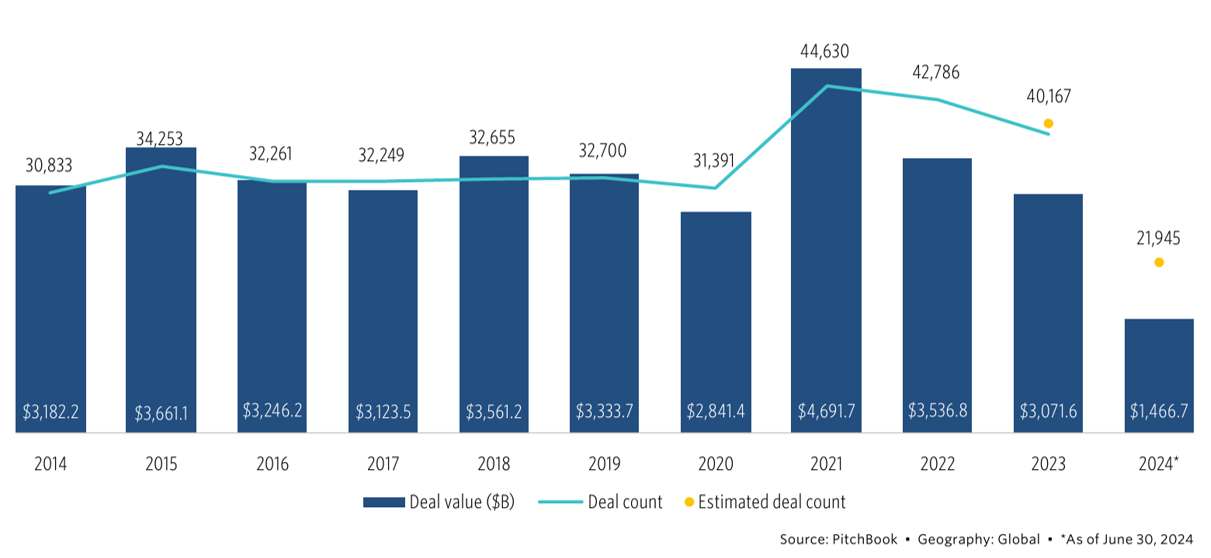

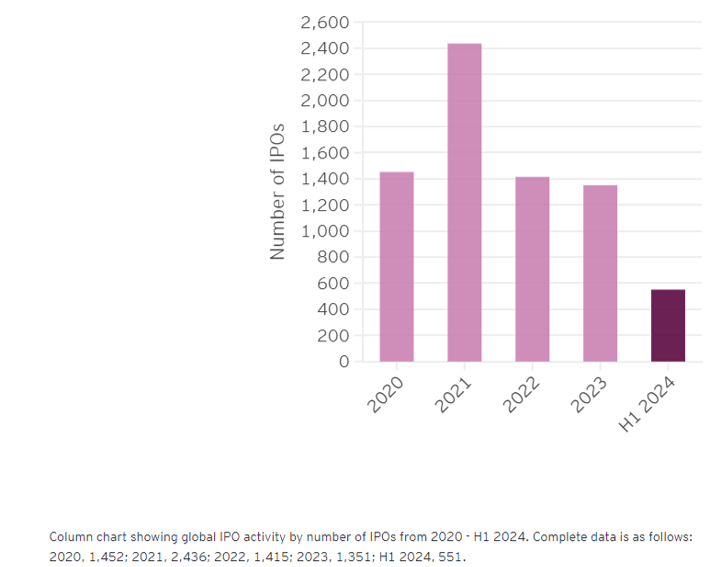

This same dynamic can be seen in business transactions. High interest rates made it more challenging for buyers and sellers to agree on a value when financing costs were so high. Thus, we’ve seen a drop-off in M&A and IPO activity over the past couple of years. Declining rates should improve profitability of businesses and improve the financeability of transactions to drive more activity from now into 2025.

M&A Activity

Global IPO Activity by number of IPOs

2020 – H1 2024

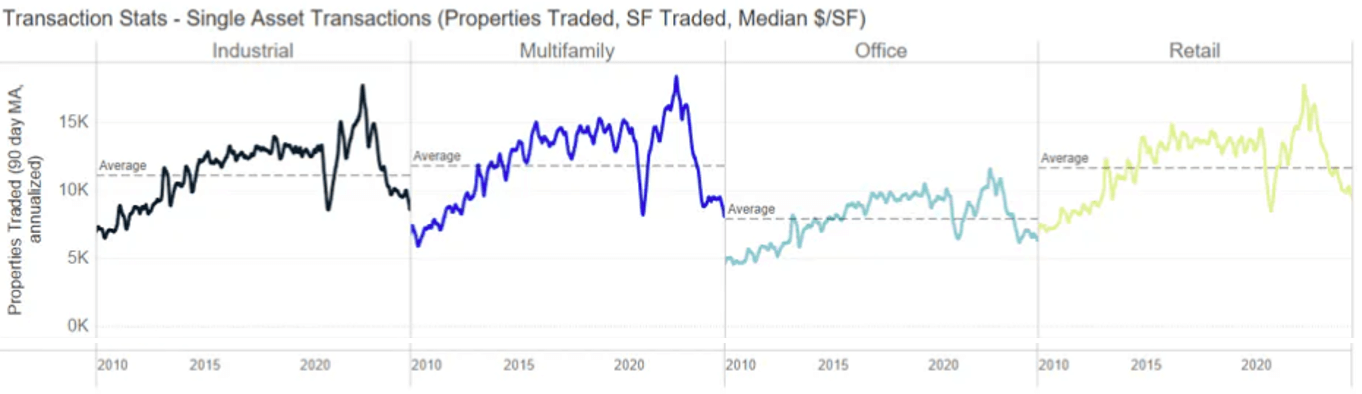

Commercial real estate has been under the most pressure in the current interest rate environment, with many property owners calling this period their second Global Financial Crisis since 2008. Real estate has been squeezed on both sides, with falling asset valuations as well as higher refinancing rates as debt maturities come due. Furthermore, real estate tends to be highly levered, between 50-80% of property value, and it is near impossible to restructure or spin-off assets without spending more money to do so. This resulted in a precipitous drop in deal activity. As rates decline, property owners should see some much-needed relief to service debt payments and stabilize valuations. This should also spur deals as investors take cash to buy high quality assets at depressed prices. We view the current environment as a great buying opportunity for long-term investments in real estate, but recognize that it will likely take a few years for dealflow and valuations to fully recover.

Transaction Stats – Single Asset Transactions (Properties Traded, SF Traded, Median $/SF)

Source: Altus data; Q1 2024 estimated based on preliminary transaction data reported through March 2024; Altus Group’s Research Team

Private asset valuations tend to be slower to adjust versus their public peers. In the 2022 bear market, tradable securities sold off immediately and materially, while their private peer valuations slowly drifted lower into 2023. In the recovery, we saw the same mirror effect of public company valuations recovering a lot faster than privates. This is creating an opportunity for buyers with available cash to provide liquidity and monetization opportunities for older investments, while also benefiting from the rate cutting cycle as a tailwind to support valuations. Secondary transactions in private equity and venture investments, as well as in private real estate, are seeing an expanding flow of these discounted opportunities of high quality assets that should perform well over the coming years.

November 5, Revisited

Just a few months ago, it seemed like we were headed to a Republican sweep across the White House and Congress, as President Biden was losing his voter base while Trump was gaining momentum surviving an assassination attempt. In a surprise turn of events, President Biden dropped out of the election in late June and Vice President Harris has accepted the Democratic nomination. Early surveys show that this will now be a hotly contested campaign for the presidency. What looked like a likely Trump win and potential Republican sweep of Congress, which would in the short-term be a win for businesses and capital markets, is now a bit less certain. We may end up with a divided administration, which the markets would appreciate, as a stuck presidency is technically the best situation to keep markets calm as political agendas are kept in check. However, we must still recognize that the US does have a deficit issue and active fiscal stimulus spending programs that will maintain pressure on inflation to the upside.

Asset Allocation Recommendations

Equities: Target-weight

Equity markets have continued to perform well this year, however the initial broadening of the rally at the start of 2024 reverted back to leadership by the mega-cap tech stocks. Outside of these large names, the rest of the market is more reasonably valued, but hasn’t garnered the attention of investors to drive stock appreciation to the same degree. Some of this is warranted, due to strong growth and pristine balance sheets of these tech companies in a high-rate environment, but as inflation cools and the Fed looks to cut, we expect the rest of the market to catch up, given the benign economic backdrop. We continue to overweight domestic equities and maintain a large-cap orientation overall but complement these exposures with high quality smaller cap active allocations based on expectations for broadening market strength. Dollar weakening may support international equities for a moment, but we are less sanguine on opportunities outside the US longer-term.

Fixed Income: Target-weight

The Fed will likely begin to cut rates this year, but the impact on longer-maturity bonds may be muted, barring a material slowdown in the economy. Thus, staying shorter-duration and picking up incremental returns from credit and securitized assets above treasuries can enhance income from this asset class. We barbell this allocation with high-income producing private credit and liquid investment grade bonds.

Liquid Alternatives: Target-weight

Hedge Funds: Hedge funds continue to serve as the diversifying asset class to traditional stocks and bonds. We continue to increase exposures to uncorrelated and macro strategies while culling more directional allocations.

Real Estate: The asset class has fallen out of favor with rising rates and looming debt maturities, despite their long-term inflation-aligned characteristics. As the inflation and rate cycle turns, we are seeking opportunistic investment strategies in both debt and equity at attractive valuations that can offer enhanced return potential without taking on material risk.

Illiquid Alternatives: Target-weight

2023 performance for illiquid assets was muted. While underlying portfolio company earnings have improved, dealmaking activity remained light. Expected rate cuts and steadier borrowing costs should revive transaction activity and return capital to investors. Additionally, as valuations have softened, current vintages provide an attractive entry point to support long-term returns. Secondaries purchases (where investors buy fund investments at a discounted price to provide the seller liquidity) are providing de-risked access to earlier deals.

Important Disclosures

This information is for general and educational purposes only. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors & Co., LLC (“Simon Quick”) nor should this be construed as an offer to sell or the solicitation of an offer to purchase an interest in a security or separate accounts of any type. Asset Allocation and diversifying asset classes may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Investing in Liquid and Illiquid Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of Alternative Investments can vary based on the underlying strategies used.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Simon Quick client, please remember to contact Simon Quick, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.

This newsletter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Economic, index, and performance information herein has been obtained from various third party sources. While we believe the source to be accurate and reliable, Simon Quick has not independently verified the accuracy of information. In addition, Simon Quick makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or benchmark index, as comparative indices or benchmark index may be more or less volatile than your account holdings. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document. Index data and other information contained herein is supplied from various sources and is believed to be accurate but Simon Quick has not independently verified the accuracy of this information.