We’ve come a long way from peak inflation of 9% and $120 per barrel of oil in 2022, down to about 3% and $80, respectively, here in early 2024. It required a dramatic 5.5% interest rate hiking program and a few bank failures, but the Fed has made substantial strides in driving disinflation (slowing inflation). The job is not done, as the long-term target is 2%, however, we’re heading in the right direction. What’s been most impressive has been the resilience of the economy, as GDP steadily expanded over the course of 2023, despite a restrictive monetary policy and reduced lending and capital markets activity.

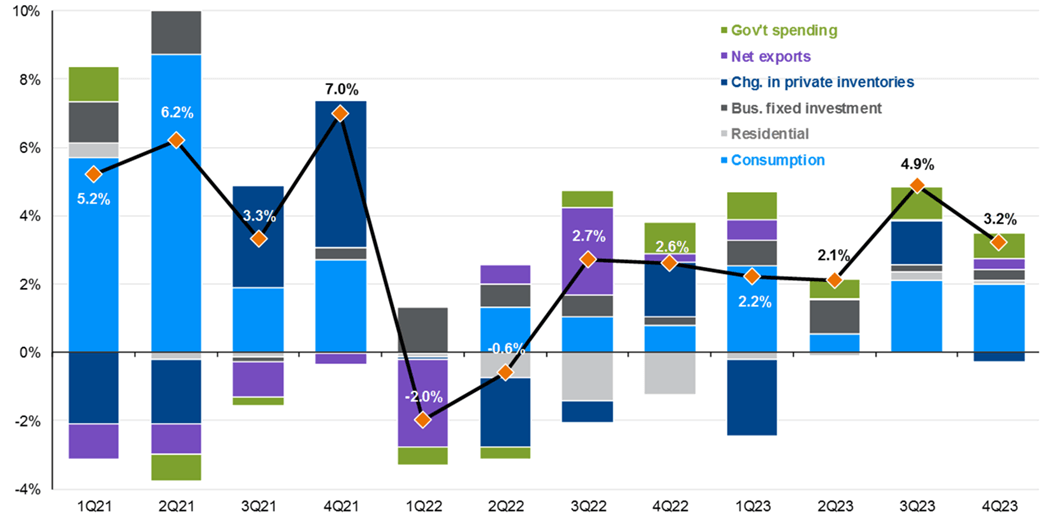

Consumption was a major driver of strong GDP in 2023

Contributors to real GDP growth

q/q % change, annualized rate

Source: JPMorgan

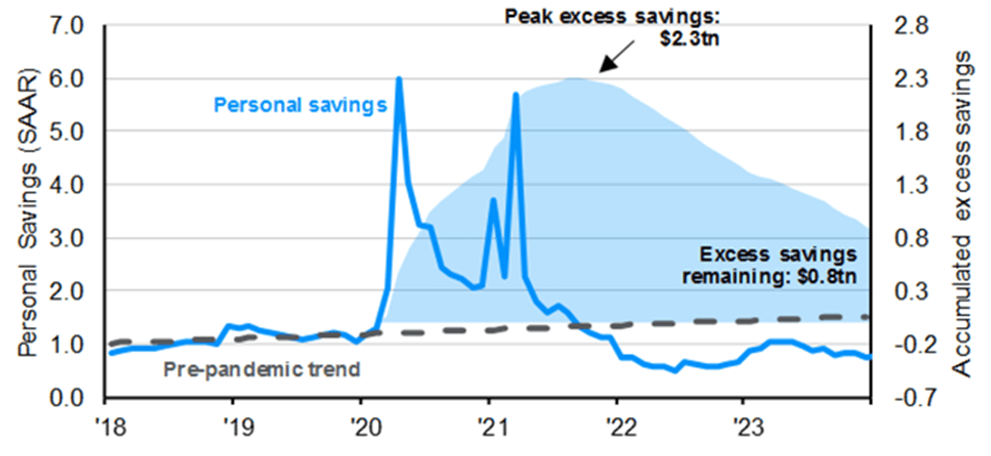

Household excess savings

Trillions of USD

Source: JPMorgan

Super Bowl Tickets Were 30%+ More Expensive this Year – And they Still Sold Out

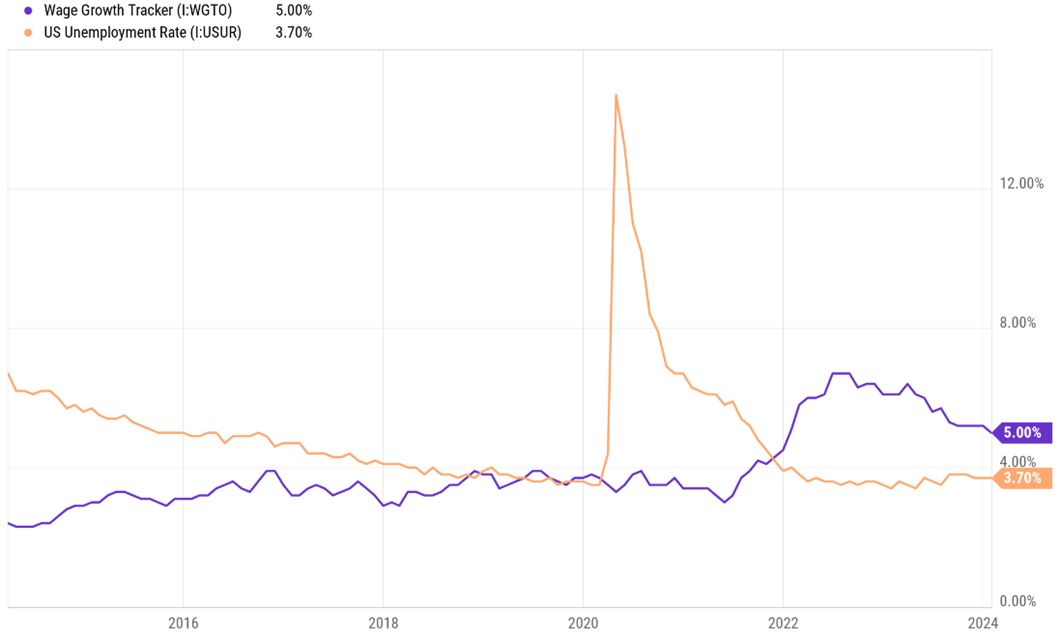

Consumers were willing to spend on services and experiences, like Taylor Swift concerts and the Super Bowl. They then also spent on airfare and hotels to attend these events and purchased merchandise to validate their attendance. Such spending was a meaningful driver behind the strength of the economy but also fueled rising prices. By raising interest rates, the Fed sought to slow the speed of hiring and wage growth in order to slow down spending, and was willing to allow for some slack in employment in order to achieve it. This worked to some degree, as the demand for workers continues to be high, but is now off the frenetic pace we saw a couple years back and we are closer to balance in the number of job seekers for available jobs today. Unemployment has remained relatively low, below 4%, despite high interest rates. Yes, excess cash from the COVID-era has diminished, housing affordability has gotten worse, and credit card borrowings and auto loan delinquencies are picking up, but all this is just getting consumers back to historical levels, rather than into a weakened state.

Wage Pressure is Alleviating while Unemployment Remains Low

Source: YCharts, Simon Quick Research

Corporate earnings have also recovered from 2022 lows, as business owners rightsized headcount and readjusted their procurement processes to account for higher wages and costs this past year. Defaults, while picking up, are still low on an absolute basis as companies refinanced and termed out their liabilities when rates were low. The tech renaissance in the US continues, as Nvidia’s video game graphics technology is now powering the advancement of artificial intelligence in the country that is years ahead of foreign competitors and is opening up new industries and long-term potential for work productivity enhancements.

The country’s economic resilience has allowed the Fed to be patient, keeping rates elevated since the summer while continuing to shrink its balance sheet. We expect interest rates to start coming down by the middle of this year, but still outpace the rate of inflation until we get closer to 2%. The Fed remains cautious and heavily focused on economic data to drive next steps on monetary policy.

Inflation has Slowed, Leaving Room for Fed to Cut

Source: YCharts, Simon Quick Research

Our base case expectation for 2024 is continued economic expansion and corporate growth. We expect pacing to slow, but still to a healthy level. The rate of disinflation will slow but should still be enough for the Fed to begin reducing rates mid-year. Despite weaker economies internationally as well as continued military conflicts, the domestic impact may be limited. All in all, we do not have any recessionary concerns this year.

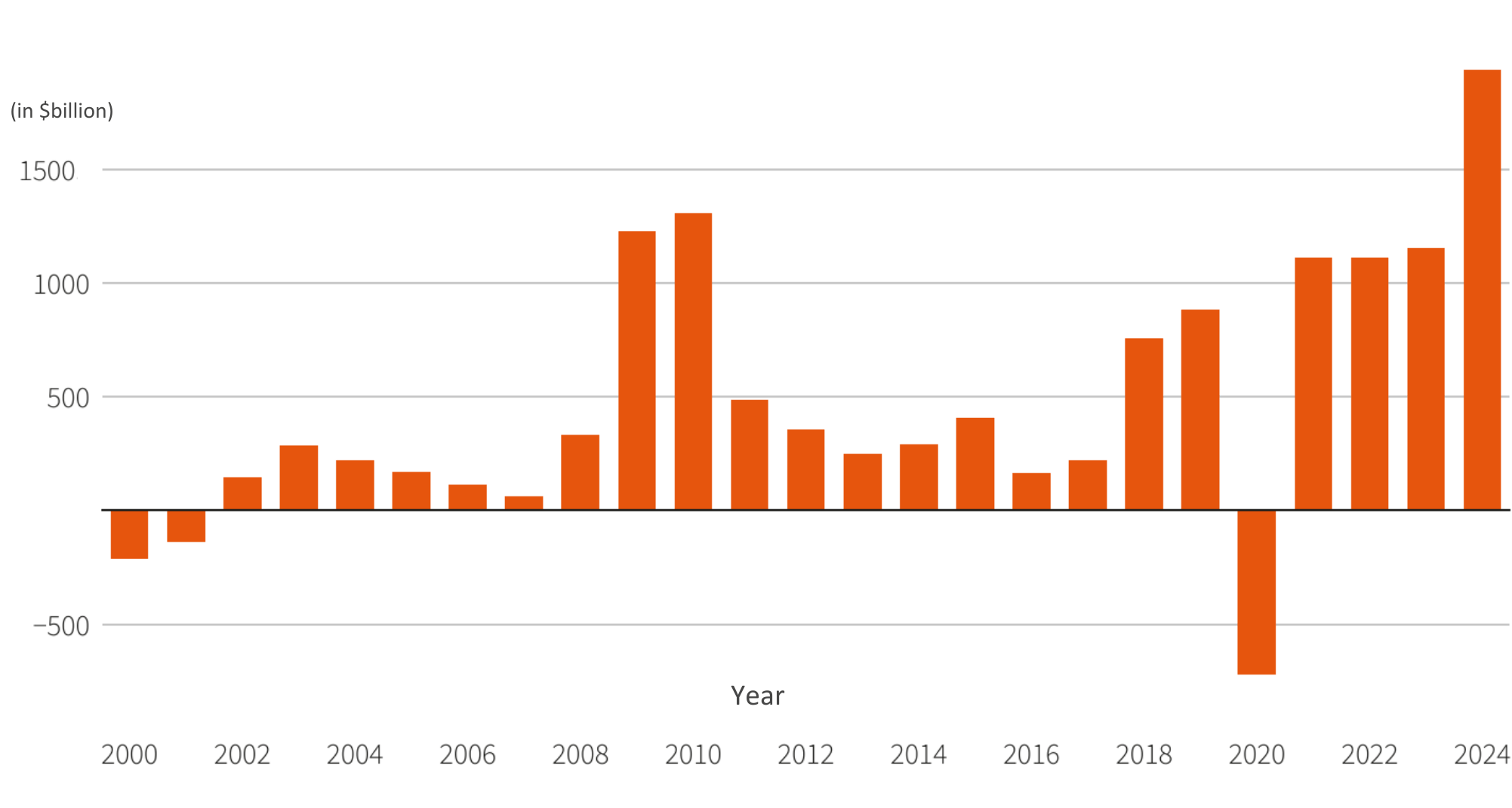

There are upside risks to inflation, the notable one being fiscal policy, set by Congress and the While House, that doesn’t necessarily have the same motivations and arguably lacks the discipline of financial responsibility as the Fed. Coming out of a debt ceiling crisis last year, the government began selling Treasuries to replenish funds, which effectively pushed up interest rates. We expect continued meaningful Treasury issuance this year, putting further upward pressure on rates. Looking back into 2022, in the depths of high inflation, Congress passed the CHIPS Act and Inflation Reduction Act. Both laws, in their own way, support domestic investment in industry, but are inflationary in nature. As a reminder, the government debt ceiling will have to be revisited again at the end of this year by the next President. These elements may be stronger factors to contend with than monetary policy, causing the economy to run hot and reintroduce inflationary risks.

Treasury Issuance may put Upward Pressure on Rates

Source: Reuters, CreditSights

While credit fundamentals overall are stable, there is acute pressure on the commercial real estate industry and the regional banks that have been long-standing lenders to them. The Silicon Valley Bank collapse of 2023 was primarily driven by dramatic interest rate challenges, not necessarily loan default concerns. In contrast, today’s challenges are predominantly credit-driven, with declining asset values, rising vacancies, and difficulties in securing affordable financing, posing risks of large defaults for regional banks, real estate lenders, and property investors. Because of these concerns, banks have been pulling back on lending broadly, and shoring up capital. As the Central Bank pulls back on financial liquidity and the banking system is less willing to lend, this may raise broader challenges to credit markets and create recessionary concerns if not carefully managed.

Smaller Banks Have More Commercial Loan Exposure

Source: JPMorgan

This is a presidential election year for the United States. There will actually be several large national elections worldwide this year. These events have historically tended to create market volatility, but as we previously mentioned in 2020, these periods of volatility present opportunities for investment. Despite short-term market shifts following elections, assets typically rebound swiftly, irrespective of the outcome.

TL;DR

- Inflation has come down meaningfully enough for the Fed to start cutting rates this summer. However, achieving the final percent reduction may prove more difficult to achieve, resulting in higher than historical borrowing rate averages.

- US debt issuance may create bond market volatility despite the Fed lowering rates. This may result in a normalizing yield curve but at higher rates across the board. Being an election year, we may see further fiscal stimulus, which would be inflationary to the economy.

- The economy is stable and showing good earnings momentum despite weaker balance sheets. We should see a broadening of positive equity market participation beyond the Magnificent 7 if fundamentals remain strong and rates move lower.

- Credit risk remains generally benign, but we are keeping a close eye on the management of commercial debt maturities and potential ripple effects on negative events.

Asset Allocation Recommendations

Equities: Target-weight

The domestic economy remains resilient, as we see above-trend GDP growth and corporate earnings strength. Consumers overall remain strong, albeit at a moderating level than what we experienced over the past couple years. A path to rate cuts should support valuations and contain volatility. Cash continues to move off the sidelines, which should support equity momentum. While the Magnificent 7 can still perform well in the new year, the current economic and Fed backdrop may favor the other 493 stocks in the index, in addition to smaller cap companies that are more levered to economic growth and lower interest rates. We remain domestically oriented as Europe appears to be lagging the disinflation trend and emerging markets continue to be volatile, led by China weakness.

Fixed Income: Target-weight

Fixed Income assets generated attractive yields and saw capital appreciation as target interest rate expectations fell. We remain constructive on the diversifying, income-producing nature of the asset class, and would barbell the asset with short-duration income producing credit and longer-duration investment grade bonds.

Liquid Alternatives: Target-weight

Hedge Funds: Hedge funds have shown their ability to be sources of portfolio diversification over the past couple of years. While stocks and bonds still exhibit positive correlation in the current environment, we appreciate the contribution of alternative strategies with low directionality, but actively traded, dynamic portfolios that can take advantage of moments of disconnect between trading relationships of securities and asset classes in periods of transition. These opportunities can help funds generate steady returns with less sensitivity to market direction or the actual path of interest rate cuts in 2024. We continue to expand our multi-strategy allocation and complemented it with differentiated lending and volatility strategies to balance out the more directional small cap exposures.

Real Estate: We have been adding core-plus real estate opportunities, notably in residential assets for its inflation aligned properties and as a complement to stock and bond portfolios. We continue to remain cautious on the fundamental outlook of office buildings. Lower interest rates should ease some pressure on financing situations.

Illiquid Alternatives: Target-weight

2023 performance for illiquid assets was muted. While underlying portfolio company earnings have improved, transaction activity has remained light. Lower rates and a narrowing of bid-ask spreads should reaccelerate over the next couple years and committed capital for opportunistic deployment should make newer vintages highly accretive. Venture valuations have remained muted, thus making secondary opportunities in this segment of the market notably attractive for discerning investors.

Important Disclosures

This information is for general and educational purposes only. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors & Co., LLC (“Simon Quick”) nor should this be construed as an offer to sell or the solicitation of an offer to purchase an interest in a security or separate accounts of any type. Asset Allocation and diversifying asset classes may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Investing in Liquid and Illiquid Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of Alternative Investments can vary based on the underlying strategies used.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Simon Quick client, please remember to contact Simon Quick, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.

This newsletter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Economic, index, and performance information herein has been obtained from various third party sources. While we believe the source to be accurate and reliable, Simon Quick has not independently verified the accuracy of information. In addition, Simon Quick makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or benchmark index, as comparative indices or benchmark index may be more or less volatile than your account holdings. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document. Index data and other information contained herein is supplied from various sources and is believed to be accurate but Simon Quick has not independently verified the accuracy of this information.