Equity markets have been exuberant over the past several years, with the S&P500 generating mid-teen annualized returns and nearly doubling in value since the beginning of 2017. Private companies have taken advantage of this opportunity by going public at a record-setting pace, starting in the back half of 2020 and continuing through this year.

Source: Bloomberg

It’s exciting to be a part of the action and own that high-flying newly-listed stock to draw the envy of your friends as you regale them with stories of your investment portfolio victories. Financial media fuels the excitement, trumpeting the 20, 40, or 60%+ single-day rallies for the stock on the day of its listing. The hype is somewhat warranted, as IPO’d stocks do tend to perform well on their inaugural day, averaging about 18% in returns. Last year was particularly notable, more than doubling average that at 38%, and logging the best performance since the dot-com bubble (>60%!).

However, all that glitters is not gold, as almost half of new IPOs lose value after their first-day close. A study of IPOs between 1985 and 2019 showed that stocks that were bought at the first day’s closing price and held for four years generated a median decline of over 17%. We won’t go too deeply here as to why this has been the case, but can attribute some of this experience to technical pressures of pre-IPO holders looking to monetize their even more significant gains by selling shares into the open market. Pre-IPO shareholders are typically restricted from selling their stakes for the first 90- to 180-days. As the restriction expires, these sales can cause downwards pressure on stock prices throughout that first year.

The chart below shows the distribution of relative performance for IPOs over the past decade. A slim majority of IPOs outperformed their respective benchmark on their opening day. However, we see that even this outperformance starts to deteriorate over time, notably as we move past the 3-month anniversary. By the 1-year anniversary, we see that more companies are underperforming the index, and this gets progressively worse at the second- and third-year anniversaries. There are stocks that will buck this trend and be strong long-term outperformers. However, this should be considered the exception rather than the rule.

Source: FactSet, Nasdaq Economic Research

So, what is an investor to do if they are a beneficiary of a large windfall from an IPO, or generally have large equity gains that would result in a significant tax bill if they were to be sold? We have previously written about tax-efficient strategies such as donating/gifting securities, reinvesting into opportunity zones, and tax-loss harvesting. Exchange funds provide another avenue of deferring sales recognition while diversifying risk, albeit with their own fund limitations and liquidity constraints. Below, we explore an exchange fund replication strategy that mimics the benefits of exchange funds by diversifying the return characteristics to a broader index, but through the use of options, allows the investor to retain ownership and liquidity of their original stock.

An exchange fund replication strategy allows holders of a concentrated single-stock position to substitute the majority of the idiosyncratic risk of that security with that of a diversified index. The underlying single-stock is still owned by the investor, with any dividends continuing to be received. However, the stock price fluctuation risk is reduced by purchasing put options and selling call options to limit the impact of the original stock’s price volatility. As the initial risk of the held stock has been contained, an overlay to obtain market exposure (the S&P500 for example) is constructed by purchasing calls and selling puts on an index or ETF. The combination of these two strategies results in the “exchange” of single-stock risk for diversified market risk and the investor’s performance should track closer to the index than the single stock.

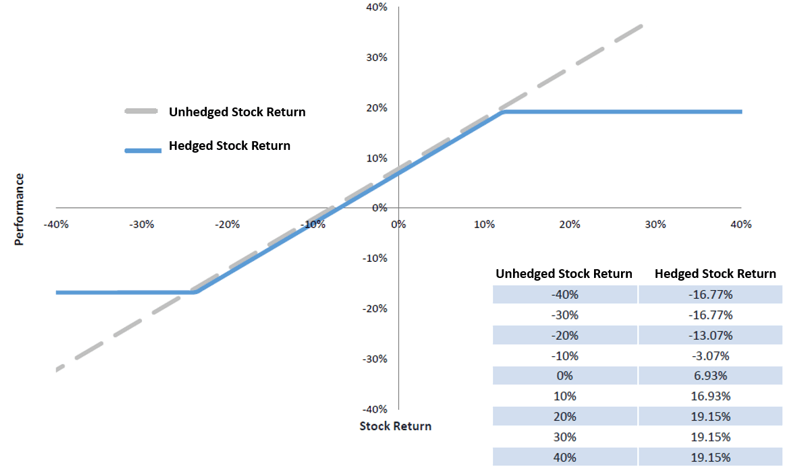

In the following example, we will use a hypothetical single-stock position and the S&P500 ETF (SPY) as the diversified market exposure. The holder of the stock would buy puts and sell calls on the amount of stock owned to truncate the volatility risk of that single position to -16.77% on the downside, and maximum upside to +19.15% on the upside.

Source: Manager Research

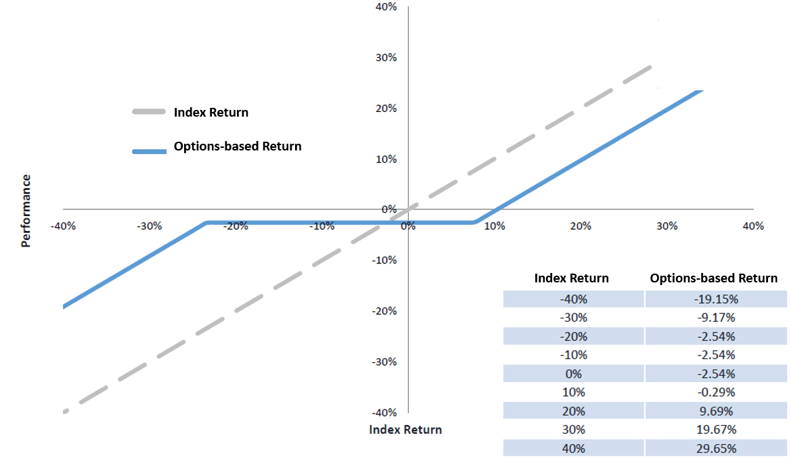

The investor would then buy an equivalent dollar value of their original stock position in SPY calls and sell puts to provide the diversified market exposure.

Source: Manager Research

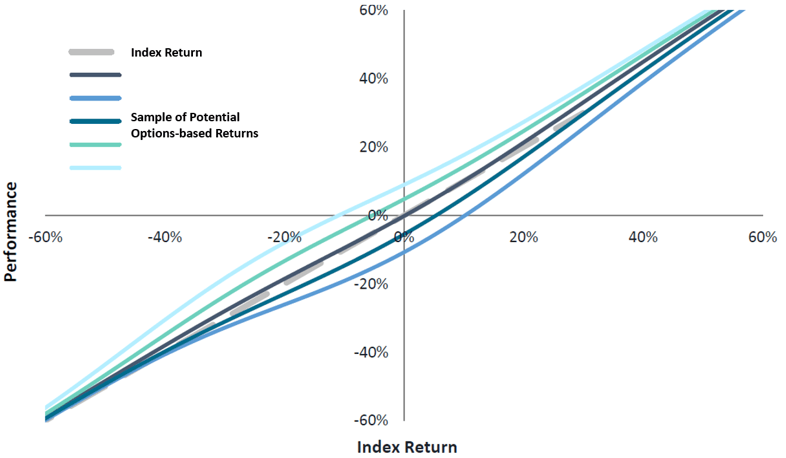

The combination of the two legs above results in the following pay-off potential when the options expire: we reduced single-stock risk by more than half, while adding an approximate equivalent amount of SPY risk, with the net effect being a slightly better return profile than even owning the SPY ETF alone.

Source: Manager Research

To be clear, it is not a perfect swap of risk but as a rule of thumb, investors can estimate their original 100% single-stock position to behave more like a 30-40% position and 60-70% index holding. This will result in a band of potential outcomes that should exhibit materially better diversification and risk reduction characteristics closer to the SPY than if one were to simply retain the original stock alone.

Source: Manager Research

We would note that traditional exchange funds also exhibit tracking error to their reference index, given the required real estate holdings and securities paid into the fund that may differ in name and sizing versus the benchmark. We view the trade-off for better liquidity and customizability of exchange fund replication to be worth the consideration.

The core motivation to pursue the exchange fund replication strategy is to substitute equity risk away from a single stock and into a diversified index without having to realize tax consequences of large stock sales. While this is a tax-efficient strategy, it is not tax-free. The original, core equity holding is retained without any tax recognition, however the options overlay that generates the diversified return stream will create some capital gains in a rising market. We’ll use another example to review this potential impact:

- Selling $100 of a long-term held stock with a zero cost-basis would result in net cash proceeds of approximately $76 assuming a 24% Federal tax rate. If those proceeds were reinvested in SPY, which returned 10% in the following year, total proceeds would equal $84. In year-two, that amount would grow to $92, assuming another 10% gain.

- In the exchange fund replication strategy, the $100 of stock would not have to be sold to experience the SPY exposure. The same 10% SPY return generated from options, or $10, would be taxed on a blended basis of long- and short-term gains, but conservatively recognizing that the gain was all short-term (which is unlikely to be the case), the investor would net $6 of post-tax gains for a total of $106. In year-two, total assets would be $112, assuming another 10% pre-tax gain. This is still more than 20% ahead of the first scenario after two years.

The exchange fund replication strategy is highly customizable, with daily liquidity and no investor accreditation requirements, making it accessible to a wide range of taxable investors. As taxes are likely to rise in the coming years, the program can be implemented as part of the solution to help clients achieve portfolio diversification and allow for continued long-term investment growth, while deferring the need to make large tax payments.

Asset Allocation

Equities: Move to Target-weight

Equity markets, as measured by the S&P 500, have logged positive returns in nine out of the past ten years, and while much can still happen between now and year-end, 2021 is on pace to add to that winning tally. What is even more remarkable is that in seven of those positive years, the index generated double-digit returns. This has been achieved not without volatility, but long-term holders of stocks have done very well over this past decade. However, we recognize that we are beyond the fat pitch of returns opportunity from stocks as the Fed begins tapering its quantitative easing program, supply-chain challenges pressure margins and delay revenues, and transitory inflation remains uncomfortably persistent. We expect interest rates to rise and weigh on stock valuations, diluting the still strong earnings expectations anticipated for the remainder of the year. To be clear, we remain constructive on equities, driven by continued economic expansion and corporate earnings recovery, however, we are moderating our return expectations and anticipate increasing volatility and are thus moving our recommendation to the asset class down to Target-weight. We would be ready buyers of equities again in any notable market pull-back driven by investor sentiment, as we continue to believe the overall macro backdrop remains resilient.

Thematically, we continue to lean into “quality” and “growth” companies, defined by steadily growing revenues and robust operating margins in new or expanding industries. We recognize that these businesses may trade at a premium to the market average, but are already market leaders or have the potential to become them in their respective industries. These companies tend to be based in the US, thus our modest bias towards domestic equities versus international stocks. We remain cautious around cyclical industries, which trade cheap, but are subject to earnings disappointment as growth moderates and businesses with high operating leverage see a return of margin and cash flow pressure. Finally, our constructive economic outlook is expressed via our small and mid-cap allocations, which are under-represented in global indices.

Fixed Income: Maintain Underweight

The likely beginning of tapering this year and return to rate hikes in 2022 will be a headwind for traditional fixed income investing. Investment grade fixed-rate assets may serve as a hedge to equities in periods of market uncertainty, but above-trend inflation will continue to weigh on the asset class and decay value. We remain underweight the asset class and seek to limit duration in what remains. Based on our constructive macroeconomic outlook and expectations for a low-default environment, we would overweight floating-rate credit risk, versus traditional bond exposures, to provide income. We recognize that credit spreads have rallied significantly alongside equities since 2020, however still find attractive yields through direct lending, structured credit, and real estate debt. For tax-sensitive investors, municipal bonds, particularly in high yield, provide an attractive relative value opportunity versus comparably rated taxable instruments. The potential for tax hikes further drives this thesis.

Liquid Alternatives: Move to Target-weight

As we move our Equities weighting to target and have been underweight fixed income, we have moved up our recommendation to liquid alternatives, particularly in low-beta arbitrage strategies that can generate stable returns in benign markets but find more opportunity and accelerate performance in periods of market dislocation or volatility. We continue to remain constructive on equity long/short funds, particularly those focused on small- and mid-cap companies, for their ability to find and concentrate around opportunities that are differentiated from the broader indices. We remain positive on systematic strategies, as well as themes in biotech and tech-enabled growth.

Illiquid Alternatives: Overweight

We remain overweight illiquid alternatives given their longer investment periods and ability to extract value through active engagement with their portfolio companies. Sponsors have supported their companies during the crisis and encouraged them to access liquidity to bridge shortfalls during that period. Additionally, sponsor-backed companies have been opportunistic buyers of weaker businesses during the crisis, which should help them come out of the recession with stronger, more diversified businesses. We recognize that competition for private assets has increased, elevating multiples and creating a scarcity of supply for good assets. However, we think company differentiation and ability to optimize operations provide an enhanced value-add and return opportunity versus public markets. We recommend allocations to innovative credit lending, buy-out strategies with a defined business moat, and specialized venture opportunities. We currently have a pipeline of small business lending, government-focused buy-out, and venture strategies in market this quarter.

Important Disclaimer

Investing in Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable, equal any corresponding indicated historical performance level(s), be suitable for a portfolio or individual situation, or prove successful. This document is strictly confidential and may not be reproduced or distributed in whole or in part without the prior written consent of Simon Quick Advisors. This presentation represents proprietary information that may not be shared without express permission from Simon Quick Advisors.

This information is being provided to you on a confidential basis. By accessing and reviewing this document, you acknowledge and agree that (i) you will not disclose or distribute this information, in whole or in part, to any third party without the prior written consent of the investment manager, Simon Quick Advisors and (ii) that such information is being provided to you for informational purposes only as a current or potential investor qualified to invest in hedge funds and other alternative investments. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer of solicitation will be made only by means of a formal Offering Memorandum that will be furnished to prospective investors.

This material is for intended to be for general and educational purposes only and is being furnished on a confidential basis to the recipient for discussion purposes only. You should not make any decision, financial, investment, trading or otherwise, based on any of the information contained herein without undertaking independent due diligence and consultation with a professional advisor of his/her choosing. You understand that you are using any and all information herein at your own risk. No information provided herein shall constitute, or be construed as an offer or recommendation to sell, acquire, or hold any security, investment product or service, nor shall any such security, product or service be offered or sold in any jurisdiction where such an offer or solicitation is prohibited by law or registration.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick Advisors is neither a law firm nor a certified public accounting firm and no portion of this document’s content should be construed as legal or accounting advice.

This report includes forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Information herein has been obtained from third party sources. While we believe the source to be accurate and reliable, Simon Quick Advisors Simon has not independently verified the accuracy of information. In addition, Simon Quick Advisors makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.