Buy Now, Pay More Later

The May Consumer Price Index (“CPI”) results were a disappointment to investors, business owners, central bank governors, and all of us as individual consumers. The latest inflation reading bucked the April trend of moderating price increases, and instead rose 1% over the prior month and is 8.6% higher than last year. Both equity and fixed income market reactions were sharply negative on the news, with interest rates moving up into the mid-3%’s and the S&P 500 officially falling into a bear market. The Federal Reserve Board was compelled to move more aggressively on its rate hiking program, announcing a 75-basis point increase this week, with the potential for the same next month. Chairman Powell emphasized that they needed to stabilize inflation to maintain economic stability, even if it meant giving back some of the significant strides made in bringing down unemployment. Hopes for a slowing, but growing economy have been replaced with concerns about how soon, and how deep a recession might be. Despite these economic headwinds and investor consternation, we do not believe this is the time to sell, particularly since markets have already repriced lower on these concerns considerably. Inflation is becoming a persistent issue and we expect it to remain elevated, but negative sentiment has likely overshot to the downside, providing an opportunity to generate strong long-term returns for the steady investor.

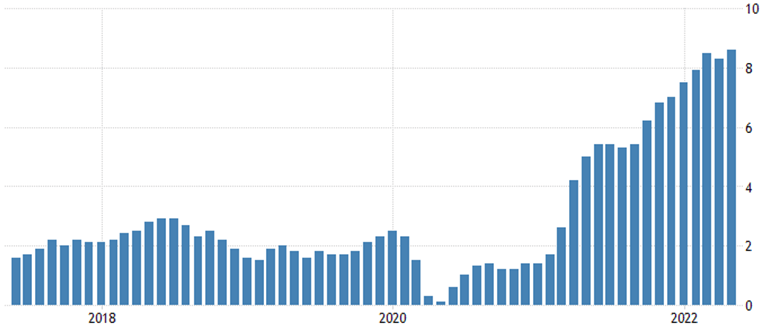

Consumer Price Index

Source: Trading Economics

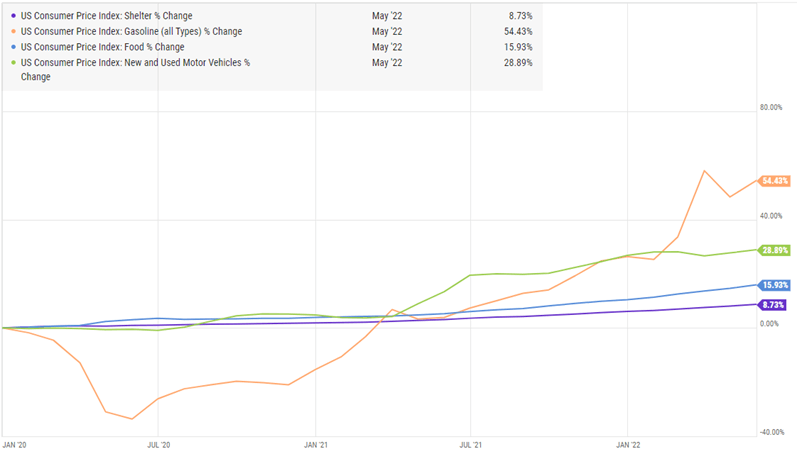

CPI is the monthly measure of change in prices for a basket of consumer goods and services. Shelter, Food, and Transportation (including fuel costs) are the largest components in these indices, with shelter alone comprising almost a third of the basket. Shelter has grown at a below-benchmark rate of about 5.5% year-over-year. In comparison, food, energy, and new and used vehicles have continued to trend at an uncomfortably high double-digit pace this year, with gasoline prices notably up over 50%. Those driving Teslas have been somewhat insulated, but electricity prices are up 12% as well.

Select Components of CPI

Source: Ycharts

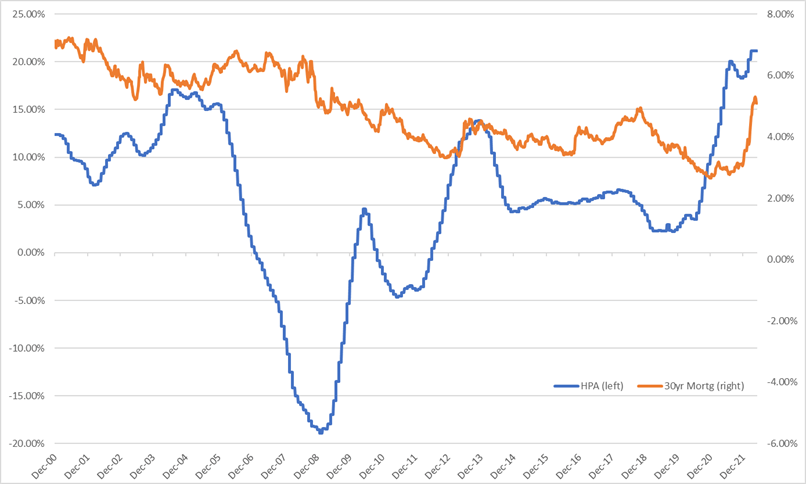

CPI measures the equivalent level of rent a homeowner might pay as part of its calculation, not the actual value of the home. Home prices have actually appreciated much more dramatically than that implied rate, at over 20% this past year. Cheap mortgage financing had allowed purchasers to buy more expensive houses with bigger loans, but with 30-year mortgage rates breaking through 6%, we expect this appreciation to abate and cool the housing market.

Home Price Appreciation (HPA) and 30-year Mortgage Rates

Source: Ycharts, Simon Quick Research

Rising costs of goods and services elevate risks to an economic slowdown as businesses and consumers begin to cut back on spending. The Fed is trying to raise rates to stem price inflation, but in doing so, is making it more expensive to invest for growth, and increasing borrowing costs that would otherwise spur business activity. With all that, interest rate hikes may still not be effective enough, partly because excess demand from consumers is not the only driver of inflation. The main factors to blame for supply shortages, and commensurately higher prices, are COVID-induced factory closures, the Russia-Ukraine War (and its impact on food and energy prices), and wage inflation created by stimulus checks and unemployment benefits. These are not all permanent structural shifts and will moderate over time as more producers enter the market, but unfortunately they are less influenced by monetary policy and will take longer to correct the supply-demand imbalance.

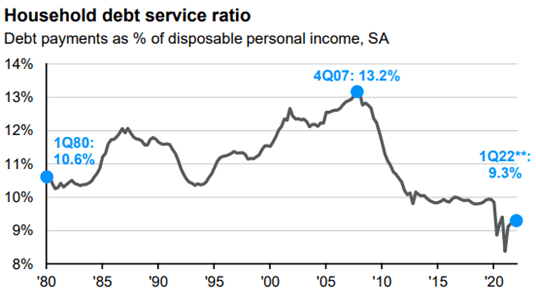

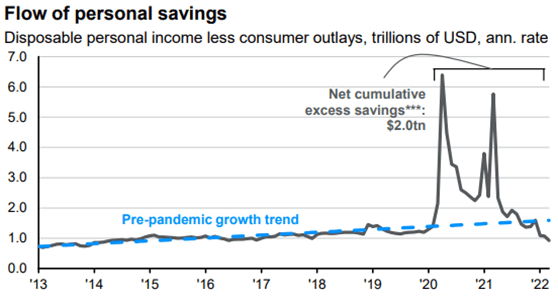

Over two thirds of our domestic GDP is based on consumption. Slowing consumer spending, combined with excess inventory and lower business investment, creates a drag on economic growth. We caveat this risk with the view that consumers are currently in a good financial position, with low unemployment, healthy wage growth, low liabilities, and diminishing, but still high savings from stimulus checks and unemployment benefits. Chairman Powell noted this strength in labor markets, possibly too strong, given below target unemployment and still high job vacancies. These factors have contributed to elevated wage inflation. The Board is willing to let employment slip a little, from rate hikes, if it can reduce the labor imbalance and moderate inflation.

Consumers Are Still In a Good Place

Source: JPMorgan

Despite relatively strong balance sheets, deteriorating buying power has weighed on consumer confidence to spend. The Consumer Sentiment Index hit an all-time low of 50.2. As you can see below, the index has been a generally reliable leading indicator of recessionary periods. However, it seems to be a contra-indicator to equity market returns. Troughs in consumer sentiment were followed by almost 25% returns, on average, in the following twelve months, despite the overhang of recession. This is probably the best depiction of Warren Buffett’s quote for investors to be “fearful when others are greedy, and greedy when others are fearful.”

Source: JPMorgan

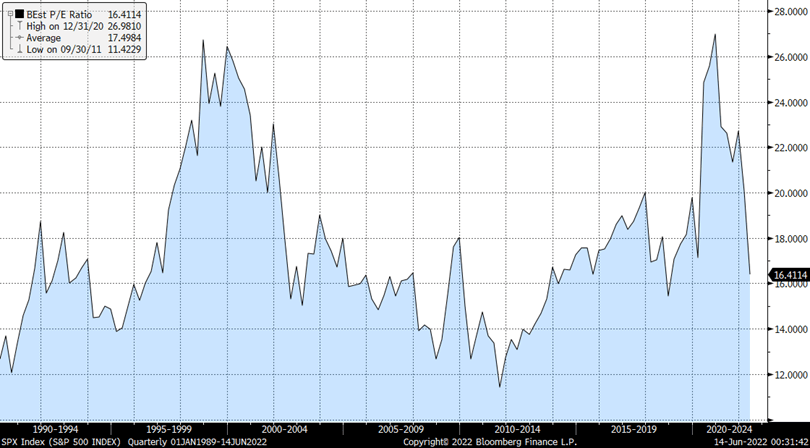

Following an over 20% loss from its all-time highs, the S&P 500 Index is now trading somewhat cheap to historical valuations, with a forward price-to-earnings multiple of 16.4x, down from its recent high of almost 27x. The historical average multiple for the index is 17.5x. We recognize that there is a risk of an earnings slowdown and the Fed’s path to curtailing inflation is still unclear. However, investor fears coupled with the recent market correction creates an opportune time to be adding to equities for those with multi-year time horizons.

S&P500 Forward P/E

Source: Bloomberg

Equities: Target-weight

Equities remain under pressure on continued inflation concerns and anticipation for a more aggressive rate hiking program from the Fed. While inflation in 2021 was driven by the reopening of cyclicals and the economy expanding, current inflation is being driven by a further tightening of supply, which can hamper economic growth. Commodity-driven sectors are strong relative and absolute outperformers thus far, with defensive sectors like staples and healthcare outperforming. However, higher-multiple consumer and technology-oriented sectors have been under pressure even though fundamental performance remains solid.

Equity valuations have compressed modestly, but stocks will continue to be pressured in a more rapidly rising rate environment. Additionally, with the Fed backing away from the market, volatility will likely remain elevated. With this backdrop, we remain long-term believers of growth businesses and innovation, however, are currently balancing this exposure with slow-but-steady value and defensive strategies that are less sensitive to interest rates. In this period of uncertainty, we continue to overweight domestic larger cap exposure as these businesses are better diversified with more operational levers to help them adapt. International markets have sold off and look compelling based on valuations, but increased macroeconomic risks keep us undersized in these regions for now.

Fixed Income: Target-weight

The Federal Reserve has quickly accelerated its path of rate hikes, with balance sheet reduction program beginning in June. This has resulted in interest rates rising across the maturity curve and driving losses in the asset class even though fundamentals remain sound. Credit spreads have widened with increasing recession concerns, albeit fundamentals remained consistent and defaults low. We continue to prefer short-duration fixed income and floating-rate instruments with direct lending exposure to generate above-market yields.

We recently upgraded our asset allocation weighting to Target-weight in order to increase overall credit quality and further shorten duration in the asset class. We expect the Fed to continue to raise rates. This should negatively impact fixed income. However, if geopolitical tensions or recession concerns increase, Treasuries tend to be negatively correlated to risk assets, and thus should protect well in this instance and could serve as liquidity to be redeployed into potentially over-sold opportunities thereafter.

For tax-sensitive investors, municipal bonds experienced one of the worst sell-offs this year, both from a performance and capital outflow perspective. We believe this was driven by general fixed income rate sensitivity and fear-driven retail selling. This has made municipal-to-treasury ratios rise and become relatively more attractive. Municipals are still subject to duration risk, but we would retain our positioning here as the losses do not seem to be fundamentally driven.

Liquid Alternatives: Target-weight

Rising rates and volatility in equity markets have made liquid alternatives a more attractive option to traditional asset classes. Equity hedge funds can add diversification to ideas through smaller, lesser-known companies and allocations to investment themes that are not easily expressed in traditional funds. Portfolio hedging and stock shorts also create opportunities to capitalize on the currently wide levels of stock dispersion. We continue to emphasize, and have been increasing allocations to multi-strategy, and low correlation arbitrage strategies as they exhibit the potential to provide better than fixed income returns while avoiding the extremes of market volatility. We find real estate opportunities to be able to mitigate some of the current inflation and interest rate pressures while generating low-volatility returns.

Illiquid Alternatives: Target-weight

We are long-term proponents for illiquid investments, as they afford a broader opportunity set from which investors can source differentiated, high-returning assets that are typically inaccessible via public markets. Furthermore, sponsors’ abilities to engage with their portfolio companies to drive operational enhancements and pursue growth initiatives increases value creation opportunities of their investments. While executing on business optimization and acquisition strategies are multi-year processes, illiquid investments have the potential to deliver returns meaningfully in excess of their public market peers with more controllable risks. Investing in buy-out, venture, credit and real estate should be a core component of wealth creation for investment portfolios that can bear the longer investment horizons.

We should also recognize though, that relative performance between public and private markets can fluctuate over shorter periods of time, and while private investments have had a tremendous run over the past couple of years, valuations have risen meaningfully as well and haven’t yet re-priced materially enough to account for the recent interest rate and inflation headwinds that public securities have experienced. As the availability of private capital has increased, acquisition multiples have remained elevated and are constraining the ability to buy good investments at reasonable prices. Furthermore, smaller businesses like the companies that sponsors tend to purchase are more economically sensitive and will experience inflationary and business cycle pressures to earnings. We had thus reduced our allocation weighting to Target-weight while we evaluate how macro pressures impact private valuations and look to harvest current realizations and distributions to build up dry powder for more liquid investment opportunities.

IMPORTANT DISCLAIMER

Investing in Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable, equal any corresponding indicated historical performance level(s), be suitable for a portfolio or individual situation, or prove successful. This document is strictly confidential and may not be reproduced or distributed in whole or in part without the prior written consent of Simon Quick Advisors. This presentation represents proprietary information that may not be shared without express permission from Simon Quick Advisors.

This information is being provided to you on a confidential basis. By accessing and reviewing this document, you acknowledge and agree that (i) you will not disclose or distribute this information, in whole or in part, to any third party without the prior written consent of the investment manager, Simon Quick Advisors and (ii) that such information is being provided to you for informational purposes only as a current or potential investor qualified to invest in hedge funds and other alternative investments. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer of solicitation will be made only by means of a formal Offering Memorandum that will be furnished to prospective investors.

This material is for intended to be for general and educational purposes only and is being furnished on a confidential basis to the recipient for discussion purposes only. You should not make any decision, financial, investment, trading or otherwise, based on any of the information contained herein without undertaking independent due diligence and consultation with a professional advisor of his/her choosing. You understand that you are using any and all information herein at your own risk. No information provided herein shall constitute, or be construed as an offer or recommendation to sell, acquire, or hold any security, investment product or service, nor shall any such security, product or service be offered or sold in any jurisdiction where such an offer or solicitation is prohibited by law or registration.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick Advisors is neither a law firm nor a certified public accounting firm and no portion of this document’s content should be construed as legal or accounting advice.

This report includes forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Information herein has been obtained from third party sources. While we believe the source to be accurate and reliable, Simon Quick Advisors Simon has not independently verified the accuracy of information. In addition, Simon Quick Advisors makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.