As the clock ticks closer to midnight on December 31, 2025, a significant change is lurking for estate and gift tax exemptions in the United States. The current lifetime exemption threshold, which stands at historic highs, is set to be cut in half, potentially leading to a substantial increase in the tax liability of certain estates.

The sunset of the Tax Cuts and Jobs Act (TCJA) of 2017 raises critical questions about estate planning strategies and the urgency to take steps today to minimize your tax burdens in the future.

The Present Opportunity

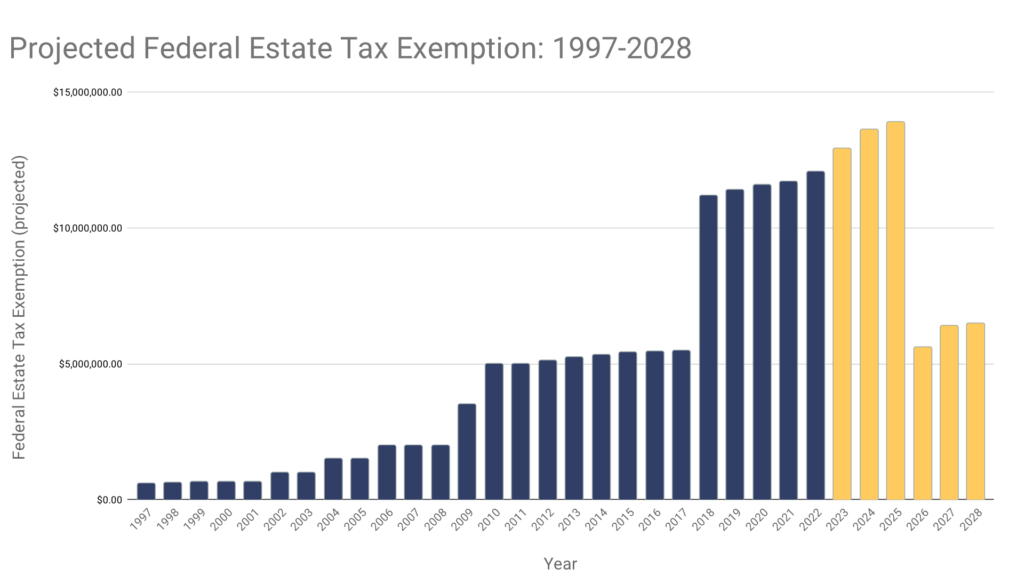

The lifetime estate and gift tax exemption represents the amount of assets you can transfer to your descendants without incurring federal estate or gift taxes. TCJA presents a remarkable opportunity for tax-efficient wealth transfer to future generations. Currently, we find ourselves at the highest exemption levels in history, thanks to the TCJA, which doubled the exemption from $5 million to $10 million in 2017.

As of 2024, the exclusion amount stands at $13.61 million per person or $27.22 million for married couples, indexed for inflation, offering a chance to transfer assets and seize this unprecedented opportunity.

The Impending Change

However, it’s important to note that this increased gifting capacity is temporary and set to expire on December 31, 2025, reverting to between $5 million and $8 million (indexed for inflation) starting January 1, 2026. Fortunately, the IRS has provided assurance that any exemption utilized before the sunset takes place will be honored and grandfathered, offering a degree of certainty.

Come January 1, 2026, the landscape of estate and gift tax planning will undergo a significant shift. While changes to tax laws typically require time and legislative action, it’s important to start acting now and to be ready for any changes by the sunset of the TCJA exemption.

Key Considerations and Next Steps

Planning for this change should be strategic, ideally spanning multiple tax years to maximize your benefits and adhere to complex tax regulations. Establish a relationship with a knowledgeable attorney and review your existing trusts to ensure it aligns with your current objectives and protections (including items such as adequate creditor and marital protection).

For those navigating the complexities of estate planning, you don’t have to do it alone. Seek guidance from a trusted advisor to leverage this exemption efficiently and take proactive measures to protect your assets and minimize tax liabilities. Every situation is unique, and tailored advice is important to develop a comprehensive estate plan that meets your needs and objectives.

A Broader Opportunity

The sunset of the TCJA act also allows for a broader opportunity to review and revise your current estate plan to ensure proper advanced directives (such as health care proxy and power of attorney) are in place and that your existing estate plan provides sufficient asset protection while mitigating not only estate tax, but also state and federal income tax.

The sunsetting of the TCJA will also trigger significant income tax changes, which should be considered in conjunction with your estate plan to maximize the efficiency of your overall financial plan.

Why Act Now?

With the approaching sunset, we believe the already heightened demand for a suitable estate planning attorney will continue to soar. It is paramount that you act now to review your existing plan and to partner with a team that has both the knowledge base and capacity to execute and implement a proper plan prior to sunset.

Simon Quick: Leading the Way in Estate Planning

At Simon Quick, we boast decades of extensive expertise in estate planning. Our team doesn’t just understand planning methodologies; we specialize in leveraging exemptions and employing transfer strategies to maximize estate and income tax benefits. By overseeing hundreds of our client’s estate plans and leveraging our extensive expertise in this subject, our Advisors can provide valuable insight and guidance.

Collaborating closely with our clients and their attorneys, we help tailor bespoke estate plans that cater to their unique situations, offering clear insights into potential liabilities and steadfast guidance throughout the process. As the sunset date approaches, there’s no better time to secure your financial legacy for generations ahead.

Visit us online, call us at (973) 525-1000 or send an email to [email protected] to discuss your specific situation.

Disclaimer

This information is for general and educational purposes only. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors & Co., LLC (“Simon Quick”) nor should this be construed as an offer to sell or the solicitation of an offer to purchase an interest in a security or separate accounts of any type. Asset Allocation and diversifying asset classes may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Investing in Liquid and Illiquid Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of Alternative Investments can vary based on the underlying strategies used.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Simon Quick client, please remember to contact Simon Quick, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.

This newsletter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.

Economic, index, and performance information herein has been obtained from various third party sources. While we believe the source to be accurate and reliable, Simon Quick has not independently verified the accuracy of information. In addition, Simon Quick makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or benchmark index, as comparative indices or benchmark index may be more or less volatile than your account holdings. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document. Index data and other information contained herein is supplied from various sources and is believed to be accurate but Simon Quick has not independently verified the accuracy of this information.