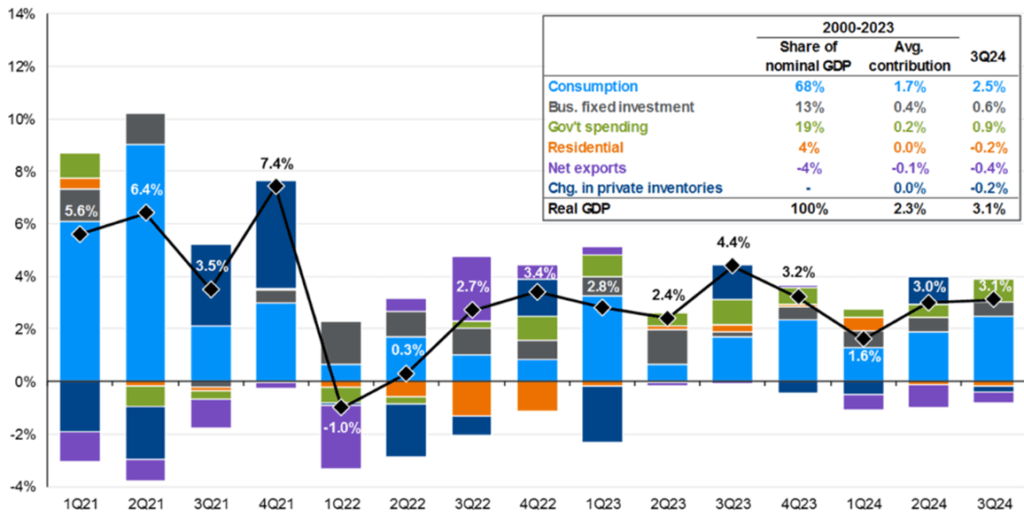

Another year has passed since the Federal Reserve began their monetary tightening campaign to slow the rapid rise of inflation. While inflation has moderated significantly over this time, economic activity has remained surprisingly resilient. A “Soft Landing” seemed far fetched in 2022 with inflation peaking over 9%, but the likelihood of a normalization of the rate environment without the need for a recession has steadily grown over time. As shown below, outside of a soft start to 2022, GDP growth has persistently been above long-term averages.

Contributors to real GDP growth

Quarter-over-quarter, seasonally adjusted annualized rate

Source: JP Morgan

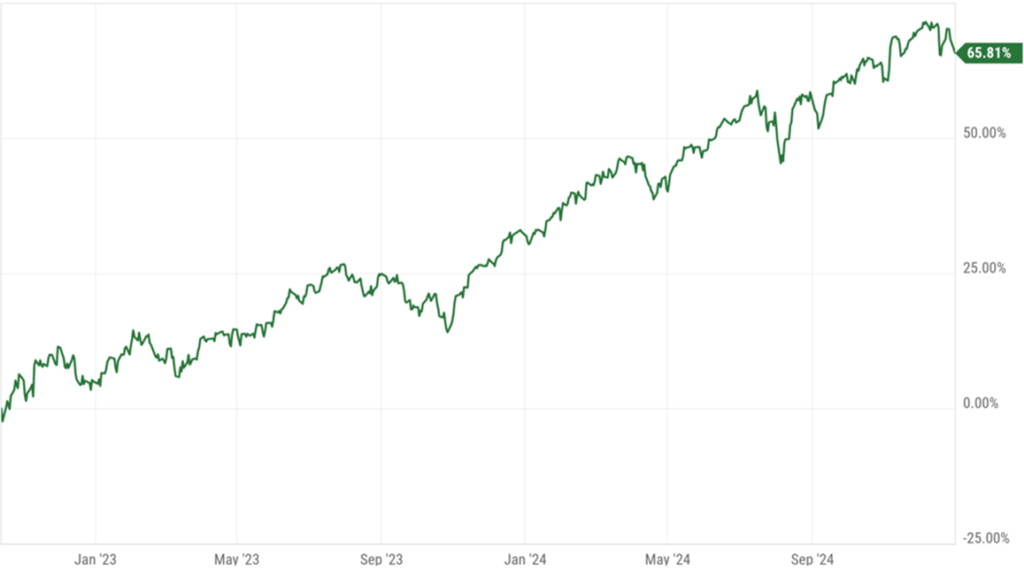

This resilience in economic activity amidst a normalization of inflation in the US has helped to propel the S&P 500 over 65% since the end of the bear market in 2022. The S&P 500 generated back-to-back years of 25%+ performance in 2023 and 2024, a feat only accomplished 3 other times since the start of the Great Depression (1935/1936, 1954/1955, 1997/1998). The following year of performance varied considerably after those 3 occasions, with a -35% return in 1937, a +7% return in 1956, and a +21% return in 1999 – making them an unhelpful analog for forecasting 2025 equity performance.

S&P 500 Cumulative Performance

Source: YCharts

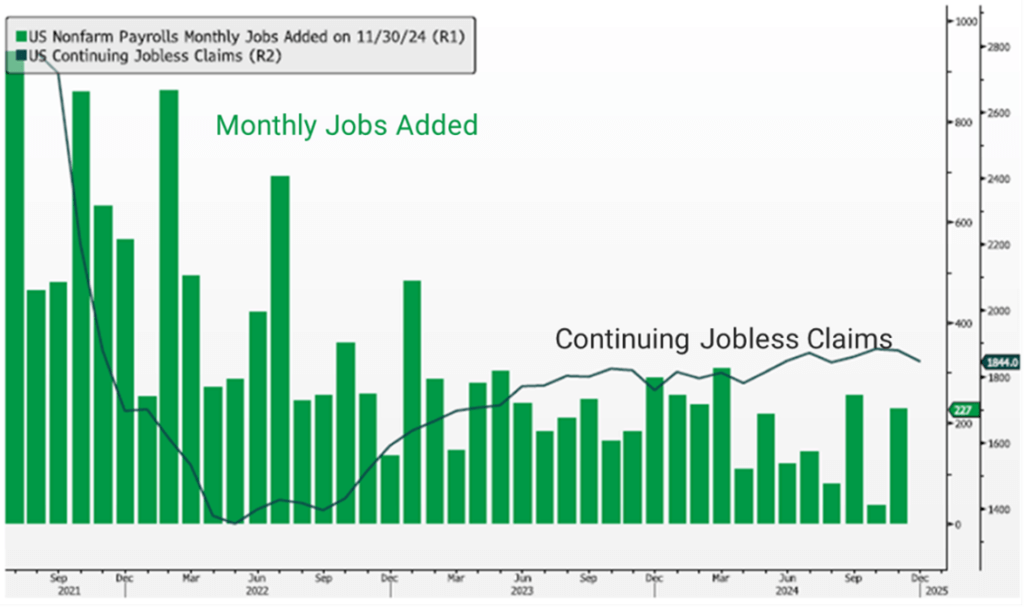

Historically, a degrading labor market has been a prerequisite for returning inflation to more sustainable levels following spikes, but the current labor market has remained highly resilient over recent years. While the number of jobs added to the economy has normalized from the post-pandemic extremes, the number of unemployed has been limited as businesses remain hesitant to cut their workforce. This labor market strength has allowed consumers to continue to spend healthily, with retail sales growing over 4% year-over-year through November.

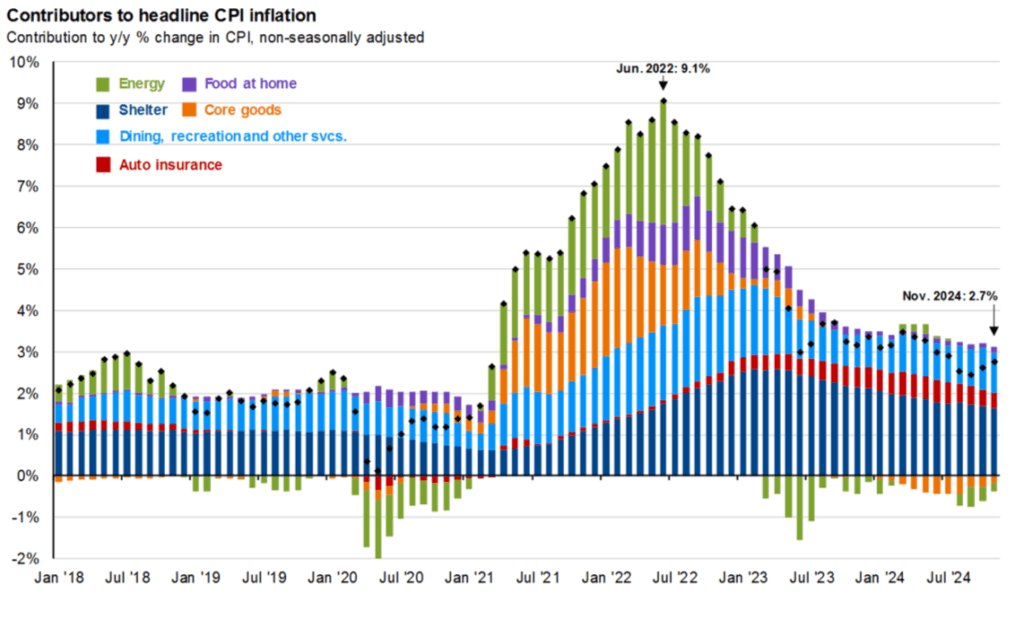

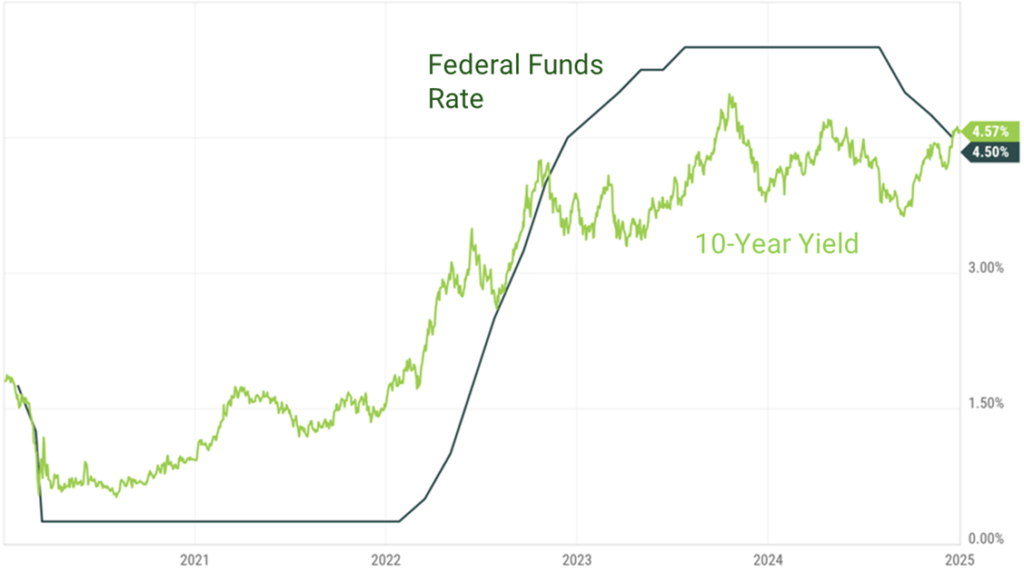

Despite the resilience of the economy since the Fed’s rate hiking campaign began, inflation has moderated significantly. After peaking at over 9% year-over-year in 2022, the rate of inflation declined significantly to 2.4% by September 2024. This impressive progress in returning inflation to more normalized levels was recognized by the Federal Reserve who moved forward with 100 basis points of rate cuts from September to December.

Contributors to headline CPI Inflation

Contribution to y/y % change in CPL non-seasonally adjusted

However, since this time, the progress on inflation has largely stalled. Since the low point of year-over-year inflation over the past several years in September, inflation steadily moved higher in October & November to 2.7%. Despite the Fed’s efforts to bring down the cost of borrowing, longer-term yields moved higher by about 100 basis points since the Fed first cut rates. In addition to inflation remaining stubborn over the last quarter of the year, the potential inflationary policies of newly elected President Trump have spooked bond investors who foresee a further expansion of fiscal deficits. The Fed has indicated it is likely to pause cutting rates coming into 2025, but a further resurgence in inflation could put additional upward pressure on yields.

Source: YCharts

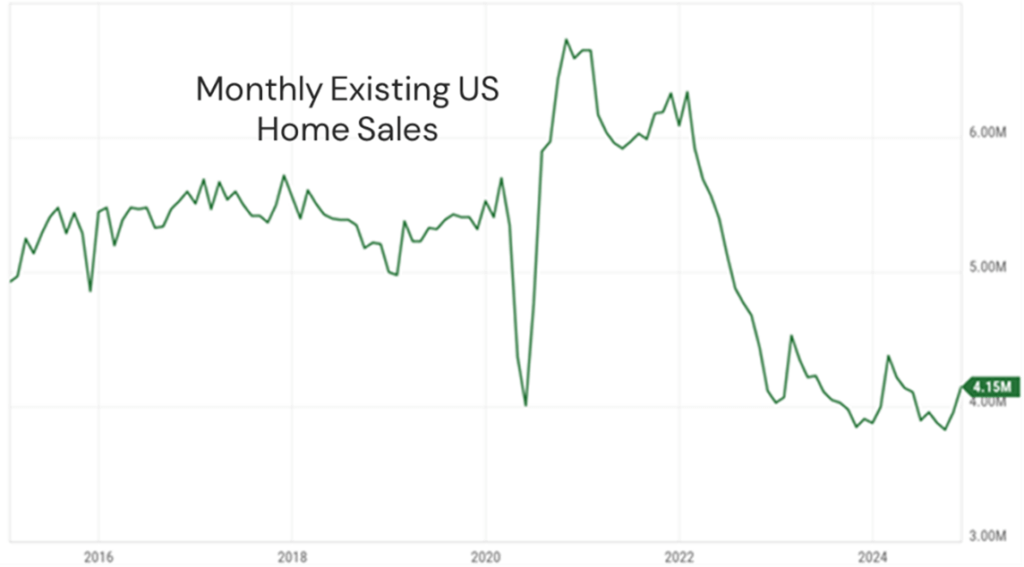

While the broader economy remains on strong footing, there are certain pockets of weakness – predominately in traditionally interest rate sensitive sectors. For example, the US housing market has slowed considerably from the peaks seen in the immediate aftermath of COVID. Due to elevated mortgage rates & home price appreciation experienced in recent years, the level of existing home sales in the US has fallen significantly from pre-COVID levels. With residential investment accounting for 3-5% of US GDP, a significant slowdown in this sector could weigh on broader economic strength – particularly if it leads to homebuilders cutting employment. In addition to other sectors reliant on financing, the prospects of interest rates remaining elevated could put further pressure on these parts of the economy.

Source: YCharts

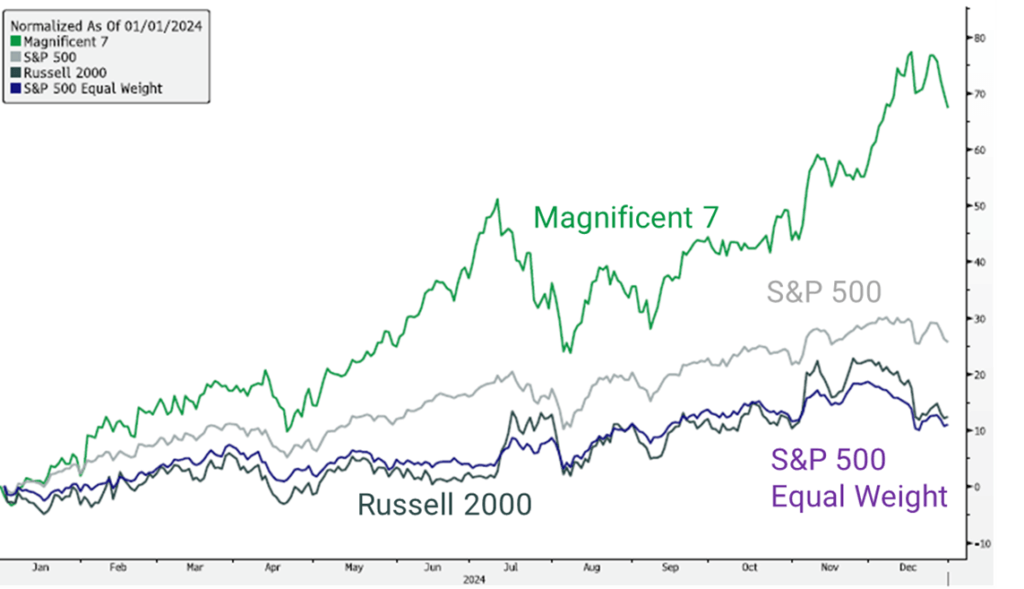

While most of 2024 saw a broader degree of participation in the equity markets as investor anticipation for a soft landing grew, the stickiness of inflation in the 4th quarter contributed to once again the Magnificent 7 dramatically outperforming other parts of the equity market. After some strong performance following the US presidential election, small caps & non-tech oriented large caps lagged the Magnificent 7 cohort considerably. This group of stocks have seen significant earnings outperformance in this period of elevated rates to help justify the strong level of returns.

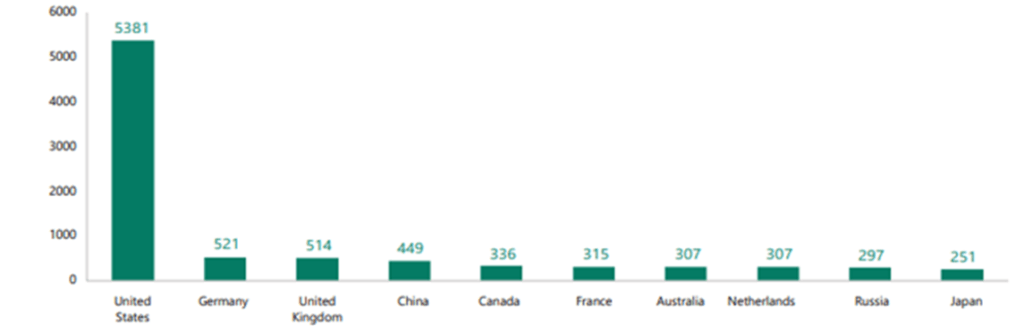

A major theme helping to propel the economy & stock market in recent years was the buildout of Artificial Intelligence capabilities. The emergence of AI focused datacenters responsible for training & powering the large language models (such as ChatGPT) and other AI-enabled technologies have been a major driver of the economy as the US has emerged as a leader in datacenter investment. Expectations for spending on the emerging technology to continue to increase throughout the decade, with significant productivity enhancements being generated as these technologies are rolled out.

Data as of March 2024.

Sources: Statista, Cloudscene, Apollo Chief Economist

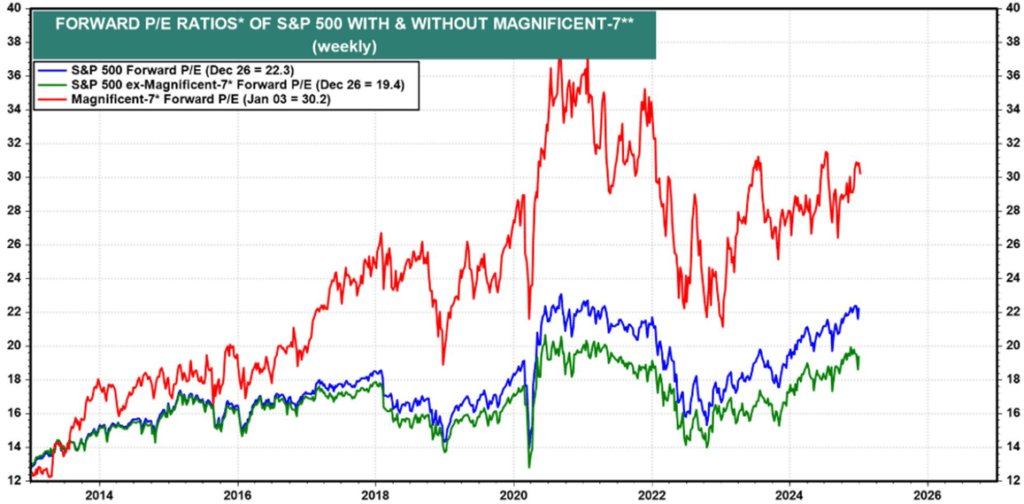

However, despite the earnings outperformance seen from the Magnificent 7, these earnings are being valued at a materially higher multiple than the remainder of the S&P 500. While valuations make a poor short-term predictor of performance, this valuation gap poses an opportunity for the ex-Magnificent 7 market to outperform if these companies cannot meet steep expectations moving forward.

Source: LSEG Datastream, © Yardeni Research. IBES.

*Price divided by consensus forward earnings forecast

**Magnificent-7 stocks include Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, NVIDIA, and Tesla. Both classes of Alphabet are included.