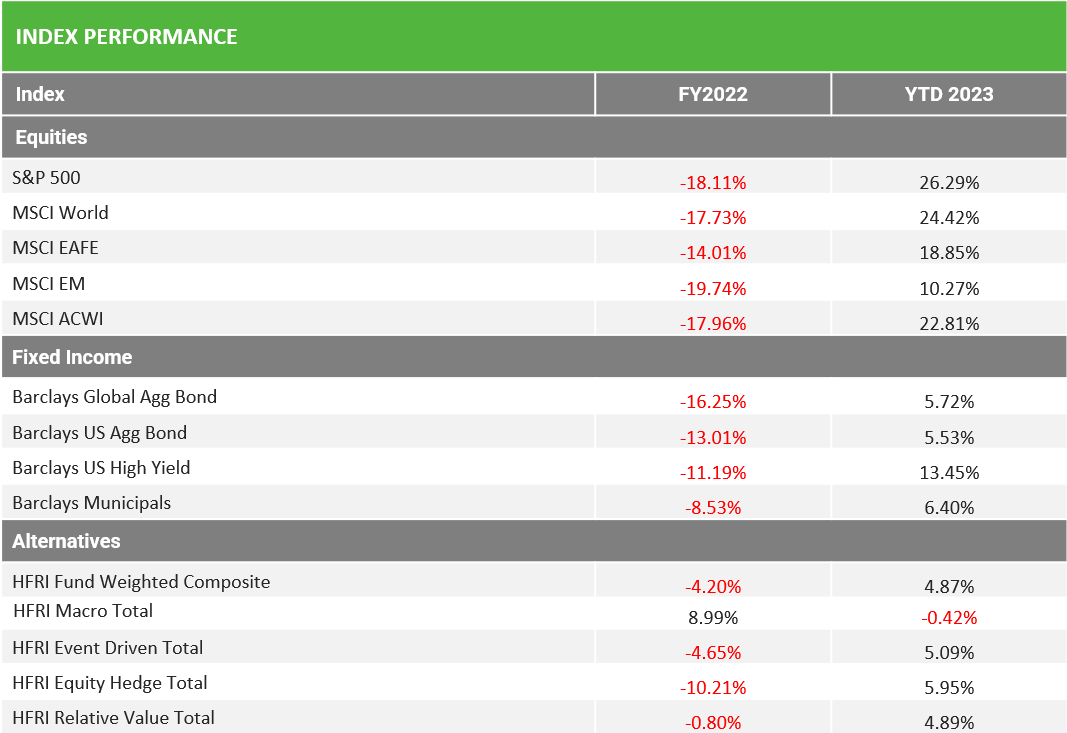

Despite a difficult investing environment in 2022, 2023 proved to be a strong year of recovery for both stocks and bonds with the S&P 500 and Barclays US Agg Bond Index up 26.2% and 5.5%, respectively. Markets remained volatile throughout the year but finished on a strong note as economic resiliency alongside persistently softening inflation has helped to drive expectations for a soft landing.

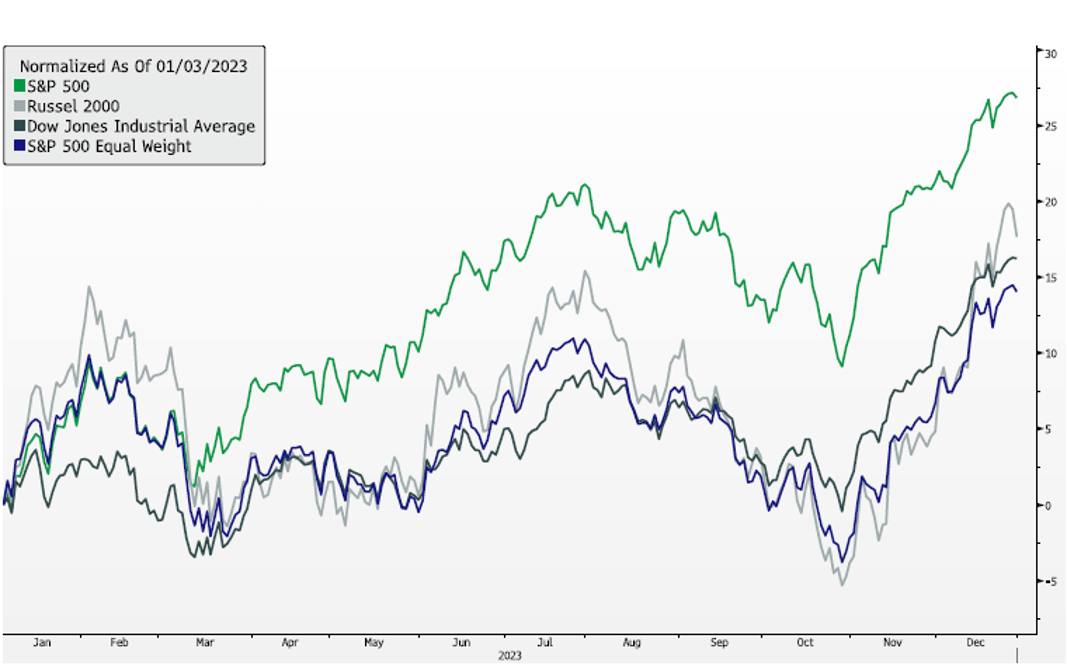

Equity markets experienced a pronounced rebound in 2023 following the over 18% selloff in 2022. As has been widely covered, equity market leadership for the vast majority of 2023 was found in the ‘Magnificent 7’. At times throughout the year, more than 90% of the S&P’s performance could be attributed to these handful of stocks. Due to the S&P’s concentration in these companies, the index strongly outperformed small cap domestic, international, and emerging markets – basically everything that held the Magnificent 7 in less size than the S&P.

Throughout most of the year, other areas of the market were pressured by the potential of an impending recession, or alternatively, the impact of higher interest rates while the economy remained resilient. Despite trading at meaningfully cheaper valuations, these generally smaller capitalization, more cyclical, and higher leveraged businesses struggled to gain investor attention given the backdrop of this uncertainty.

However, market breadth expanded meaningfully to end the year as sentiment began to shift. Expectations for the Fed to keep interest rates higher for longer quickly dissipated in Q4 as soft-landing calls have once again become consensus. Since the start of November, these beaten-down areas of the market strongly outperformed, highlighted by the Russell 2000 outperforming the S&P 500 by nearly 9% over this time.

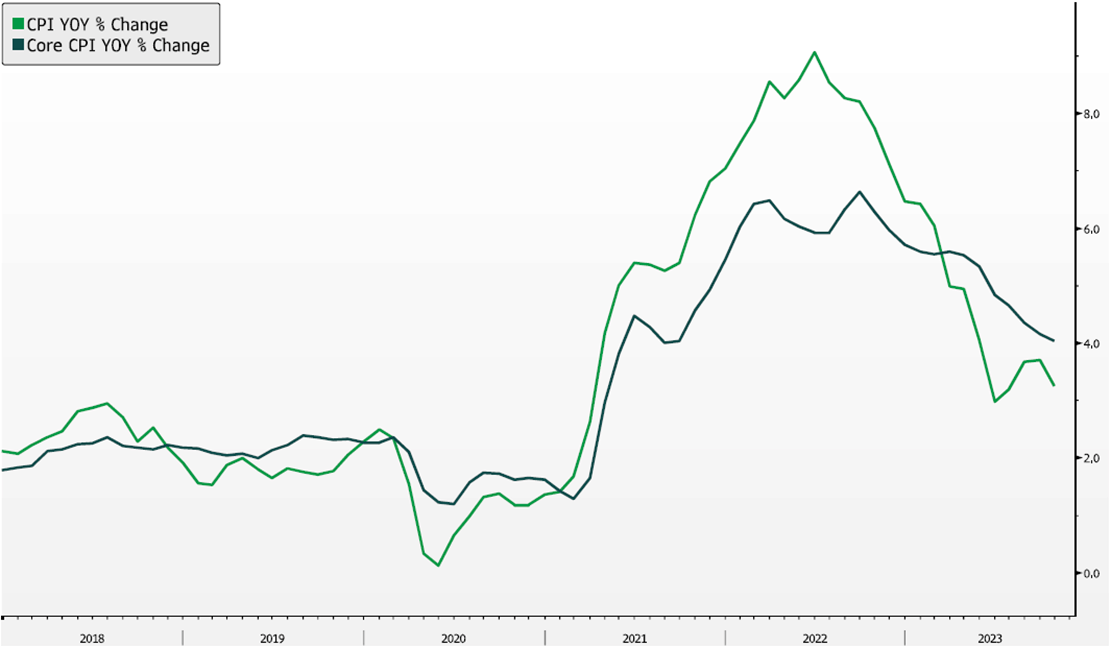

This shift in sentiment was driven in large part by a change in tone from the Federal Reserve. Following multiple quarters of hawkish commentary and pushback against easing policy prematurely, the Fed acknowledged the progress made on the inflation front and signaled their intention to cut rates in 2024. The year-over-year change in the Consumer Price Index moved from a high of 9.1% in June of 2022 to 3.1% by November of 2023, driven in large part by the continued normalization of supply chains and decreasing energy prices. While still above long-term targets of 2%, the Fed has recognized the lagging elements of inflation that should allow it to further cool in 2024.

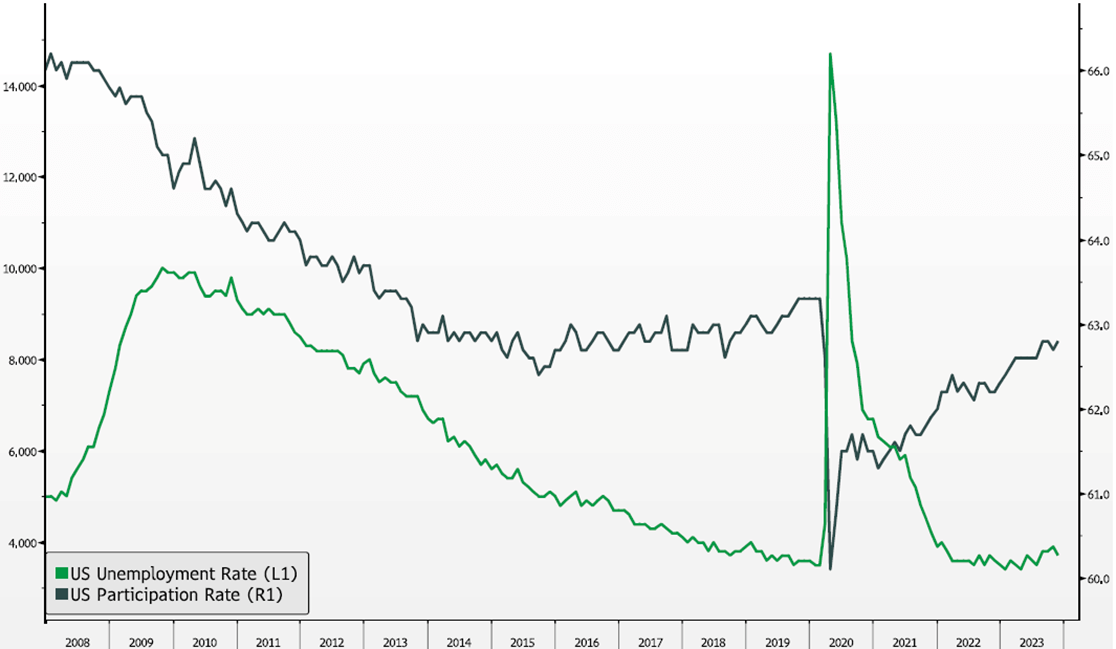

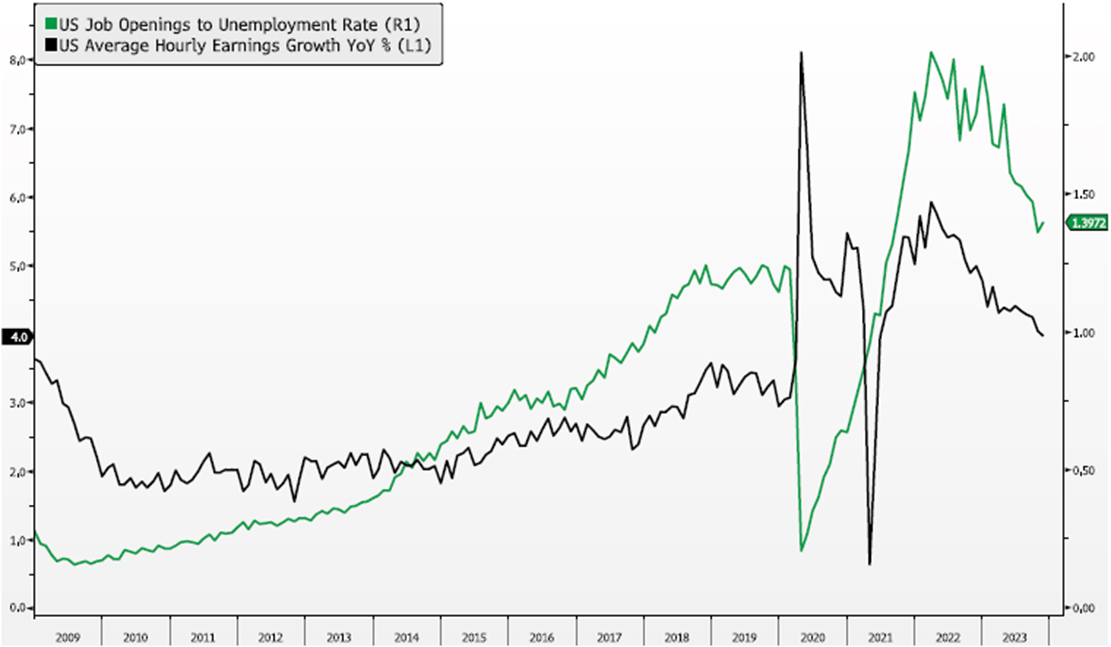

While inflation has persistently declined in 2023, employment remained surprisingly resilient with US unemployment rates near all-time lows heading into 2023. However, other metrics of labor market slack have shown signs of easing. For example, the number of job openings in the US has eased meaningfully over the past year while participation rates steadily climbed, leading to significantly less job openings per unemployed person.

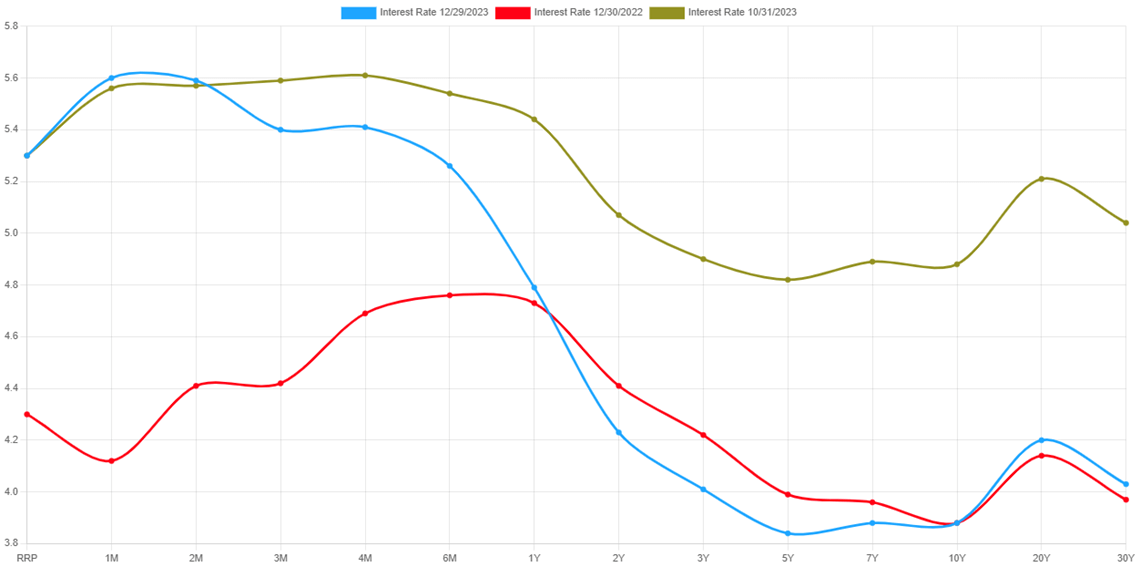

Fixed income market volatility continued to remain elevated despite the over 5% performance in 2023. Following a flight-to-safety moment surrounding the regional bank failures in Q1, fixed income was challenged throughout most of the year. Higher-for-longer expectations and fears surrounding treasury issuance drove yields higher, with the 10-Year Treasury Yield peaking over 5%. However, fixed income markets strongly rebounded following the Fed pivot and change in market sentiment in Q4 as the Barclays Agg advanced 6.8% on the quarter. Heading into 2024, the market is pricing in 6 rate cuts of 25 basis points with the first cut beginning in March. Whether the Fed meets these expectations or not is expected to have a material impact on market performance in 2024.

Market Overview

After a year of concern of inflation & recessionary risks, market expectations for a soft-landing drove strong performance in both equities and fixed income to end the year.

Domestic equities, led by the ‘Magnificent 7’, drove outperformance against international markets in 2023. Fixed Income markets were led by High Yield, benefiting from high coupons and tightening spreads.

Source: Bloomberg Barclays, MSCI; FY2022 as of 12/31/2022. For Equities & Fixed Income, YTD 2023 as of 12/31/2023. For Alternatives, YTD 2023 as of 11/30/2023.

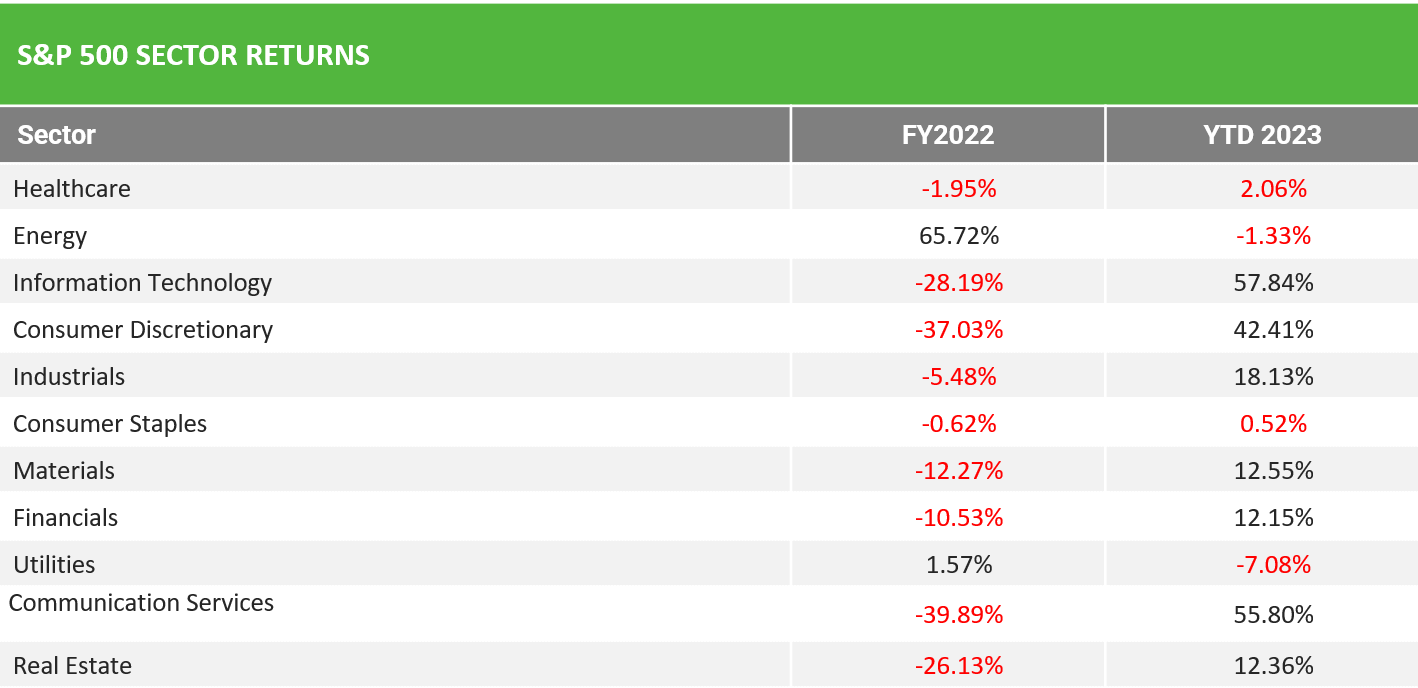

The Magnificent 7 are concentrated across the Info Tech, Comm Services, and Consumer Discretionary sectors, leading to strong outperformance against other industries.

Following the Fed pivot in late 2023, the lagging sectors of the equity market have started to participate to a stronger degree.

Source: Bloomberg; FY2022 as of 12/31/2022;. YTD 2023 as of 12/31/2023.

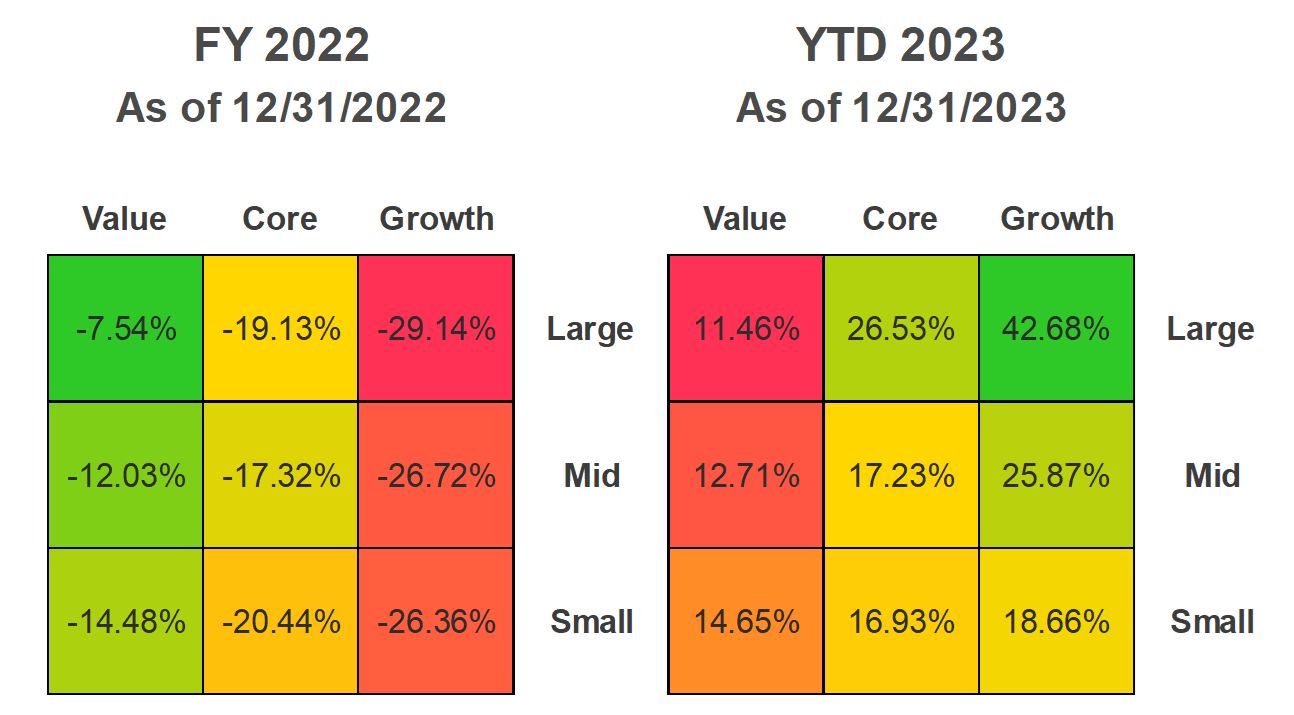

U.S. Equity Style & Market Capitalization Returns

Large Cap Technology, highlighted by the Magnificent 7, continue to lead equity markets.

However, Small and Midcap companies saw strong momentum to end the year.

Source: Bloomberg; FY 2022 as of 12/31/2022. YTD as of 12/31/2023.

Equity Market Dispersion

The S&P 500 strongly outperformed other areas of the equity market for most of 2023, driven by strong megacap tech performance.

However, equity market breadth expanded notably as the soft-landing view became consensus.

Source: Bloomberg. As of 12/31/2023

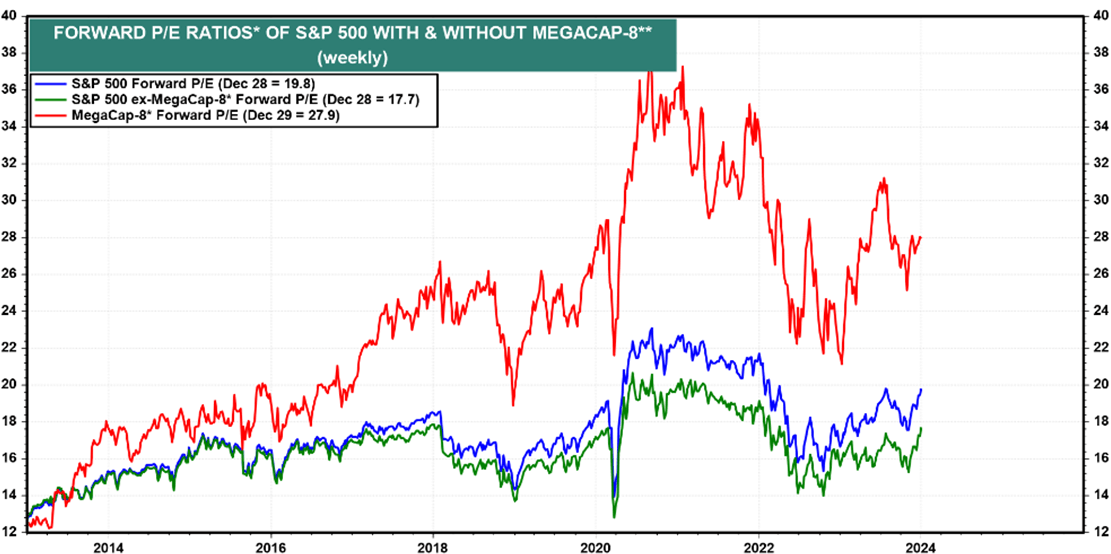

Valuations on the S&P 500 remain above long-term averages, driven by the megacap cohort that led markets.

Outside of this expensive cohort, valuations remain more attractive.

Source: LSEG Datastream and © Yardeni Research.

* Price divided by consensus forward earnings forecast

** MegCap-8 stocks include Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Netflix, NVIDIA, and Tesla. Both classes of Alphabet are included.

Moves in the Treasury Curve

Higher for longer interest rate narratives lost steam in late 2023 as soft-landing views and Fed rate cut expectations drove long-dated yields to the year’s starting point.

Source: ustreasuryyieldcurve.com

Inflation Continues to Move off Highs

Inflation continues to moderate from multi-decade highs experienced in 2022.

This persistent disinflation experienced alongside economic resiliency has driven expectations for a soft-landing scenario.

Source: Bloomberg, as of 11/30/2023

Employment Remains Resilient

Labor markets have continued to remain resilient throughout the Fed tightening cycle.

Unemployment remains near all-time lows while participation rates have continued to recover.

Source: Bloomberg, as of 11/30/2023

Signs of Labor Market Slack

But signs of normalization are appearing as the number of available jobs per unemployed worker reaches pre-COVID levels.

Wage growth remains elevated but has moved lower with this trend.

Source: Bloomberg, as of 11/30/2023

Asset Class Analysis

Equities: Move to Target-weight

The domestic economy remains resilient, as we see above-trend GDP growth and corporate earnings strength. Consumers overall remain strong, albeit at a moderating level than what we experienced over the past couple years. A path to rate cuts should support valuations and contain volatility as we start 2024. We believe the late-2023 market rally still has some room to run as cash moves off the sidelines and are thus moving to a target-weighing for stocks as equity allocations have organically grown. While the Magnificent 7 can still perform well in the new year, the current economic and Fed backdrop may favor the other 493 stocks in the index, in addition to smaller cap companies that are more levered to economic growth and lower interest rates. We remain domestically oriented as Europe appears to be lagging the disinflation trend and thus is maintaining a more hawkish monetary stance.

Fixed Income: Move to Target-weight

Fixed Income assets generated attractive yields and saw capital appreciation as target interest rate expectations fell. We remain constructive on the diversifying, income-producing nature of the asset class, but would pause on additional allocations given the rapid tightening we saw in longer-duration yields as the market is calling for more aggressive Fed easing. We maintain a balance between investment grade duration exposure and floating rate lending strategies, as recession risk still remains relatively low.

Liquid Alternatives: Target-weight

Hedge Funds: Hedge funds have shown their ability to be sources of portfolio diversification over the past couple years. While stocks and bonds still exhibit positive correlation in the current environment, we appreciate the contribution of alternative strategies with low directionality, but actively traded, dynamic portfolios that can take advantage of moments of disconnect between trading relationships of securities and asset classes in periods of transition. These opportunities can help funds generate steady returns with less sensitivity to market direction or the actual path of interest rate cuts in 2024. We continue to expand our multi-strategy allocation and complemented it with differentiated lending and volatility strategies to balance out the more directional small cap exposures.

Real Estate: We have been adding core-plus real estate opportunities, notably in residential assets for its inflation aligned properties and as a complement to stock and bond portfolios. We continue to remain cautious on the fundamental outlook of office buildings. Lower interest rates should ease some pressure on financing situations.

Illiquid Alternatives: Target-weight

2023 performance for illiquid assets was muted. While underlying portfolio company earnings have improved, transaction activity has remained light. Lower rates and a narrowing of bid-ask spreads should reaccelerate over the next couple years and committed capital for opportunistic deployment should make newer vintages highly accretive. Venture valuations have remained muted, thus making secondary opportunities in this segment of the market notably attractive for discerning investors

Disclaimer

The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained herein is intended to constitute legal, tax, accounting, securities, or investment advice nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick Advisors LLC), or any non-investment related content, made reference to directly or indirectly in this presentation will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Investing in alternatives may not be suitable for all investors, and involves a high degree of risk. Many alternative investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of alternative investments can vary based on the underlying strategies used.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

Simon Quick Advisors LLC is neither a law firm nor a certified public accounting firm and no portion of the presentation content should be construed as legal or accounting advice. If you are a Simon Quick Advisors LLC client, please remember to contact Simon Quick Advisors LLC, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please Note: (1) performance results do not reflect the impact of taxes; (2) It should not be assumed that account holdings will correspond directly to any comparative benchmark index; and, (3) comparative indices may be more or less volatile than your account holdings.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document

Economic, index, and performance information is obtained from various third party sources. While we believe these sources to be reliable Simon Quick Advisors LLC has not independently verified the accuracy of this information and makes no representation regarding the accuracy or completeness of information provided herein.

As of April 1st, 2022, Simon Quick Advisors LLC has changed private capital index providers from Cambridge Associates to Pitchbook Benchmarks.