Financial markets remained volatile into the third quarter of 2022 as we saw a continuation of markets being driven by persistently elevated inflation and hawkish Central Bank responses, with a surging US dollar that has begun to cause ripple effects across rate & FX markets globally. Risk assets had a tumultuous third quarter, seeing strong gains from the mid-June lows through mid-August before selling off again to end the quarter. Interest rates had initially paused their aggressive move higher as weakening leading economic indicators drove investors to position for a pivot in Central Bank monetary policy. This proved supportive for equities, particularly growth-oriented businesses that had led the market to the downside this year, with the S&P up nearly 18% from the mid-June lows through early August. Equities farther out on the risk spectrum saw even stronger performance, with Kathy Wood’s ARKK fund up nearly 40% over this time.

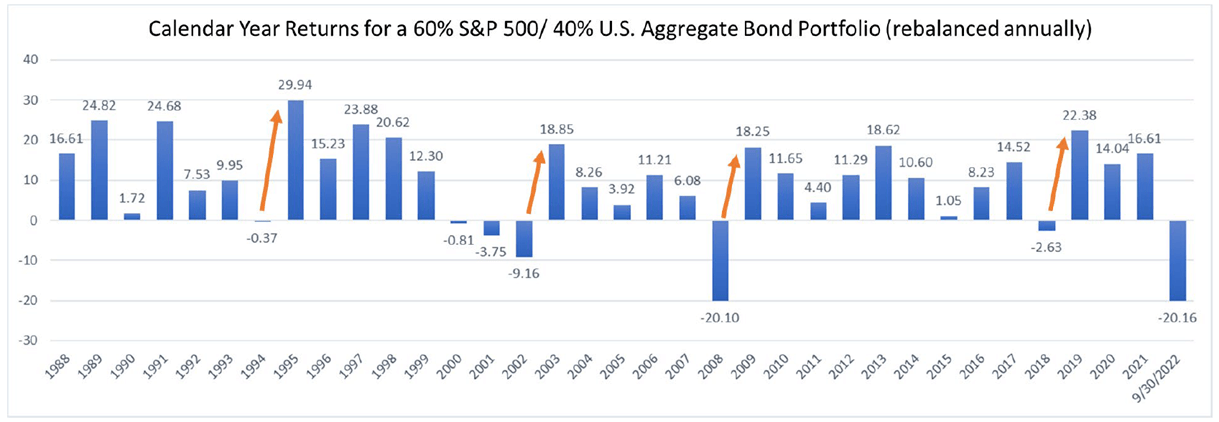

This relief rally lost steam during August however as Chairman Powell’s Jackson Hole speech reinforced to the market that the Fed was not close to pivoting its hiking policy and remained focused on bringing inflation back to 2%. The momentum from this rally was quickly unwound as interest rates once again moved higher, with the 10-year US Treasury yield finishing the quarter at 3.8%. The S&P finished the quarter down 4.9%, its third straight quarter of negative performance, while the Aggregate Bond Index detracted 4.8% on the quarter. The similarly weak performance from stocks and bonds on the year has caused a traditional 60/40 portfolio to return -20% through Q3, a historically challenging year for risk parity that is matched only by a -20.1% performance in 2008.

Economic data continues to be headlined by persistently elevated inflation and a strong labor market. The August CPI reading caused significant market volatility as both headline and Core inflation surprised to the upside, driven in large part by the broadening of inflationary pressures to more sticky elements like shelter and services. Concurrently, the labor market has remained extremely strong with the US unemployment rate remaining at all-time lows and finished the quarter at 3.5%. The tightness of the labor market further reinforced the Fed’s inability to pivot policy as the risk of a wage price spiral remains. In response, the Fed has been forced to continually raise their expectations for the terminal rate and utilized a third straight 75bp hike in September to try and slow inflation, with the expectation for more hikes in November and December.

Domestic markets outperformed international and emerging markets during the quarter as many countries deal with energy and food shortages. Europe in particular is at risk of being short of energy if this is a cold winter, with potential for rationing and mandatory demand cuts. The US Dollar has been a strong benefactor of this environment, appreciating significantly this year against a basket of major currencies. The Euro, Pound, and Yen have depreciated significantly vs the Dollar as investors have gravitated towards the depth & quality of the US economy. A strengthening Dollar poses challenges for many countries and international businesses that denominate trade and debt in the Dollar, and even required intervention from the Bank of Japan, the European Central Bank, and the Bank of England to slow the speed of their currencies’ depreciation.

Moving forward, the market continues to focus on inflation and labor as Central Banks remain data dependent in their approach to monetary policy. While a near term pivot from Central Banks does not appear likely, weakening economic data may be taken as a positive sign that inflation should ease. Expectations for earnings growth remain resilient for Q4 and 2023 and could also serve to support markets if expectations are met.

What We’re Watching

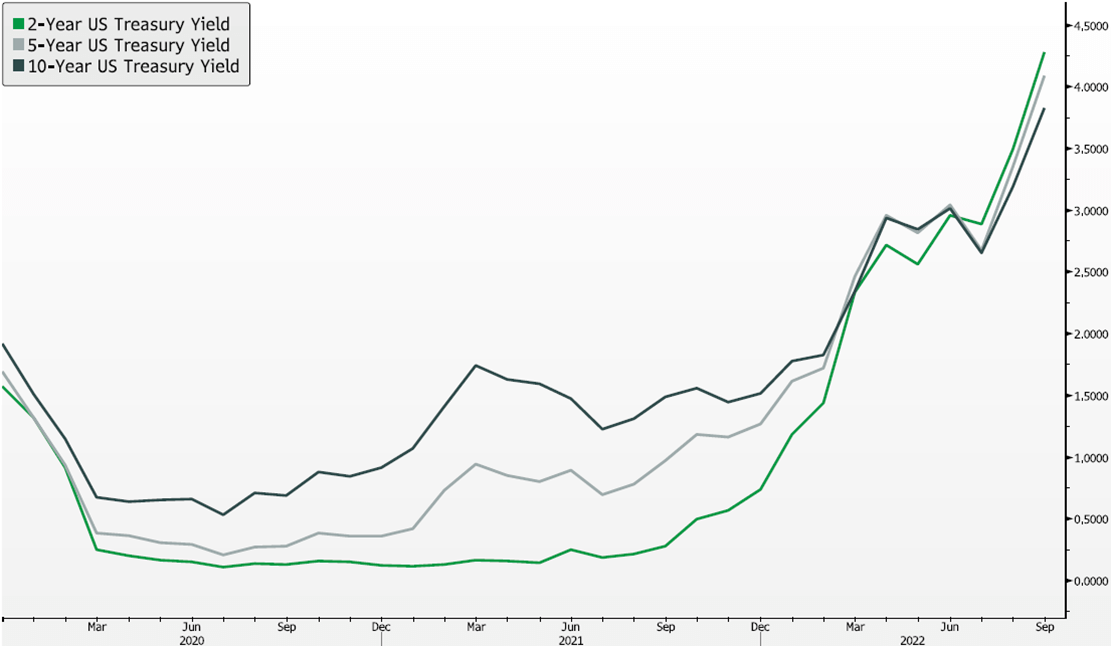

Yields continued their march higher in Q3 after temporarily trading in a range bound fashion. Investors anticipated an easing monetary policy at the beginning of the quarter but changed their tune following multiple upside surprises to inflation and a more hawkish than anticipated tone from the Fed. 10-year US Treasury yields hit a low during the quarter at 2.6% before moving higher and ending the quarter at 3.8%.

The US Treasury curve grew significantly more inverted over Q3 as fears of a policy misstep continued to grow, along with a third straight 75bp rate hike from the Fed. The 2-year yield ended the quarter nearly 50bps higher than the 10-year, a level of inversion not seen since the early 2000’s.

Yields have Risen, and the Curve has Inverted

Source: Bloomberg

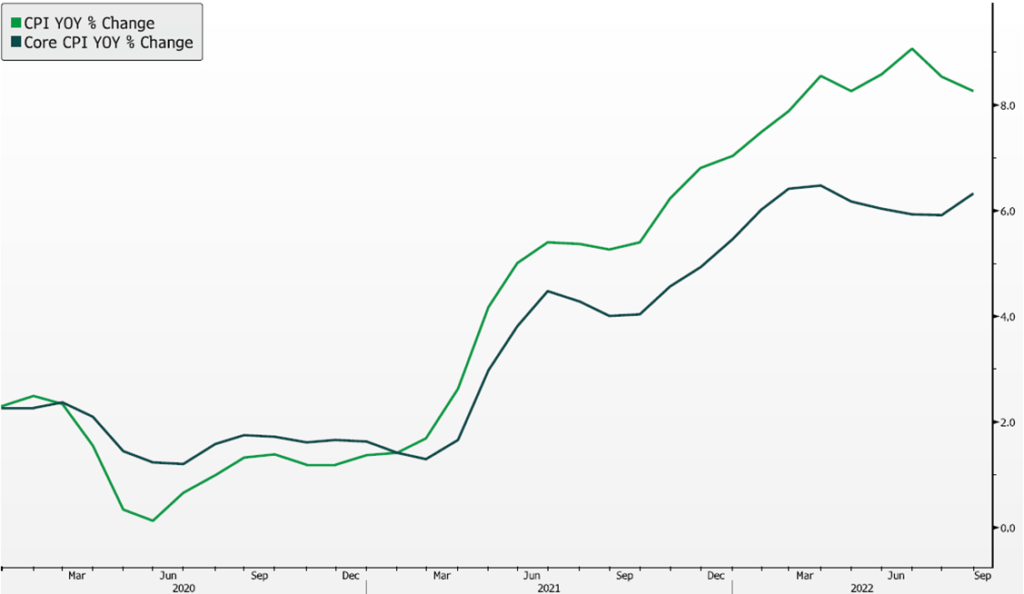

Investors and Central Bankers continue to put an emphasis on inflation readouts in today’s environment of rapidly rising prices. Inflation surprised to the upside throughout the quarter for both Headline and Core CPI, spurring market volatility and selloffs for stocks & bonds.

Headline CPI reached a current cycle high of 9.1% in July but consistently declined throughout the quarter off the back of falling commodity prices. Core CPI continued to move higher however as inflation measures broadened out to shelter and services. Reducing these elevated levels of inflation will continue to be paramount for the Fed to retain credibility in the market.

Inflation Remains Elevated

Source: Bloomberg

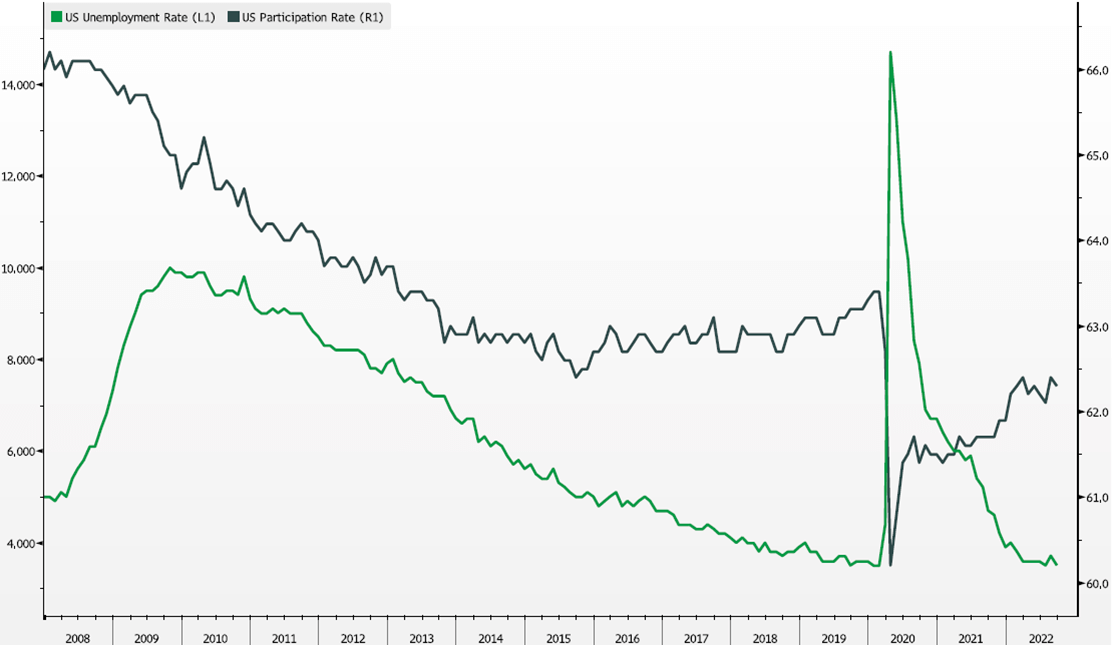

The US Labor market continues to be extremely resilient amidst market and macro volatility. The US unemployment rate remained at all-time lows and finished the quarter at 3.5%, while the participation rate only edged slightly higher. Additionally, wage growth continues to remain robust above 5%, and job openings to unemployed persons remains at elevated levels.

Companies have so far shown an unwillingness to lay off employees despite the growing calls for recession, and wage growth has yet to drive a larger portion of the population back into the labor market. This tightness in the labor market continues to make the Fed’s job more challenging as the Central Bank will likely need to see weakness here before contemplating a pivot in monetary policy.

Labor Markets Stay Tight

Source: Bloomberg

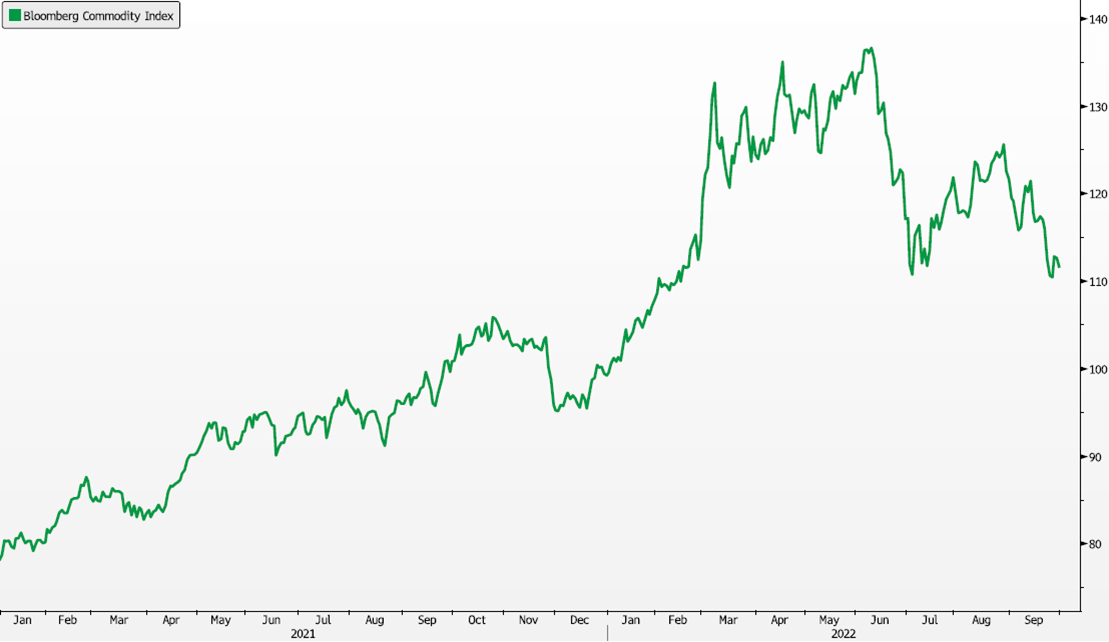

Commodity prices, as measured by the Bloomberg Commodity Index, ended the quarter slightly lower after trading higher throughout July and into August. Prices for many commodities now sit at or below pre-Russian invasion levels as recessionary slowdown fears and demand destruction from elevated prices weigh.

Attention will continue to be paid to the commodity space as countries brace for a world without access to cheap Russian resources. Excess capacity for mining, drilling, and refining resources remains scarce and will likely lead to continued volatility in the market moving forward.

Recessionary Fears Impact Commodities

Source: Bloomberg

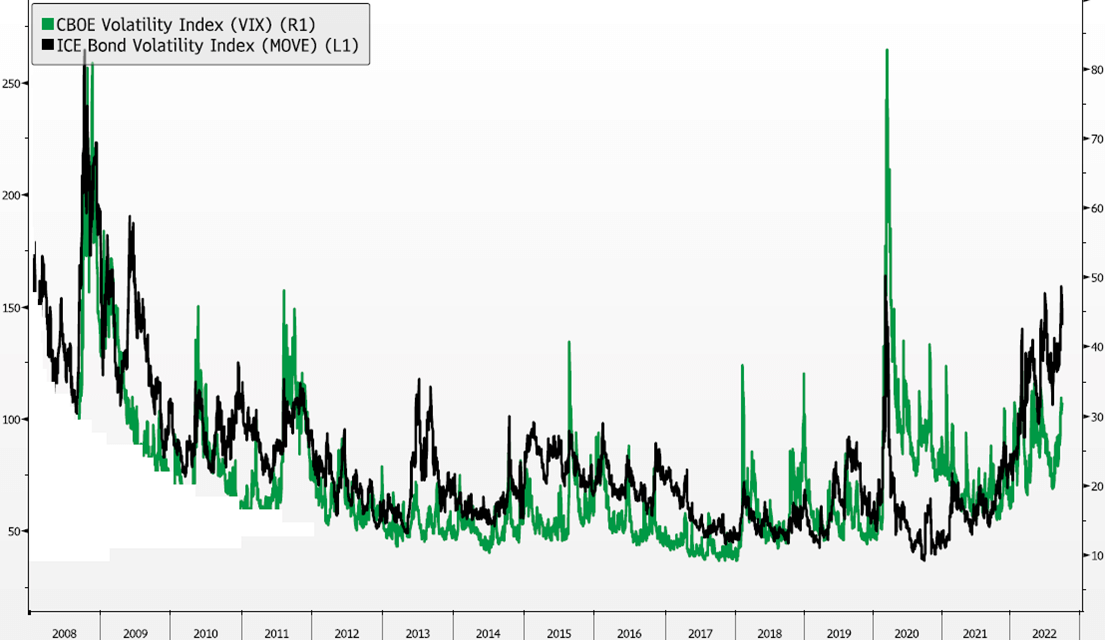

While the implied volatility levels of equities, as measured by the VIX, have avoided trading above crisis-type levels in 2022, bond volatility has been extremely pronounced. Bond volatility, as measured by the ICE Bond Volatility Index, has spent most of 2022 at historically elevated levels and has even reached levels experienced during the peak of the COVID crisis.

Investors’ fluctuating expectations for inflation, rate hikes, and terminal fed funds rates have driven this volatility, causing stresses across funding and equity markets. Market strategists are awaiting a normalization of bond volatility as a sign of a potential market bottom.

Equity and Bond Movement

Source: Bloomberg

The 60/40 stock to bond portfolio has been a staple of modern portfolio theory for decades but is experiencing perhaps its worst year of performance on record. Through Q3, a 60/40 portfolio is down over 20%. This is historically poor performance matched only by a -20% year in 2008.

A secular trend of falling rates and accommodative monetary policy helped to support the 60/40 portfolio over the past 4 decades, but the unprecedented rise in rates during 2022 has pressured this model.

Access to high quality alternative investment options have proven their worth in portfolios during the year and could prove to remain an important driver of diversification during this period of elevated inflation.

Pain for the 60/40 Portfolio

Source: FactSet, John Hancock Investments

Asset Class Analysis

Equities: Target-weight

Stocks are setting new lows for the year. While corporate earnings have thus far remained resilient in the face of high wages and cost pressures, consumers are spending less as their balance sheets shrink and spending power declines. This will have slowing effects on the economy, but while inflation remains elevated and labor markets too tight, the Fed will continue to maintain its restrictive policy of raising interest rates and reducing liquidity in the bond markets, even if it tips the country into a recession. Continued strength of the US Dollar versus other currencies has put further economic strains beyond our shores, while we continue to deal with the inflationary impacts of the Russia-Ukraine war and China’s tough COVID stance. In the midst of all this fear, equity valuations look generally cheap. While not at Amazon Prime Day deals level, we are modest adders to stocks at these prices, with the recognition that we will likely see continued volatility for a few more quarters. A weak earnings season may pressure stocks further, but may be the catalyst to make us more conviction buyers. We remain relatively defensively positioned here, balanced across cash flowing businesses and heavily punished growth stocks, but still domestically oriented and favoring large over small caps.

Fixed Income: Target-weight

We have been steadily increasing duration and credit quality within our liquid fixed income allocation throughout the course of the year. While we may have been a little early, as the Fed has been even more hawkish than we anticipated, investment grade bonds now provide a yield that are multiples higher than what it was over the past several years. Furthermore, if a recession is on the horizon, owning higher quality assets that will benefit from a Fed pivot, and serve as a positive counterbalance to stocks seems warranted. We continue to emphasize alternative credit strategies that can generate meaningfully higher returns than those in liquid markets. These include private corporate and real estate lending and structured credit. We anticipate higher defaults than what we experienced the past few years, however higher returns from higher rates should more than compensate investors for that risk.

Liquid Alternatives: Target-weight

After several years of a relative dry spell for returns, we think heightened volatility across asset classes is creating a ripe opportunity for diversified and long/short hedge funds. As traditional assets continue to remain under pressure, strategies that can take advantage of short-term pricing dislocations in a choppy market can generate more consistent returns through this challenging period. Furthermore, we have been adding residential real estate for its inflation-aligned properties as a complement to stock and bond portfolios.

Illiquid Alternatives: Target-weight

Private equity investments across venture, growth and buy-out are currently seeing valuations adjust lower, similar to the price adjustments we are seeing for public markets that started earlier in the year. This will likely persist for the next few quarters and slow the pace of buy and sell activity in the near-term, but will establish an attractive period to be an investor in private businesses for the long-term for those who have capital to deploy. Secondaries and Distressed investing strategies may benefit well from a slowing economy as they tend to be opportunistic buyers of good assets at discounted valuations, during a period of market uncertainty.

If you would like to learn more about the topics discussed in this article, please check out our recent Market Update Webinar where Simon Quick Advisors, Chief Investment Officer Christopher Moore, Head of Research Wayne Yi, and Chief Marketing Officer Darcy O’Brien (moderator) discuss recent market volatility and notable factors driving it.

Disclaimer

The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained herein is intended to constitute legal, tax, accounting, securities, or investment advice nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick Advisors LLC), or any non-investment related content, made reference to directly or indirectly in this presentation will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Investing in alternatives may not be suitable for all investors, and involves a high degree of risk. Many alternative investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of alternative investments can vary based on the underlying strategies used.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

Simon Quick Advisors LLC is neither a law firm nor a certified public accounting firm and no portion of the presentation content should be construed as legal or accounting advice. If you are a Simon Quick Advisors LLC client, please remember to contact Simon Quick Advisors LLC, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick Advisors as being “registered” does not imply a certain level of education or expertise.

Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. You cannot invest directly in an index.

Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.

Please Note: (1) performance results do not reflect the impact of taxes; (2) It should not be assumed that account holdings will correspond directly to any comparative benchmark index; and, (3) comparative indices may be more or less volatile than your account holdings.

Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document

Economic, index, and performance information is obtained from various third party sources. While we believe these sources to be reliable Simon Quick Advisors LLC has not independently verified the accuracy of this information and makes no representation regarding the accuracy or completeness of information provided herein.

As of April 1st, 2022, Simon Quick Advisors LLC has changed private capital index providers from Cambridge Associates to Pitchbook Benchmarks.