Volatility across markets remained elevated into the second quarter of the year. High inflation and Central Bank monetary tightening continue to be the dominant drivers behind it, but rising fears of a global recession also began to weigh on markets.

The S&P 500 detracted over 15% in the quarter, the worst quarter of performance since the COVID-affected Q1 of 2020 and the Global Financial Crisis of Q4 2008 before that. The index dipped into a bear market throughout the quarter, defined by a 20% decline from the market’s peak. Sharp selloffs followed poor earnings and rising inventories from major retailers in May and an unexpectedly high inflation reading in June.

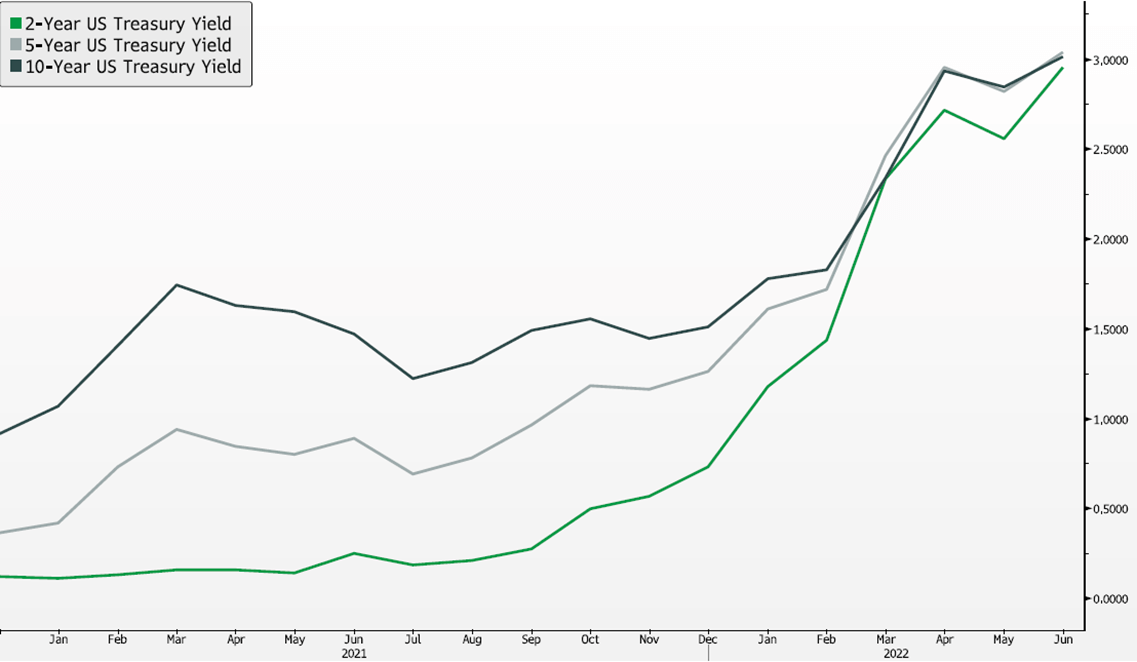

The Fed was busy throughout the quarter, raising rates by 50bps at the May meeting and 75bps in June – the highest rate hike since 1994. The Fed raised rates more aggressively than originally expected in the quarter as initial steps failed to reverse inflationary trends. The Fed has emphasized the desire to keep inflation expectations anchored and market participants have begun to predict that an economic slowdown may be needed to accomplish this. While rates rose off the back of Fed hikes and CPI prints, global recession narratives became more prevalent throughout the quarter. This led to a flattening of the yield curve with the 2-year and 10-year Treasury yields briefly inverting in June, a popular predictor of coming recessions.

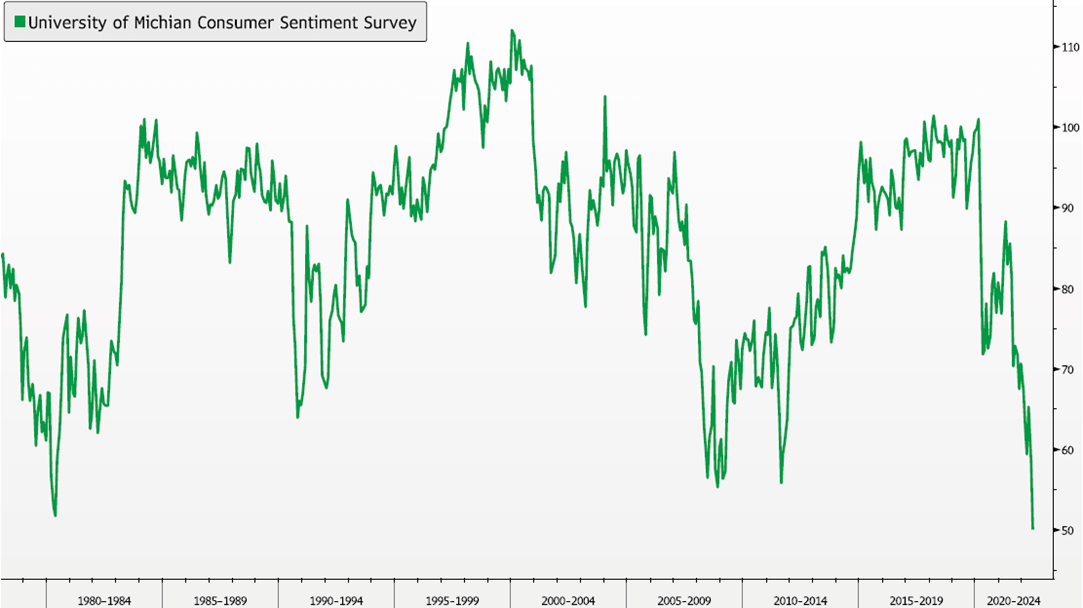

The Energy sector, and commodities broadly, was one of the few bright spots in markets through the first half of the year. The sector benefited from strong demand and a lack of response in production due to bottlenecks and general unwillingness to invest in increased production. However, energy led the market to the downside in June as oil fell over 7% and other commodities were pressured due to fears of demand destruction and a slowing economy. Consumer sentiment hit a multi-decade low during the month, highlighting the fear of a global slowdown across market participants.

Globally, the economic picture looks bleak as well. The Russia-Ukraine war has disrupted many economies due to Europe’s reliance on Russia for natural gas and many countries’ dependence on Ukrainian wheat & food exports. Additionally, China continues to struggle with its own Zero-COVID policy that has led to rolling lockdowns in major cities across the country as well as slowing goods demand from the West.

The macroeconomic environment remains highly uncertain into the second half of the year, but it should be noted that markets and economies move at different paces. Markets tend to be forward-looking, as shown by the dramatic post-March 2020 recovery, and much of the economic pain may already be priced into markets. However, markets remain volatile and there will be a continued focus on economic data readings and Central Bank actions over the next several months.

What We’re Watching

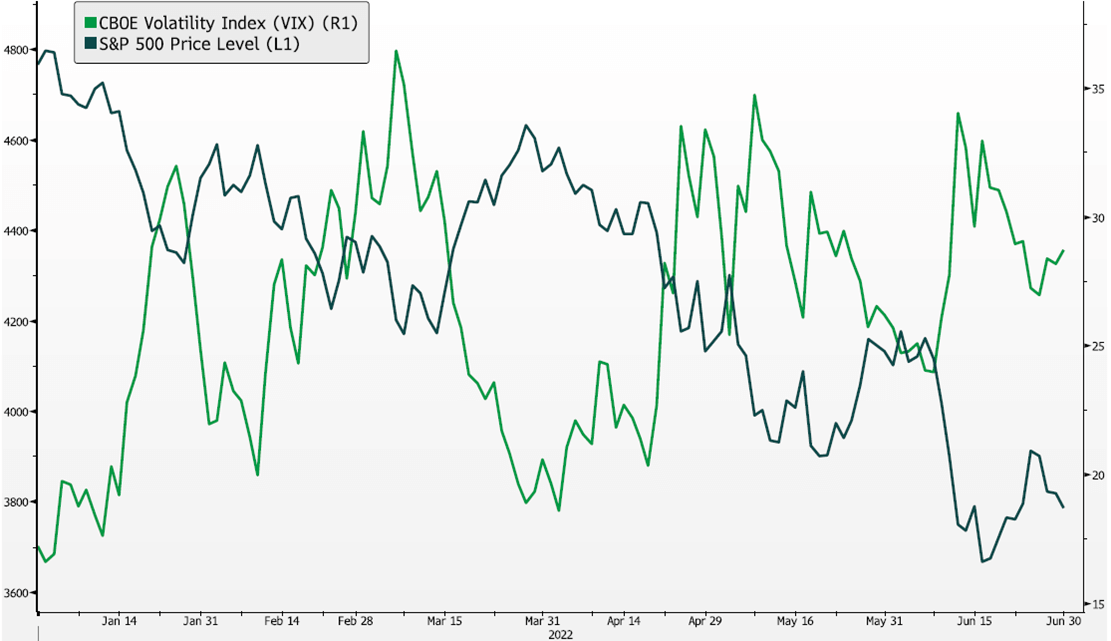

Markets entered the quarter off the back of a strong March recovery with the VIX down below 20. Volatility levels raised into Q2 however, spending most of the quarter elevated above 25 as equities accelerated their losses.

The S&P was pressured throughout the quarter with notable volatility spikes surrounding weak earnings from key retailers, such as Walmart & Target, increasing Fed Hawkishness, and increasing consumer inflation expectations.

Volatility Remains Elevated

Source: Bloomberg

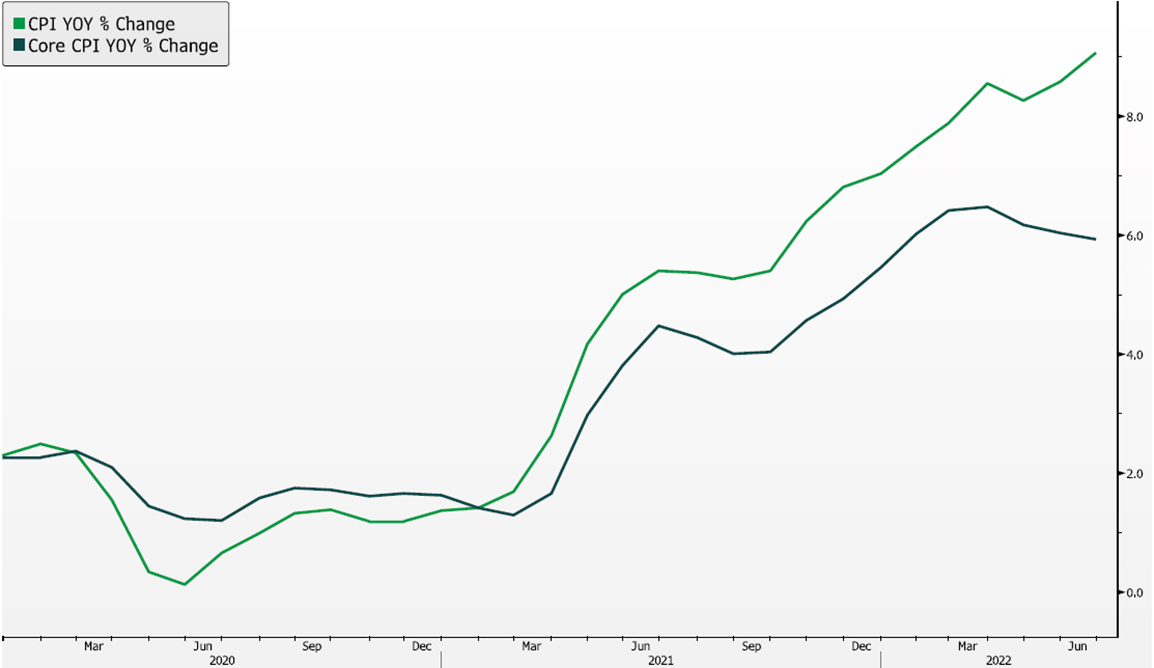

Headline inflation continued to advance on the quarter. CPI hit a fresh 40-year high of 8.6% in May, unexpectedly breaking the previous high of 8.5% set in March, and continued to advance higher with a 9.1% reading in June. These CPI prints were largely off the back of continued increases in energy & food prices, but inflationary pressures have broadened out to services & shelter costs as well.

While headline CPI extended to new highs in the quarter, core CPI continued to decline off its March peak. This may be a promising sign as supply chain bottlenecks begin to ease and consumer preferences normalize.

The growing calls for a recession may serve to dampen inflationary pressures moving forward as commodity prices fall and inventories for durable goods grow. The recent selloff in commodities may reflect this expectation, but commodity prices remain above historic levels.

Inflation Continues to Rise

Source: Bloomberg

Consumer sentiment, as measured by the University of Michigan’s Sentiment Survey, reached an all-time low in the quarter since the data was tracked in the late 1970s. This marks a dramatic shift in consumer sentiment from a year prior as rising costs weigh on consumers. Markets rallied on this data print as negative sentiment is often viewed as a contrarian indicator and may be a sign that much of the pain in markets is already behind us.

Consumer Sentiment Hits an All Time Low

Source: Bloomberg

The yield curve continued to move higher during the quarter as the Fed hiked rates twice. The Fed notably hiked rates 75 basis points in June, the highest rate hike since 1994. Another 75-basis point hike is expected in July, highlighting the Fed’s desire to lower inflation.

The yield curve also continued the trend of flattening with the 2-year and 10-year curves briefly inverting in June, a popularly referenced predictor for future recessions. The movements of yields will continue to be an important factor in market performance moving forward. Any signs that the Fed is slowing its hiking cycle may serve as a tailwind for markets.

Rising & Flattening Yield Curve

Source: Bloomberg

While the economy seems poised to slow in the near future, historically expansions and bull markets have lasted longer and been much stronger than recessions and bear markets. Over time it has been beneficial to hold equity exposure throughout these periods where emotions tend to drive investor decisions.

It is also important to note that markets move at different speeds than economies. Markets are forward-looking while economic data tends to reflect what’s already happened. Much of the pain experienced in markets this year may already be pricing in the economic slowdown ahead.

Duration and Magnitude of Market and Macro Trends

Source: JPMorgan’s Guide to the Markets

Asset Class Analysis

Equities: Target-weight

Equities remain under pressure on continued inflation concerns and an aggressive rate hiking program from the Fed. While inflation in 2021 was driven by the reopening of cyclicals and the economy expanding, current inflation is being driven by a further tightening of supply, which can hamper economic growth. Commodity-driven sectors are strong relative and absolute outperformers thus far, with defensive sectors like staples and healthcare outperforming. However, higher-multiple consumer and technology-oriented sectors have been under pressure even though fundamental performance remains solid for now.

Equity valuations have compressed, but stocks will continue to be pressured in a more rapidly rising rate environment. Additionally, with the Fed backing away from the market, volatility will likely remain elevated. With this backdrop, we remain long-term believers of growth businesses and innovation, however, are currently balancing this exposure with slow-but-steady value and defensive strategies that are less sensitive to interest rates. In this period of uncertainty, we continue to overweight domestic larger cap exposure as these businesses are better diversified with more operational levers to help them adapt. International markets have sold off and look compelling based on valuations, but increased macroeconomic risks keep us undersized in these regions for now.

Fixed Income: Target-weight

The Federal Reserve has quickly accelerated its path of rate hikes, with balance sheet reduction programs beginning in June. This has resulted in interest rates rising across the maturity curve and driving losses in the asset class even though fundamentals remain sound. Credit spreads have widened with increasing recession concerns, albeit fundamentals remained consistent and defaults low. We had recently upgraded our asset allocation weighting to Target-weight in order to increase overall credit quality and further shorten duration in the asset class. Following the 0.75% rate hike in June, we have begun to extend duration modestly and further increased credit quality in our fixed income portfolios. We expect the Fed to continue to raise rates in July and September. This should negatively impact fixed income. However, if geopolitical tensions or recession concerns increase, Treasuries tend to be negatively correlated to risk assets, and thus should protect well in this instance and could serve as liquidity to be redeployed into potentially over-sold opportunities thereafter.

For tax-sensitive investors, municipal bonds experienced one of the worst sell-offs this year, both from a performance and capital outflow perspective. We believe this was driven by general fixed income rate sensitivity and fear-driven retail selling. This has made municipal-to-treasury ratios rise and become relatively more attractive. Municipals are still subject to duration risk, but we would retain our positioning here as the losses do not seem to be fundamentally driven.

Liquid Alternatives: Target-weight

Rising rates and volatility in equity markets have made liquid alternatives a more attractive option to traditional asset classes. Equity hedge funds can add diversification to ideas through smaller, lesser-known companies and allocations to investment themes that are not easily expressed in traditional funds. Portfolio hedging and stock shorts also create opportunities to capitalize on the currently wide levels of stock dispersion. We continue to emphasize and have been increasing allocations to multi-strategy, and low correlation arbitrage strategies as they exhibit the potential to provide better than fixed income returns while avoiding the extremes of market volatility. We find real estate opportunities able to mitigate some of the current inflation and interest rate pressures while generating low-volatility returns.

Illiquid Alternatives: Target-weight

We are long-term proponents for illiquid investments, as they afford a broader opportunity set from which investors can source differentiated, high-returning assets that are typically inaccessible via public markets. Furthermore, sponsors’ abilities to engage with their portfolio companies to drive operational enhancements and pursue growth initiatives increases value creation opportunities for their investments. While executing on business optimization and acquisition strategies are multi-year processes, illiquid investments have the potential to deliver returns meaningfully in excess of their public market peers with more controllable risks. Investing in buy-out, venture, credit and real estate should be a core component of wealth creation for investment portfolios that can bear the longer investment horizons.

We should also recognize that relative performance between public and private markets can fluctuate over shorter periods of time, and while private investments have had a tremendous run over the past couple of years, valuations have risen meaningfully as well and haven’t yet re-priced materially enough to account for the recent interest rate and inflation headwinds that public securities have experienced. As the availability of private capital has increased, acquisition multiples have remained elevated and are constraining the ability to buy good investments at reasonable prices. Furthermore, smaller businesses like the companies that sponsors tend to purchase are more economically sensitive and will experience inflationary and business cycle pressures to earnings. We had thus reduced our allocation weighting to Target-weight while we evaluate how macro pressures impact private valuations and look to harvest current realizations and distributions to build up dry powder for more liquid investment opportunities.

IMPORTANT DISCLOSURES

This information is for general and educational purposes only. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors & Co., LLC (“Simon Quick”) nor should this be construed as an offer to sell or the solicitation of an offer to purchase an interest in a security or separate accounts of any type. Asset Allocation and diversifying asset classes may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Investing in Liquid and Illiquid Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of Alternative Investments can vary based on the underlying strategies used. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Simon Quick client, please remember to contact Simon Quick, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick as being “registered” does not imply a certain level of education or expertise. This newsletter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events. Economic, index, and performance information herein has been obtained from various third party sources. While we believe the source to be accurate and reliable, Simon Quick has not independently verified the accuracy of information. In addition, Simon Quick makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties. Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or benchmark index, as comparative indices or benchmark index may be more or less volatile than your account holdings. You cannot invest directly in an index .Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses. Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document. Index data and other information contained herein is supplied from various sources and is believed to be accurate but Simon Quick has not independently verified the accuracy of this information.