Capital markets experienced a highly volatile start to the year as inflation, the tightening of monetary policy, and war between Russia and Ukraine stoked investor concerns.

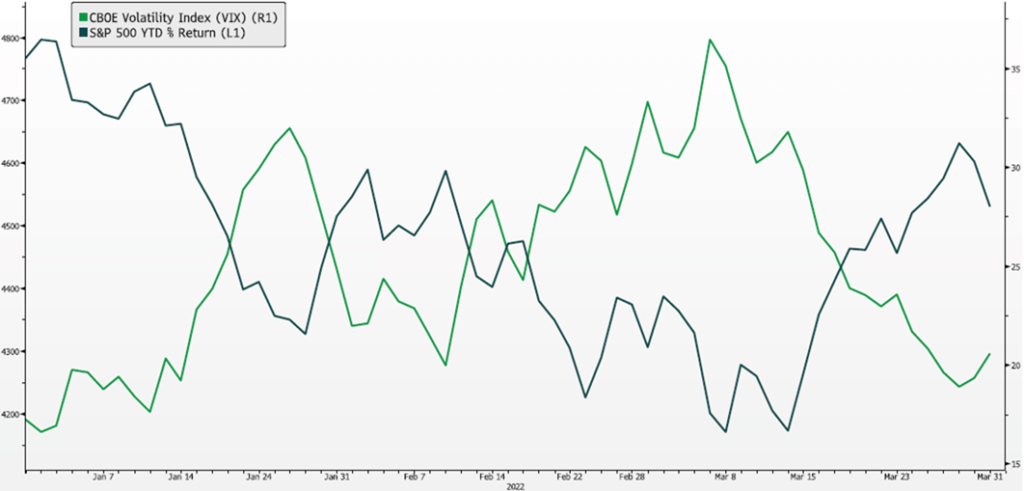

After a strong end to 2021, equity markets hit an all-time high on the first trading day in January before fears over elevated inflation and Russian aggression led equity markets to enter correction territory. While the selloff at the beginning of the year was concentrated in expensive growth-oriented equities, the Russian invasion led to a broader based selloff with pain concentrated in European companies with strong ties to the Russian economy. Equities partially recovered in March to end the quarter, but markets remain volatile as investors closely watch the conflict for signs of escalation or de-escalation.

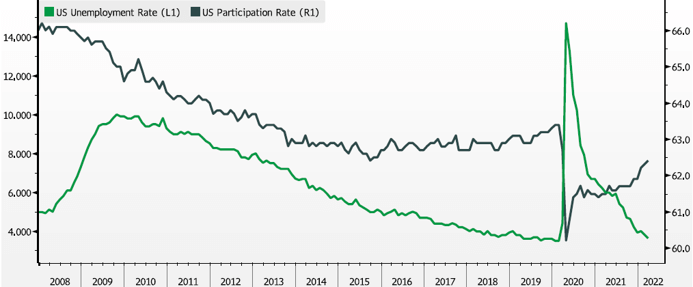

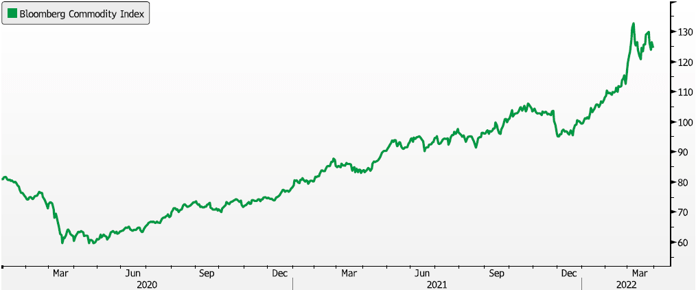

Inflation continues to be a driving force on markets and the economy, with the Consumer Price Index advancing +7.9% year-over-year in March. Inflationary pressures have been broadening out in 2022 after being driven mainly by areas of the market impacted by supply chain disruptions in 2021, such as semiconductor chips and used cars. Commodities broadly have moved higher throughout the first quarter of the year, highlighted by accelerating price increases for energy & food. Labor shortages are driving increased wage growth as well, with the US unemployment rate continuing to grind lower to 3.6% and wage growth accelerated to 5.6% year-over-year during Q1.

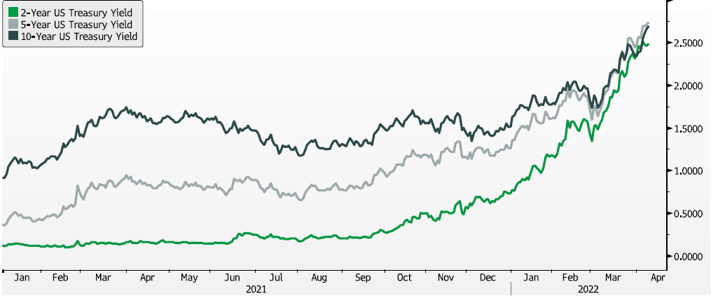

The Fed and other central banks have begun to respond to inflationary pressures with rate hikes and guidance for a quicker tightening of monetary policy than originally intended. The Fed raised the federal funds rates by 25 basis points in Q1 and the market is expecting additional hikes throughout the year. The hikes and rising yields led to poor performance broadly for fixed income products and other duration-sensitive investments. While the short end of the yield curve has been rising aggressively based on these expectations, the longer end of the yield curve has been much more subdued leading to inversions along the interest rate curve, a technical signal for a potential recession.

Many investors believe that in order to suppress inflation, the Fed and other central banks will be forced to induce a recession or a slowdown of global growth. Fears of ‘stagflation,’ or an environment of low growth and high inflation, have become an area of focus for many investors in light of this. However, employment, corporate earnings, and household and corporate balance sheets all remain strong and highly supportive of an expanding economy at the time of this writing.

Looking forward, investors will remain focused on inflationary pressures, the tightening of monetary policy by central banks, and the Russia-Ukraine Conflict as the primary factors impacting markets. Additionally, investors will be focused on Q1 corporate earnings and management guidance for clues on the economic impact of these developments.

Volatility Rises

Source: Bloomberg

US Employment Remains Strong

Source: Bloomberg

Inflation Continues to Rise

Source: Bloomberg

Rising & Flattening Yield Curve

Source: Bloomberg

Asset Analysis

Equities: Maintain Target-weight

Equities sold off to start 2022 as inflation continued to rise, exacerbated by the Russia-Ukraine war, and investors pricing in a belated but more aggressive rate hiking program from the Fed. While inflation in 2021 was driven by the reopening of cyclicals and the economy expanding, current inflation is being driven by a further tightening of supply, which can challenge economic growth. Commodity-driven sectors are strong relative and absolute outperformers thus far, with defensive sectors like staples and healthcare outperforming. However, higher-multiple consumer and technology-oriented sectors have been under pressure even though fundamental performance remains solid.

Equity valuations have compressed modestly, but stocks will continue to be pressured in a more rapidly rising rate environment. Additionally, with the Fed backing away from the market, volatility will likely remain elevated. With this backdrop, we remain long-term believers of growth businesses and innovation, however, are currently balancing this exposure with slow-but-steady value and defensive strategies that are less sensitive to interest rates. In this period of uncertainty, we continue to overweight domestic larger-cap exposure as these businesses are better diversified with more operational levers to help them adapt. International markets have sold off and look compelling based on valuations, but increased macroeconomic risks keep us undersized in these regions for now.

Fixed Income: Move to Target-weight

The Federal Reserve has started on its path of rate hikes, soon to be followed by its balance sheet reduction program, in hopes of taming inflation. This has resulted in interest rates rising across the maturity curve and driving losses in the asset class even though fundamentals remain sound. Credit spreads continue to remain on the tighter end of historical ranges as the economy is growing and defaults remain low. We continue to prefer short-duration fixed income and floating-rate instruments with structured credit spreads to generate above-market yields.

We are upgrading our asset allocation weighting to Target-weight in order to increase overall credit quality and further shorten duration in the asset class. We expect the Fed to continue to raise rates. This should negatively impact fixed income, but longer-duration assets moreso than our recommended short-term positioning. However, if geopolitical tensions or recession concerns increase, Treasuries tend to be negatively correlated to risk assets, and thus should protect well in this instance and could serve as liquidity to be redeployed into potentially over-sold opportunities thereafter.

For tax-sensitive investors, municipal bonds experienced one of the worst quarters to start off 2022, both from a performance and capital outflow perspective. We believe this was driven by general fixed income rate sensitivity and fear-driven retail selling. This has made municipal-to-treasury ratios rise and become relatively more attractive. Municipals are still subject to duration risk, but we would retain our positioning here as the losses do not seem to be fundamentally driven.

Liquid Alternatives: Maintain Target-weight

Rising rates and volatility in equity markets have made liquid alternatives a more attractive option to traditional asset classes. Equity hedge funds can add diversification to ideas through smaller, lesser-known companies and allocations to investment themes that are not easily expressed in traditional funds. Portfolio hedging and stock shorts also create opportunities to capitalize on the currently wide levels of stock dispersion. We continue to emphasize, and have been increasing allocations to multi-strategy, and low-correlation arbitrage strategies as they exhibit the potential to provide better than fixed income returns while avoiding the extremes of market volatility. We are also diligencing real estate opportunities that would mitigate some of the current inflation and interest rate pressures while generating low-volatility returns.

Illiquid Alternatives: Downgrade to Target-weight

We are long-term proponents for illiquid investments, as they afford a broader opportunity set from which investors can source differentiated, high-returning assets that are typically inaccessible via public markets. Furthermore, sponsors’ abilities to engage with their portfolio companies to drive operational enhancements and pursue growth initiatives increases value creation opportunities of their investments. While executing on business optimization and acquisition strategies are multi-year processes, illiquid investments have the potential to deliver returns meaningfully in excess of their public market peers with more controllable risks. Investing in buy-out, venture, credit and real estate should be a core component of wealth creation for investment portfolios that can bear the longer investment horizons.

We should also recognize though, that relative performance between public and private markets can fluctuate over shorter periods of time, and while private investments have had a tremendous run over the past couple years, valuations have risen meaningfully as well and haven’t yet re-priced to account for the recent interest rate and inflation headwinds that public securities have experienced. As the availability of private capital has increased, acquisition multiples have remained elevated and is constraining the ability to buy good investments at reasonable prices. We have thus reduced our allocation weighting to Target-weight while we evaluate how macro pressures impact private valuations and look to harvest current realizations and distributions to build up dry powder for more liquid investment opportunities.

IMPORTANT DISCLOSURES

This information is for general and educational purposes only. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Simon Quick Advisors & Co., LLC (“Simon Quick”) nor should this be construed as an offer to sell or the solicitation of an offer to purchase an interest in a security or separate accounts of any type. Asset Allocation and diversifying asset classes may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Investing in Liquid and Illiquid Alternative Investments may not be suitable for all investors and involves a high degree of risk. Many Alternative Investments are highly illiquid, meaning that you may not be able to sell your investment when you wish. Risk of Alternative Investments can vary based on the underlying strategies used.Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Simon Quick), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Simon Quick is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Simon Quick client, please remember to contact Simon Quick, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Simon Quick Advisors, LLC (Simon Quick) is an SEC registered investment adviser with a principal place of business in Morristown, NJ. Simon Quick may only transact business in states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. A copy of our written disclosure brochure discussing our advisory services and fees is available upon request. References to Simon Quick as being “registered” does not imply a certain level of education or expertise.This newsletter and the accompanying discussion include forward-looking statements. All statements that are not historical facts are forward-looking statements, including any statements that relate to future market conditions, results, operations, strategies or other future conditions or developments and any statements regarding objectives, opportunities, positioning or prospects. Forward-looking statements are necessarily based upon speculation, expectations, estimates and assumptions that are inherently unreliable and subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements are not a promise or guaranty about future events.Economic, index, and performance information herein has been obtained from various third party sources. While we believe the source to be accurate and reliable, Simon Quick has not independently verified the accuracy of information. In addition, Simon Quick makes no representations or warranties with respect to the accuracy, reliability, or utility of information obtained from third parties.Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or benchmark index, as comparative indices or benchmark index may be more or less volatile than your account holdings. You cannot invest directly in an index.Indices included in this report are for purposes of comparing your returns to the returns on a broad-based index of securities most comparable to the types of securities held in your account(s). Although your account(s) invest in securities that are generally similar in type to the related indices, the particular issuers, industry segments, geographic regions, and weighting of investments in your account do not necessarily track the index. The indices assume reinvestment of dividends and do not reflect deduction of any fees or expenses.Please note: Indices are frequently updated and the returns on any given day may differ from those presented in this document. Index data and other information contained herein is supplied from various sources and is believed to be accurate but Simon Quick has not independently verified the accuracy of this information.